Circuit breakers are essential tools for stabilizing stock markets during volatility, helping investors make informed decisions amidst chaos.

Circuit breakers are automatic systems that pause stock market trading when prices drop sharply, helping to prevent panic and stabilize markets. They were introduced after the 1987 Black Monday crash and have been refined over time. Here's a quick breakdown:

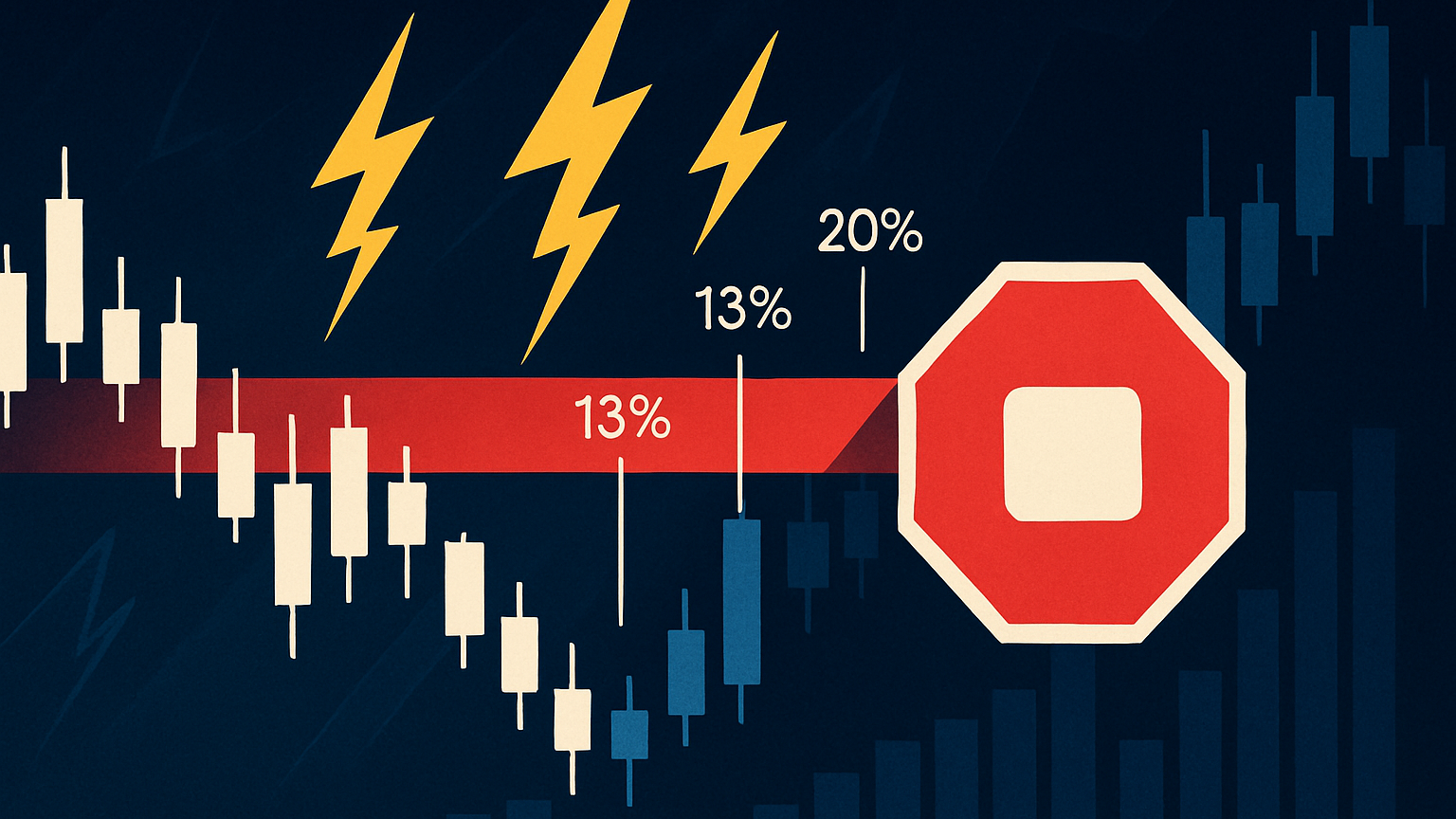

- How They Work: Triggered at 7%, 13%, or 20% drops in the S&P 500. Levels 1 and 2 cause 15-minute halts (if before 3:25 p.m.), while Level 3 closes the market for the day.

- Purpose: To give investors time to evaluate and make informed decisions during extreme volatility.

- Impact: Useful for long-term stability but can disrupt day trading and sometimes amplify short-term volatility.

- Individual Stocks: The Limit Up-Limit Down (LULD) system halts trading if a stock price moves outside set bands.

Circuit breakers are a vital measure for managing market chaos, though they come with challenges like increased volatility near trigger points. To navigate them, traders should use stop-loss orders, manage position sizes, and analyze market conditions carefully.

Why Do Stocks Halt? Stock Circuit Breakers For Dummies And How They Work

Circuit Breaker Mechanics

This section breaks down how circuit breakers enforce trading halts to maintain order during volatile periods. These mechanisms operate at both the market-wide and individual stock levels, using set thresholds and timed pauses to manage disruptions.

Market-Wide Stop Points

Market-wide circuit breakers are recalculated daily using the previous day's S&P 500 closing price. There are three trigger levels, each with specific rules:

| Level | Decline Threshold | Trading Hours Impact |

|---|---|---|

| Level 1 | 7% decline | 15-minute halt (before 3:25 p.m. ET) |

| Level 2 | 13% decline | 15-minute halt (before 3:25 p.m. ET) |

| Level 3 | 20% decline | Market closes for the day |

For example, if the S&P 500 falls by 5,592.21 points, it hits Level 1; by 5,231.42 points, Level 2; and by 4,810.50 points, Level 3.

