LuxAlgo’s AI Backtesting Assistant just got a huge upgrade — now supporting 93 assets, 6M+ strategies, Oscillator Matrix tools, and classic indicators. Trade smarter, instantly.

Today at LuxAlgo, we are thrilled to announce a massive upgrade to our AI Backtesting Assistant –packed with powerful new features and enhancements designed to take your trading to the next level.

Here’s what’s new:

Expanded Market Coverage

Our AI Backtesting Assistant now supports an impressive 93 assets, providing comprehensive coverage across all major asset classes:

For the complete list of available tickers, simply ask our AI anytime for the list. With this expanded coverage, you can effortlessly backtest your strategies across all markets, enhancing the versatility and effectiveness of your analysis.

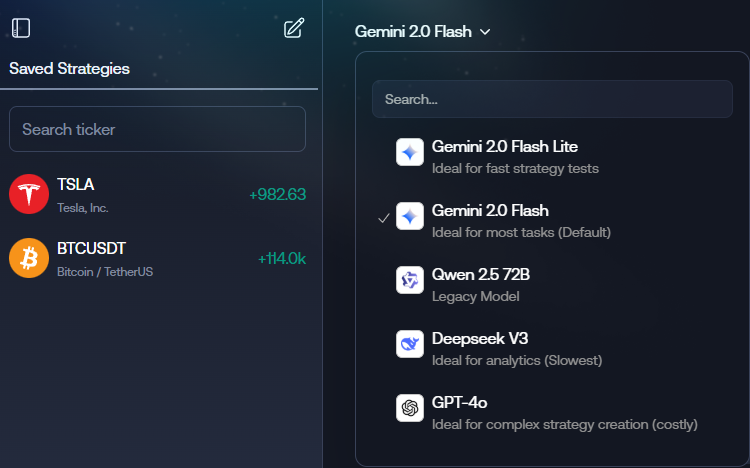

Over 6 million strategies at your fingertips

From thousands to millions – We've dramatically increased the number of accessible strategies available for users, now exceeding 6 million. Whether you're searching for trend-following, breakout, or momentum strategies, our AI makes identifying and testing your ideal approach faster and simpler than ever.

Introducing Oscillator Matrix Toolkit Strategies

Since our AI's launch, we only supported strategies with Signals & Overlays and Price Action Concepts toolkits. Responding to popular demand from our community, we’re excited to introduce strategies from our Oscillator Matrix toolkit to fully support all of our exclusive tools. Leverage all main features, including:

- Smart Money Flow Readings

- HyperWave Signals

- Reversal Signals

- Divergence Identification

- Confluence Analysis

These new Oscillator Matrix based strategies help you pinpoint precise entry and exit points to sharpen your trading edge.

Classic indicator strategies now available

We've significantly enhanced the capabilities of our AI assistant by integrating an extensive array of classical technical indicators. Now, you can easily create strategies based on:

- Exponential Moving Average (EMA)

- SuperTrend

- Volume Weighted Average Price (VWAP)

- Ichimoku Cloud

- Linear Regression

- Bollinger Bands

- Donchian Channels

- Aroon Indicator

- Relative Strength Index (RSI)

- Money Flow Index (MFI)

- Stochastic Oscillator

- Moving Average Convergence Divergence (MACD)

- Volume

- Volume Delta

Some of these added indicators can also serve as filters, providing greater depth and precision to your strategy creation process.

In the near future, we plan to have all categories of tools able to be combined for individual strategies.

Additional Price Action Concepts features

We’re also thrilled to expand on the features used to create strategies from our Price Action Concepts toolkit. You can now retrieve strategies based on:

- Liquidity Grabs: Locates potential trades in liquid zones – bullish in demand zones, bearish in supply zones.

- Volume Imbalances: When candle bodies don’t overlap, but wicks do – a key indicator particularly effective on stocks and lower timeframes.

- Opening Gaps: Gaps formed by non-overlapping wicks between adjacent candles, especially useful in stocks and short-term timeframes.

- Liquidity Trendline Breaks: Zones based on liquidity at specific price levels, helping you spot high-probability breakout opportunities.

With these enhancements, our AI Backtesting Assistant offers unparalleled depth, precision, and versatility, empowering you to trade smarter, faster, and with greater confidence.

At LuxAlgo, we now not only lead as the largest provider of trading indicators (free & paid), however, we now have the most extensive AI backtesting platform for custom indicators, allowing traders to find the best tools & automatically find the best strategies by simply talking to AI in natural language.