Introduction: The Rise of AI in Trading

In the modern financial landscape, artificial intelligence (AI) and machine learning (ML) have revolutionized trading strategies, unlocking unprecedented levels of market analysis and predictive capability. Traditional indicators, while effective, often rely on static parameters that fail to adapt to changing market conditions. This limitation has fueled the rise of AI-enhanced indicators that employ machine learning techniques like k-means clustering to dynamically optimize trading strategies.

In this blog, we explore three cutting-edge AI-driven trading indicators that leverage clustering algorithms to provide adaptive market insights:

- SuperTrend AI Clustering – An advanced version of the SuperTrend indicator that dynamically selects the optimal ATR multiplier using AI clustering.

- AI Channels (Clustering) – A machine learning-driven price channel that identifies dynamic support and resistance zones.

- AI SuperTrend Clustering Oscillator – A trend-strength oscillator that segments market momentum into AI-classified clusters.

Together, these indicators form a comprehensive AI-powered trading system that adapts to evolving market structures, providing traders with a robust edge in decision-making.

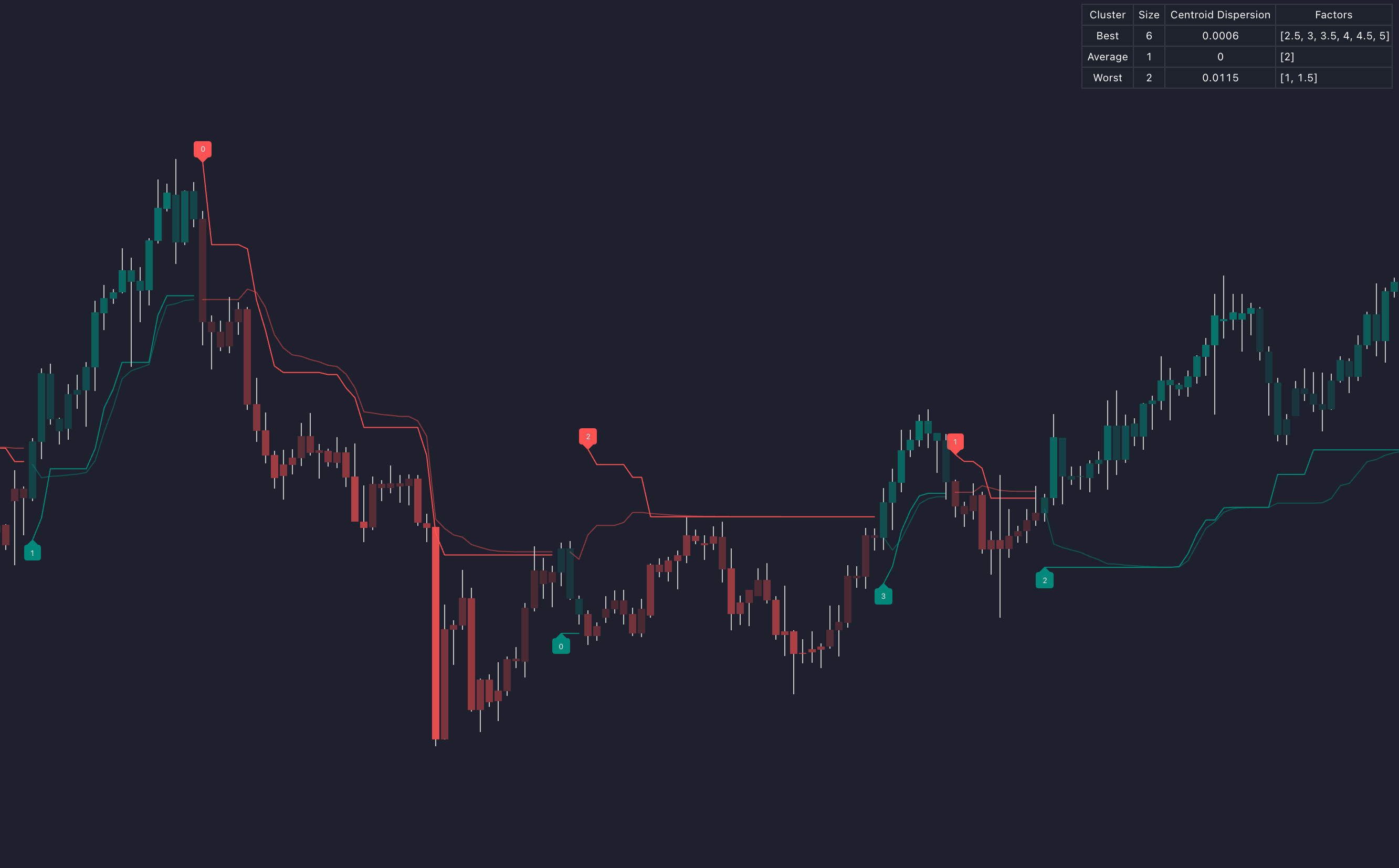

1. SuperTrend AI Clustering: An Intelligent Trend-Following Algorithm

How It Works

Traditional SuperTrend indicators apply a fixed ATR multiplier to determine dynamic support and resistance levels. However, static ATR values can be ineffective in rapidly changing market conditions. The SuperTrend AI Clustering indicator introduces a machine learning approach by leveraging k-means clustering to dynamically optimize ATR multipliers.

