Candlestick patterns are one of the most powerful tools in a trader’s arsenal. These visual indicators tell the story of market sentiment and help traders spot potential market reversals before they happen. By mastering key candlestick patterns, you’ll be able to make smarter, more informed trading decisions.

What Are Candlestick Patterns?

Candlestick patterns are formations that appear on price charts and represent the price movement for a specific time frame. Each candlestick shows the open, high, low, and close of the price during that period. The body of the candlestick shows the difference between the open and close, while the wicks (or shadows) show the high and low prices.

Candlestick patterns are a visual representation of the ongoing "battle" between buyers (bulls) and sellers (bears). Certain patterns signal that one side is gaining control, which often results in price reversals.

Why Candlestick Patterns Matter

Understanding candlestick patterns can give you an edge in the market by helping you:

- Identify Reversal Points: Spot areas where the market is likely to change direction.

- Time Your Entries and Exits: Enter trades at optimal moments and avoid chasing the market.

- Build Confidence in Your Trades: Confirm potential moves before committing your capital.

By learning to recognize these patterns, you’ll be able to avoid bad trades and focus on high-probability opportunities.

Key Bullish Reversal Patterns

These patterns indicate a potential shift from a downtrend to an uptrend. Here are the most important bullish reversal candlestick patterns to know:

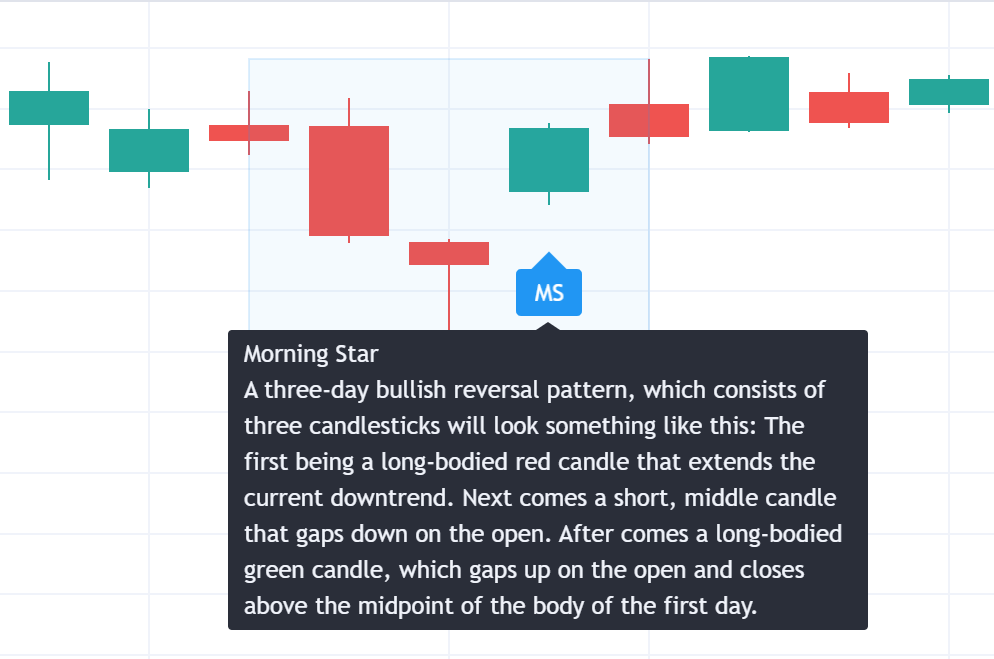

1. Morning Star (There is also a Evening Star formation for bearish setups)

- Structure: A large bearish candle, followed by a small indecision candle (like a Doji or Spinning Top), and finally a large bullish candle.

- What It Means: The bears initially have control, but indecision sets in, and the bulls regain control, signaling an upward reversal.

