Introduction

In the world of technology, few companies command as much attention—and valuation—as Apple. With a market cap that has soared to unprecedented heights, Apple remains the crown jewel of the tech industry. But as its stock price continues to climb, a debate rages on: Is Apple’s valuation truly justified, or are we witnessing the inflation of a tech bubble destined to burst? Some argue that Apple, once the leader in tech innovation, has become more of a follower, raising questions about its long-term growth prospects.

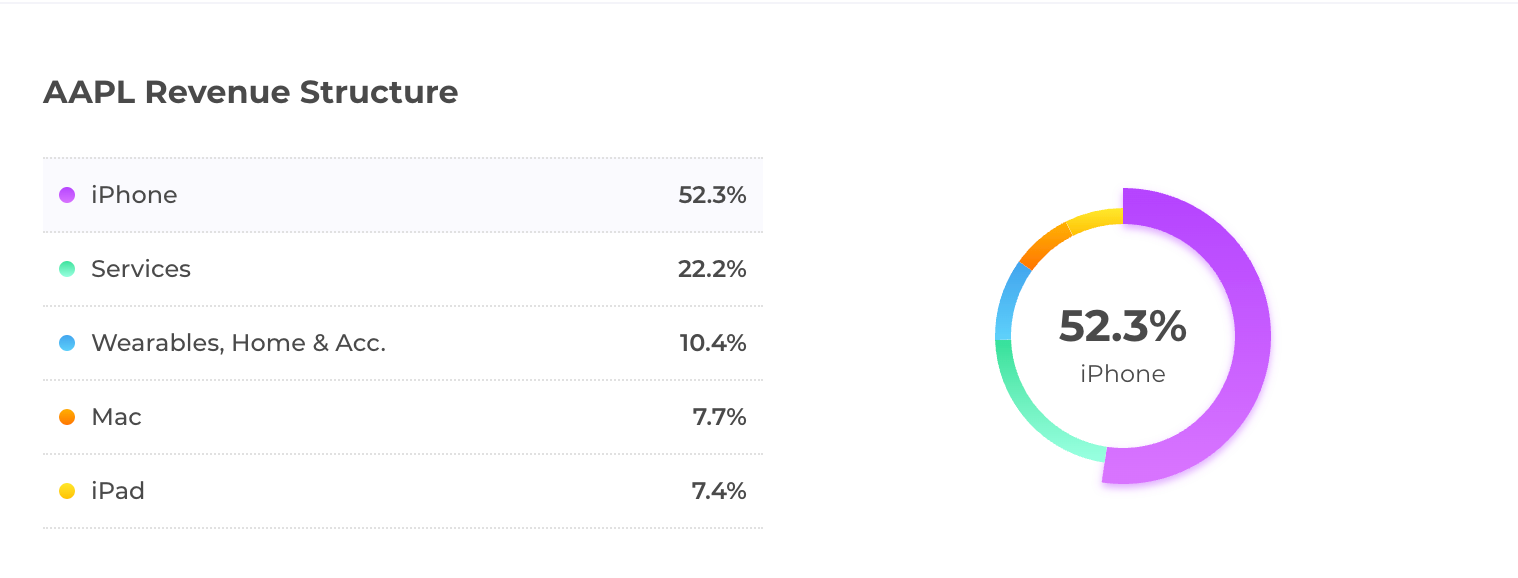

On one side, defenders argue that Apple’s unmatched ecosystem, loyal customer base, and strategic diversification make it a solid investment. On the other, skeptics point to the company’s heavy reliance on iPhone sales, the perceived stagnation in innovation, and the risks of an economic downturn as reasons to question the sustainability of its valuation.

Apple’s Current Valuation and Market Position:

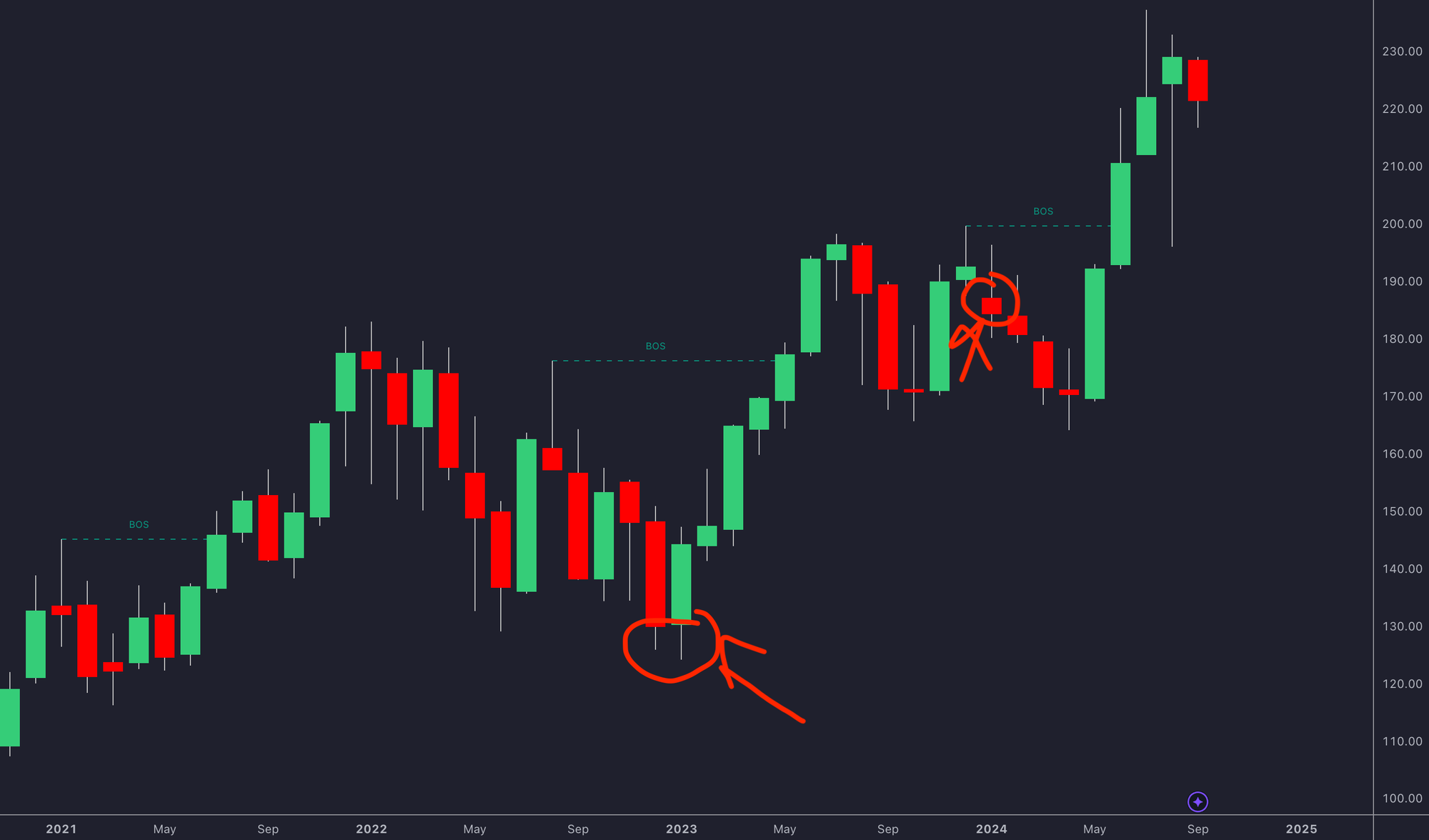

Apple’s rise to becoming a $3 trillion company is nothing short of remarkable. It’s a brand synonymous with innovation, quality, and a premium user experience. However, in 2023, Apple experienced Iphone negative revenue growth.

Despite a 50% increase in its stock price in that same year of 2023,

Apple was the worst-performing FAANG stock that year, leading some analysts to downgrade their outlook on the company

The Skeptic’s Perspective:

For those who believe Apple’s valuation might be overinflated, the arguments are clear. The company’s reliance on iPhone sales is a significant concern.