Individual Stock Controls

The Limit Up-Limit Down (LULD) system protects individual stocks by setting price bands based on stock type and price range:

| Stock Category | Regular Trading Hours Band | Final 25 Minutes Band |

|---|---|---|

| Tier 1 NMS Securities (S&P 500, Russell 1000) | 5% | 10% |

| Tier 2 NMS Securities (> $3.00) | 10% | 20% |

| Stocks ($0.75 – $3.00) | 20% | 40% |

| Stocks (< $0.75) | Lesser of 75% or $0.15 | Lesser of 150% or $0.30 |

If a stock's price moves outside its band and stays there for 15 seconds, trading halts for 5 minutes. This ensures targeted intervention without unnecessarily disrupting the entire market.

Timing and Trigger Rules

Circuit breakers follow precise timing protocols:

- Level 1 and 2 halts only occur before 3:25 p.m. ET.

- After 3:25 p.m. ET, only Level 3 halts can stop trading.

- Levels 1 and 2 can trigger just once per trading day.

- LULD mechanisms work during regular trading hours (9:30 a.m. – 4:00 p.m. ET).

"The securities and futures exchanges have procedures for coordinated cross-market trading halts if a severe market price decline reaches levels that may exhaust market liquidity." – US Securities and Exchange Commission

These timing rules help maintain an orderly flow of information and trading, especially as the market approaches closing time.

Effects of Circuit Breakers

Market Protection Measures

Circuit breakers act as a safety net during extreme market turbulence. A clear example came in 2020 when the New York Stock Exchange activated them four times in just ten days due to intense volatility (NYSE).

"The trading halt was working as it's designed to function so that the market can absorb what news was out overnight, how investors are reacting so they can make decisions, and everyone gets a chance to see what's happening." – Stacey Cunningham, NYSE President

These mechanisms help prevent large players from taking advantage of rapid price swings, creating a more balanced environment. However, while circuit breakers stabilize markets, they also come with certain drawbacks.

Limitations and Issues

Although designed to reduce panic, circuit breakers can sometimes create additional challenges, such as:

| Challenge | Impact | Potential Consequence |

|---|---|---|

| Market Fragmentation | Lower liquidity | Less effective price discovery |

| False Security | Delayed reactions | Possible increase in volatility |

| Herd Behavior | Accelerated selling | Pressure near trigger thresholds |

| Trading Disruption | Issues for day traders | Positions stuck during halts |

Research highlights that as markets approach these triggers, trading activity intensifies, return volatility rises, and negative return skewness increases. Professor Hui Chen from MIT Sloan observes:

"The fear of an imminent trading halt causes some investors to sell aggressively, which actually makes the market more volatile, not less."

Circuit Breaker Impact Analysis

History shows circuit breakers can be effective in stabilizing markets. Before 2020, the U.S. market-wide circuit breaker had only been triggered once since its introduction in 1988—on October 27, 1997.

"[Circuit breakers are] the equivalent of catching your breath and counting to 10 before you say or do something rash." – Greg McBride, Chief Financial Analyst at Bankrate

These pauses give investors time to process information, make thoughtful decisions, and bring balance back to the market. The U.S.'s tiered thresholds have proven more reliable compared to systems like China's 5% threshold, which was abandoned in January 2016 after triggering twice in just four days.

Managing Trades During Halts

Understanding circuit breakers and their effects is just the start. Traders need a solid plan to handle halts effectively.

Pre-Halt Planning

Preparation is key. Market volatility can spike without warning, so having safeguards in place is crucial:

| Protection Measure | Implementation | Purpose |

|---|---|---|

| Stop-Loss Orders | Set stop-loss orders at critical levels | Minimizes losses during sudden moves. |

| Position Sizing | Limit position sizes to a small percentage of capital | Reduces risk of overexposure. |

| Alert Systems | Set up price and volatility alerts | Provides early warnings of potential halts. |

Trading After Halts

- Understand the cause: Regulatory issues, news, or extreme volatility?

- Analyze order flow and market depth: See how traders and institutions are positioning.

- Use limit orders: Control entry prices and avoid poor fills.

- Track volume: Stabilizing volume often signals a market finding its footing.

Market Analysis Tools

Modern platforms offer tools to help you evaluate conditions after a halt. For instance, Bookmap provides real-time order flow visualization.

Key metrics to focus on include:

- Volume Profile Maps: Highlights price levels with the highest trading activity.

- Order Flow: Spot institutional buy/sell trends.

- Market Depth: Shows available liquidity at different price points.

- Support & Resistance Zones: Identifies key price barriers based on price action.

Summary and Guidelines

Circuit Breaker Overview

Circuit breakers play a key role in maintaining market stability. These mechanisms halt trading temporarily to prevent panic and allow investors to regroup. First introduced after Black Monday in 1987, they have proven their worth during turbulent times, such as the March 2020 selloff.

Here’s a quick breakdown of how they work:

| Trigger Level | Market Drop | Action Taken | Trading Hours |

|---|---|---|---|

| Level 1 | 7% | 15-minute halt | Before 3:25 PM ET |

| Level 2 | 13% | 15-minute halt | Before 3:25 PM ET |

| Level 3 | 20% | Market closes | Rest of trading day |

Trading Best Practices

To navigate circuit breaker activations, consider these strategies:

- Keep position sizes smaller when volatility spikes.

- Use stop-loss orders to set clear exit points.

- Leverage platforms that visualize market depth and order flow.

"In the U.S., most people view circuit breakers as a necessary tool, especially when the market is in a state of chaos."

These pauses are an opportunity to step back, analyze the situation, and make decisions based on facts rather than emotion.