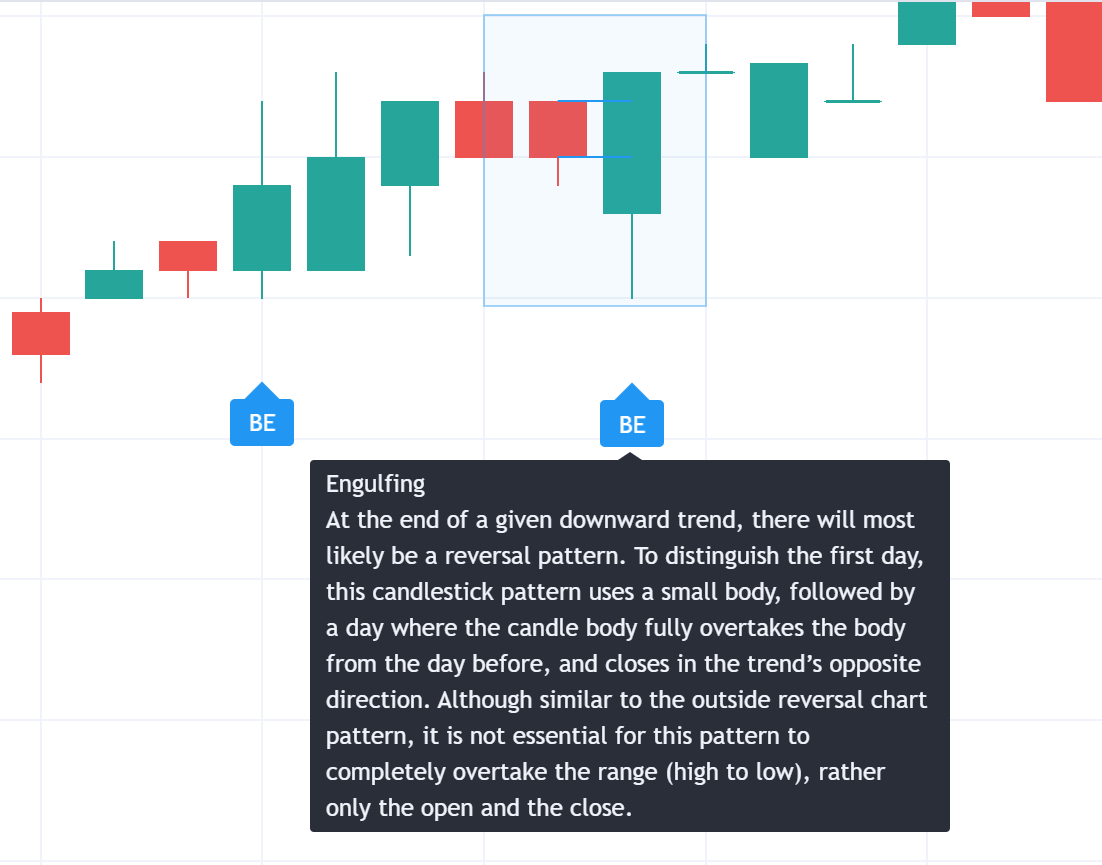

2. Bullish Engulfing (There is also a bearish Engulfing formation for bearish setups)

- Structure: A small bearish candle followed by a large bullish candle that "engulfs" it.

- What It Means: The bulls have overpowered the bears, signaling a potential price reversal to the upside.