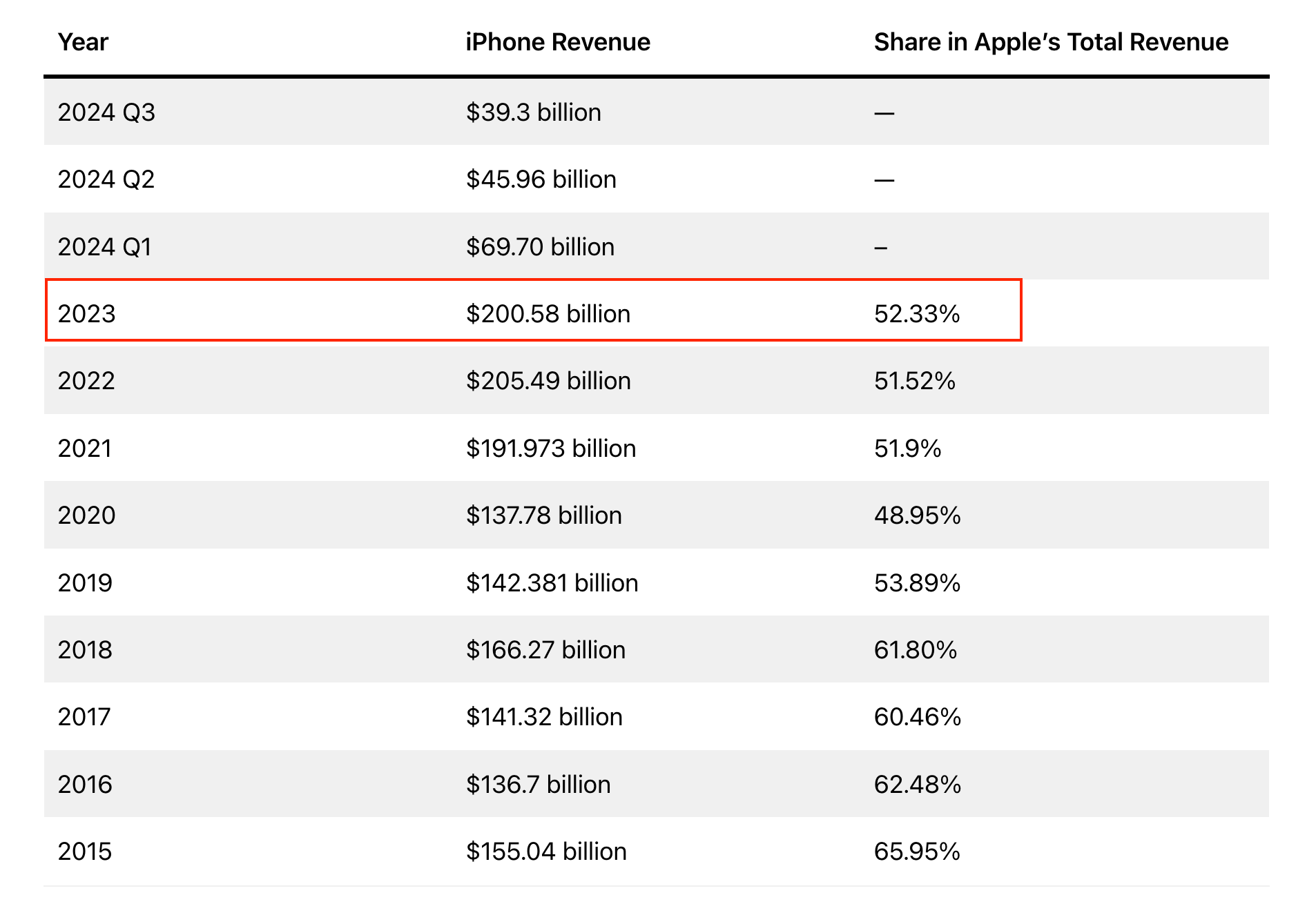

The iPhone alone generated $200.5 billion in revenue in 2023, accounting for over 50% of Apple’s total revenue . Yet, the smartphone market is reaching saturation, and with economic pressures mounting, consumers may soon be less inclined to buy the latest model, especially when their current phones work just fine.

There’s also the question of innovation. Critics argue that Apple has become more of a follower than a leader, waiting for technologies like AI to mature before jumping on the bandwagon. The Vision Pro, despite its initial buzz, has failed to sustain long-term excitement.

Also the failure of ventures like the Apple Car casts doubt on the company’s ability to pivot to new product lines if iPhone sales decline.

Furthermore, notable financial analysts like those from Barclays have downgraded Apple’s stock to a “Sell” rating, expressing concerns over its future growth potential.

Economic Influences on Consumer Behavior:

Recent economic events have significantly shaped consumer behavior, especially in technology spending. Inflation has been a persistent issue, with consumer prices rising cumulatively by 18.6% over the past three years. This sustained inflationary pressure has diminished the purchasing power of consumers, making them more hesitant to invest in high-end electronics like the latest iPhone models, despite a slight easing in the inflation rate recently.

Moreover, the global economic growth has been tepid, with projections indicating only modest increases. This economic stagnation contributes to a cautious spending environment where consumers are more likely to hold onto their money or opt for less expensive alternatives. In the U.S., there is a notable trend of consumers trading down for better pricing and value, a behavior that is particularly pronounced among younger and lower-income demographics. This shift towards more economical choices is driven by a combination of ongoing economic uncertainty and a desire to maximize financial stability.