The AI Process:

- The indicator computes multiple SuperTrend variations using a range of ATR multipliers.

- Each variation is evaluated based on its historical performance in predicting trends.

- K-means clustering is applied to categorize performance into three groups:

- Best-performing multipliers (high accuracy in identifying trends)

- Average performers

- Worst performers

- Traders can select their optimization approach, choosing to trade based on:

- The best-performing cluster (aggressive approach)

- The average (balanced approach)

- The worst-performing (counter-trend approach)

Key Benefits:

✅ Self-Optimizing ATR Multiplier – Automatically selects the best ATR settings for trend detection.

✅ Dynamic Adaptability – Adjusts to changing volatility conditions in real time.

✅ AI-Driven Trend Confirmation – Ensures that traders follow the most statistically significant price movements.

By eliminating the need for manual ATR tuning, this AI-powered indicator provides traders with a mechanically adaptive trend-following strategy that continuously evolves.

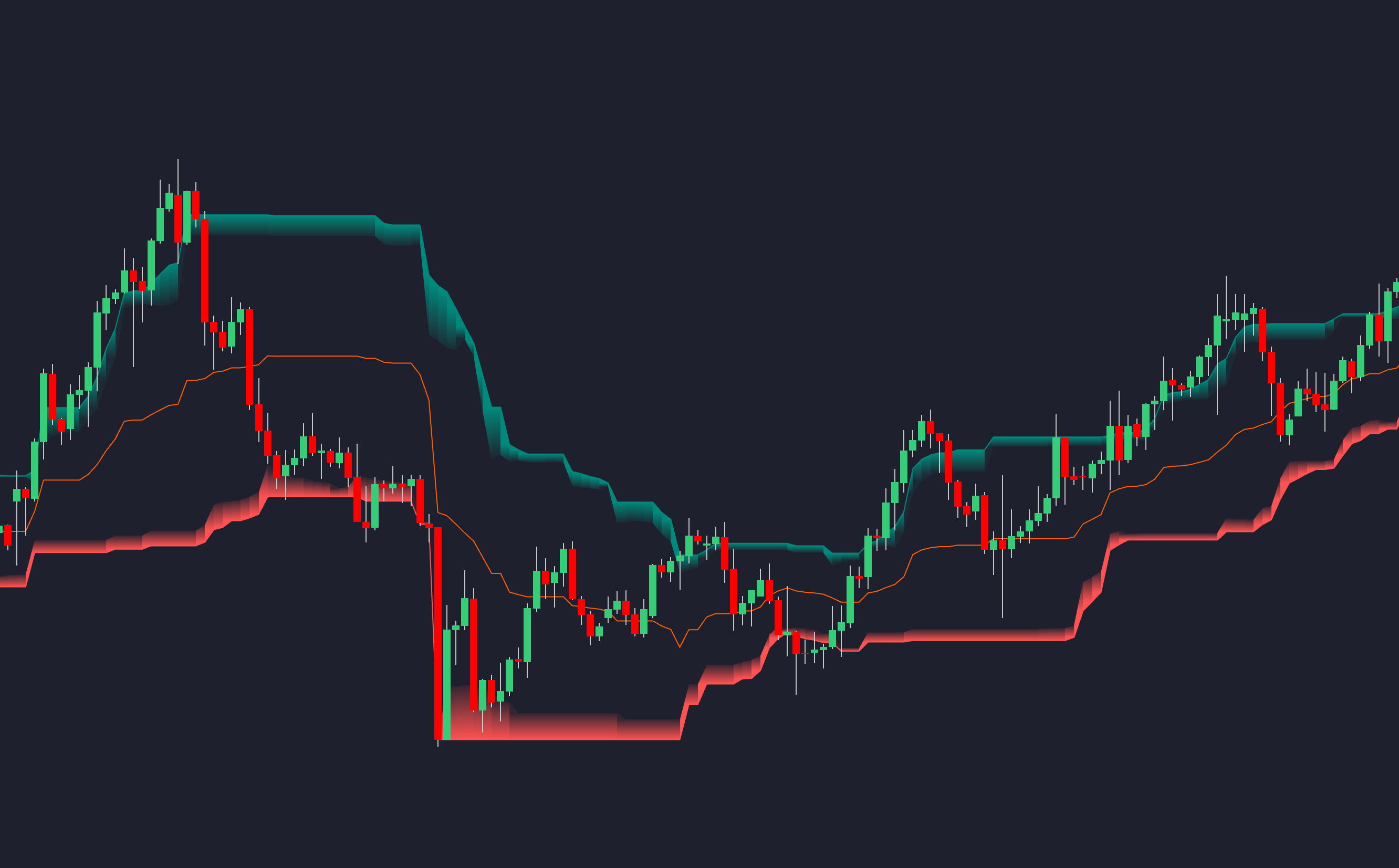

2. AI Channels (Clustering): Machine Learning-Powered Support & Resistance

How It Works

Support and resistance levels are critical for price action trading, yet most conventional approaches rely on subjective analysis. AI Channels (Clustering) addresses this issue by employing k-means clustering to objectively classify key price levels based on historical price action.

The AI Process:

- The indicator gathers historical closing price data over a defined period.

- It applies k-means clustering to segment price points into distinct clusters.

- The centroids of these clusters represent the most significant support and resistance levels.

- The highest cluster represents strong resistance, the lowest strong support, and the midline serves as an equilibrium price.

- Traders can denoise the levels for smoother trend identification or use the trailing stop mode to dynamically follow price action.

Key Benefits:

✅ AI-Generated Support & Resistance – Eliminates subjective bias in level selection.

✅ Self-Adjusting Zones – Channels evolve based on real-time market data.

✅ Market Structure Awareness – Provides a probabilistic view of price consolidation and breakout zones.

This machine learning-driven price channel enables traders to navigate market reversals, trend continuations, and breakout scenarios with AI-powered precision.

3. AI SuperTrend Clustering Oscillator: A Machine Learning Approach to Trend Strength

How It Works

Unlike traditional momentum oscillators that use fixed formulas, the AI SuperTrend Clustering Oscillator adopts an unsupervised machine learning technique to quantify trend strength. Instead of relying on static price differentials, it applies k-means clustering to price deviations from SuperTrend levels.

The AI Process:

- Multiple SuperTrend variations are calculated across different ATR multipliers.

- The difference between the close price and each SuperTrend level is analyzed.

- K-means clustering groups these deviations into:

- Bullish clusters (strong buying pressure)

- Neutral clusters (market indecision)

- Bearish clusters (strong selling pressure)

- The indicator smooths these values to create an AI-driven trend strength oscillator.

- Stronger signals appear as deep-shaded areas, while weaker trends appear lighter.

Key Benefits:

✅ AI-Powered Trend Strength Analysis – Provides probabilistic trend confirmation.

✅ Self-Adaptive Algorithm – Adjusts trend strength in response to volatility shifts.

✅ Momentum Clustering – Separates true trend momentum from noise.

This oscillator enhances SuperTrend trading strategies by helping traders identify high-confidence trend reversals and filter out weak signals.

4. Combining These AI Indicators for a Complete Trading System

Each of these indicators can be used individually, but when combined, they create a robust AI-driven trading system:

🔹 Trend Identification (SuperTrend AI Clustering)

- Establishes whether the market is in an uptrend or downtrend.

- Uses machine learning to optimize trend detection settings dynamically.

🔹 Key Levels (AI Channels)

- Defines AI-determined support and resistance zones.

- Helps traders identify entry & exit points based on price clustering.

🔹 Trend Strength & Confirmation (AI SuperTrend Clustering Oscillator)

- Measures momentum intensity to confirm whether a trend is gaining or losing strength.

- Filters out low-confidence signals.

By integrating these three AI indicators, traders gain an adaptive, self-optimizing trading strategy that removes the subjectivity from trend detection, support/resistance analysis, and momentum assessment.

Conclusion: The Future of AI in Trading

The combination of machine learning and technical analysis is transforming the way traders approach the market. AI-powered indicators remove the guesswork, providing traders with data-driven, self-optimizing, and adaptive strategies that evolve in real-time.

✅ AI SuperTrend Clustering ensures traders follow the most statistically relevant trend.

✅ AI Channels provide an objective view of dynamic support and resistance levels.

✅ AI SuperTrend Clustering Oscillator quantifies market momentum with precision.

As AI continues to advance, we can expect even more sophisticated machine learning tools that will refine market predictions and create intelligent AI trading agents capable of autonomous decision-making.

🚀 The future of trading isn’t just about technical analysis—it’s about AI-driven market intelligence. Are you ready to embrace the revolution?

Get Access to AI Trading Indicators

To start using these AI-powered indicators, visit the LuxAlgo Library and explore cutting-edge tools designed to enhance your trading performance.