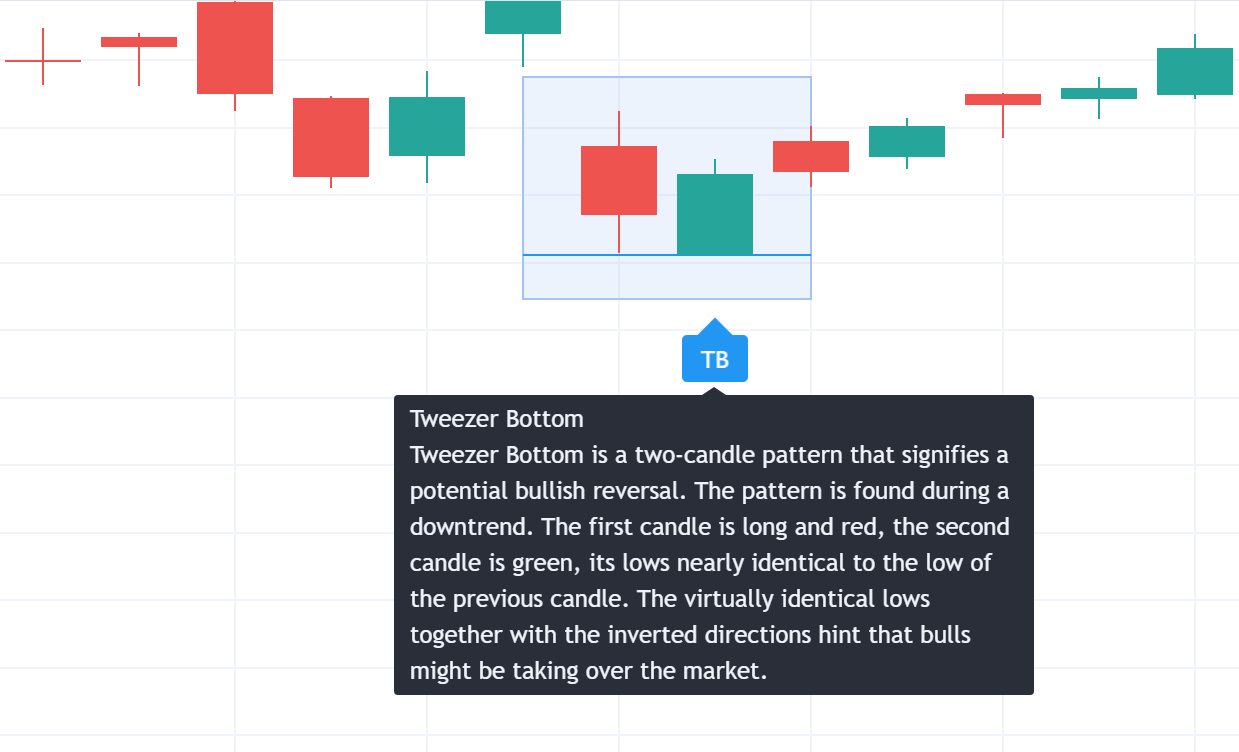

3. Tweezer Bottoms (There is also a Tweezer Bottoms formation for bearish setups)

- Structure: Two candles with equal lows, typically seen as a small bearish candle followed by a small bullish candle.

- What It Means: The market has "tested" the same low twice, and buyers are stepping in to push the price higher

Indecision Patterns and What They Mean

Not all candlestick patterns signal a clear reversal. Sometimes, the market shows indecision, and these patterns can help you anticipate future moves:

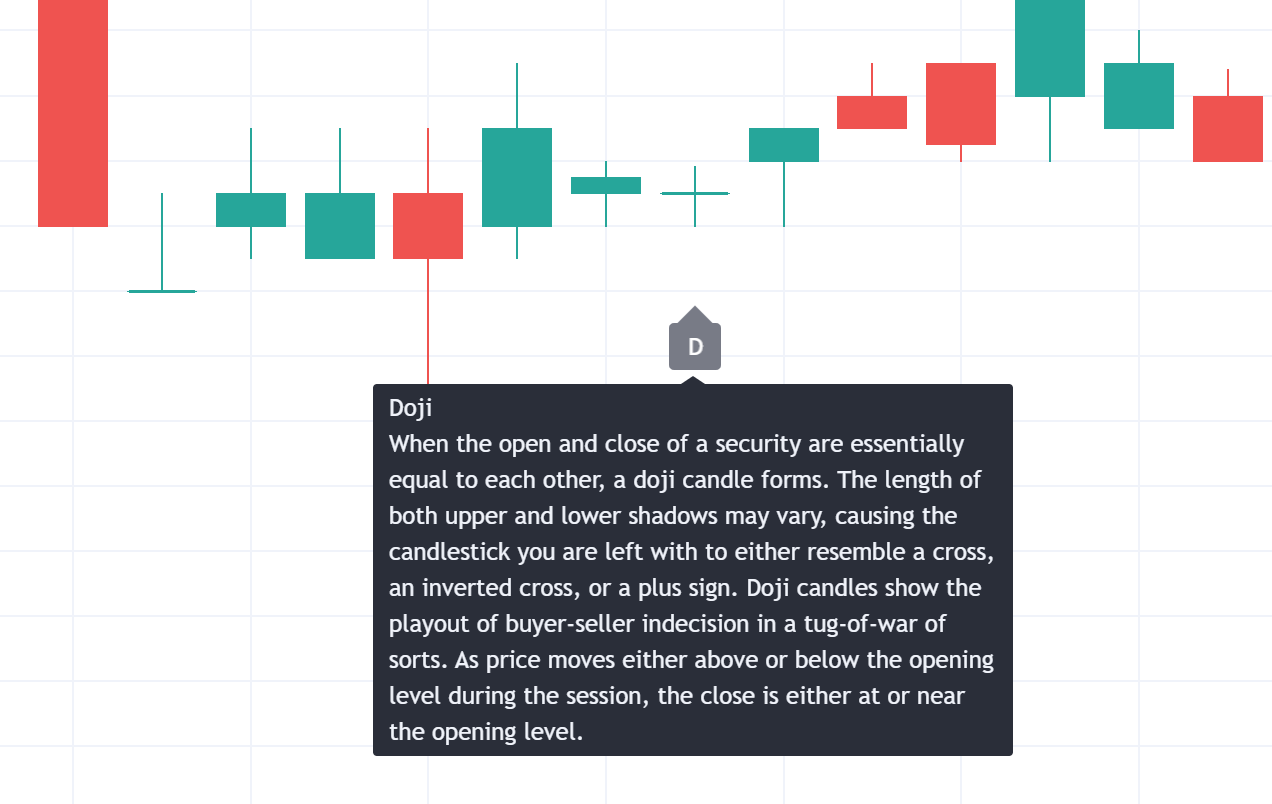

1. Doji

- Structure: The open and close prices are the same or very close, with long wicks on both sides.

- What It Means: Neither bulls nor bears have control. The market is undecided, and a potential reversal or continuation could follow.

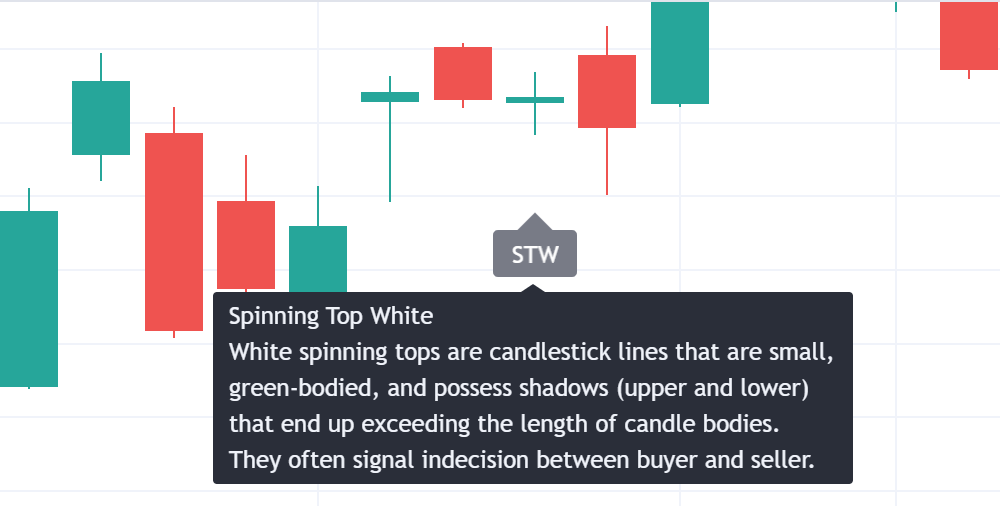

2. Spinning Top

- Structure: Small candle body with long upper and lower wicks.

- What It Means: It’s a sign of market uncertainty. It’s often seen at the top or bottom of trends, hinting at a possible reversal.

How to Trade Candlestick Patterns

Knowing candlestick patterns is one thing, but using them effectively is another. Here’s a simple process to follow when trading with candlestick patterns:

- Wait for the Close: Never trade in the middle of a candlestick formation. Wait for the final candle to close to confirm the pattern.

- Look for Confluence: Combine candlestick patterns with other indicators (like support and resistance, Fibonacci, or moving averages) to increase confidence.

- Set Stop-Losses Wisely: Place your stop-loss below the low of a bullish pattern or above the high of a bearish pattern.

- Use Multiple Time Frames: Look for candlestick patterns on higher timeframes (like 1-hour or 4-hour charts) for stronger confirmation.

Common Mistakes to Avoid

- Relying Solely on Candlestick Patterns: Patterns alone are not enough. Use them with other technical analysis tools.

- Ignoring the Overall Trend: If the broader trend is down, bullish reversal patterns are less reliable.

- Trading Without Confirmation: Always wait for the final candle to close to avoid being "faked out."

Final Thoughts

Candlestick pattern give you a peek into market sentiment and help you spot when a big price shift might be on the way. But here’s the thing – context is everything. Don’t just rely on patterns alone. Pair them up with other technical indicators to boost your accuracy, and always wait for the candle to close before jumping into a trade.

With a bit of practice, you’ll be spotting Morning Stars, Engulfing Patterns, and Tweezer Tops like a pro. These patterns become your secret weapon in the market, giving you the confidence to make smarter, more calculated trades.