These economic conditions, coupled with a cautious consumer sentiment, mean that many are delaying upgrades to newer technology. The psychological impact of economic uncertainty further encourages consumers to cling to existing devices longer than in more stable times. This cautious behavior is crucial for understanding the challenges companies like Apple face in motivating consumers to purchase their latest products amidst financial uncertainties and a competitive marketplace.

Apple’s Approach to Artificial Intelligence

Apple’s strategy in bringing AI into its ecosystem has been met with mixed reactions. Unlike competitors such as Google and Microsoft, who have been heavily investing in developing their own AI models, Apple chose a different path by integrating OpenAI’s ChatGPT into its products under the branding of “Apple Intelligence.

This move has sparked discussions about whether Apple, once seen as a leader in innovation, is now leaning more towards following industry trends rather than setting them.

One notable aspect of this integration is that Apple Intelligence is exclusive to the iPhone 15 Pro and 15 Pro Max, as well as future models, effectively making it inaccessible to older iPhone models. This exclusivity raises questions about Apple’s intent: Is this a strategic move to leverage AI as a selling point to drive upgrades, or does it signal a deeper issue where Apple is struggling to innovate in-house? By restricting this feature to newer models, Apple may be attempting to nudge its customer base toward purchasing the latest devices, possibly out of concern that consumers are becoming less inclined to upgrade regularly due to the lack of groundbreaking innovations in recent years.

Moreover, the decision to integrate an existing AI model like ChatGPT, rather than develop a proprietary AI system, could be seen as a pragmatic choice, but it also highlights potential gaps in Apple’s AI research and development capabilities. In an era where AI is becoming a cornerstone of technological advancement, Apple’s reliance on an external AI provider could be interpreted as a sign that the company is playing catch-up in this critical area.

Apple has always positioned itself as a company that perfects and refines existing technologies rather than rushing to be the first to market. However, in the case of AI, this approach may come across as more reactive than proactive, especially when compared to the ambitious AI strategies of its competitors. While this strategy has often worked in Apple’s favor, leading to polished and user-friendly products, the AI space is fast-paced and fiercely competitive, where being merely a fast follower might not be enough to maintain a leadership position.

The exclusivity of Apple Intelligence to newer models might also exacerbate concerns about accessibility and equity among Apple’s customer base. By making a highly-anticipated feature available only on the latest devices, Apple risks alienating a portion of its user base that either cannot afford to upgrade or sees no need to, given the incremental nature of recent hardware improvements.

Apple’s approach to AI integration reflects its broader strategy of incremental innovation and leveraging its ecosystem to maintain customer loyalty. However, as AI becomes increasingly central to the tech landscape, Apple’s reliance on third-party technology and the exclusionary nature of its implementation could be seen as a potential weakness—one that raises questions about the company’s ability to remain at the forefront of technological innovation in the years to come.

Potential Outcomes:

Looking ahead, the big question remains: What happens if iPhone sales continue to decline? Skeptics warn that without major innovation, Apple could struggle to maintain its current growth trajectory. However, defenders argue that the company’s robust ecosystem and growing services sector provide a safety net that will allow Apple to pivot and adapt, even in a challenging market.

The Vision Pro, while not an immediate success, could evolve into a significant revenue driver as augmented reality becomes more mainstream. Similarly, Apple’s investments in AI and other emerging technologies might not yield immediate results, but they position the company to capitalize on future trends.

Closing Reflections:

The debate over Apple’s valuation is far from settled. On one hand, the concerns about innovation stagnation and over-reliance on iPhone sales are valid. On the other, Apple’s strong ecosystem, strategic diversification, and ability to adapt suggest that the company is well-positioned to continue its dominance in the tech industry. As with any investment, the key is to weigh the risks and rewards carefully, keeping in mind that in the world of tech, the only constant is change.

References:

(1) Apple Revenue Statistic: https://www.demandsage.com/iphone-user-statistics/

(2) FAANG Stocks performance: https://www.barchart.com/story/news/22913217/these-are-the-best-and-worst-faang-stocks-for-2024-according-to-wall-street

(3) 2023 Revenue Article: https://www.demandsage.com/iphone-user-statistics/

(4) Apple Vision Productions Halted: https://www.macrumors.com/2024/10/23/apple-may-stop-producing-vision-pro-by-end-of-2024/

(5) Apple Car Canceled: https://www.macrumors.com/roundup/apple-car/

(6) OpenAI & Apple Partnership: https://openai.com/index/openai-and-apple-announce-partnership/