A recent unwind of what's known as the Yen Carry Trade caused volatile panic by investors in not only Japan's stock market, but in all markets around the world. Let’s explore the mechanics of the Yen Carry Trade and see the dramatic impact it has had on global markets.

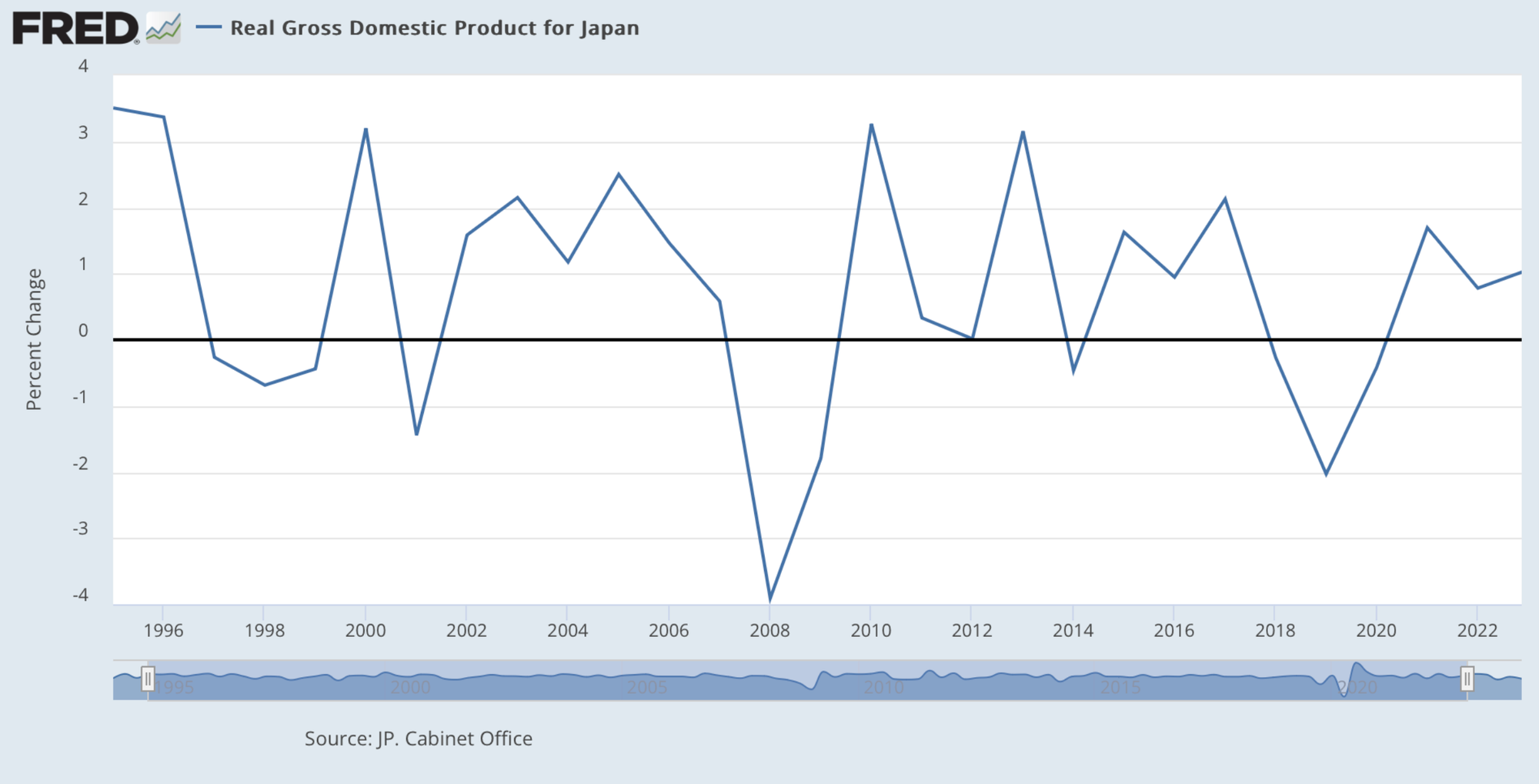

For decades, Japan has held interest rates near zero in hopes of encouraging economic growth as the world's fourth-largest economy. The country has struggled to produce a consistently positive Gross Domestic Product (GDP), something officials and economists hoped the loose monetary policy would remedy. While the effect of low borrowing costs on Japan's economy is undetermined, but what is evident is the massive implications it has had for Japan's currency and how it was leveraged as a tool for liquidity across the globe.

How Does A Carry Trade Work?

A carry trade involves utilizing the difference in interest rates between two central banks and their respective currencies. The lower interest rate currency, often called the "funding currency" is shorted by traders, or possibly loaned in that country and then sold for another "asset currency."

Without major changes to interest rates or currency exchange values, carry trades allow parties to profit from this difference, borrowing for less and using the higher interest rates to maximize returns. This may sound like an infinite money glitch, but what happens when the governing bodies change interest rates? Well, that's exactly what happened with the Bank of Japan…

Decades of Japanese Deflation

Prior to this month, the Bank of Japan had not raised rates in over 17 years. This zero-interest-rate policy (ZIRP) had been maintained by the central bank in an effort to combat low economic growth in the region. The bank has actively intervened in both the government bond market, a practice known as yield curve control, and recently in the Forex currency markets.

This monetary policy combined with Japan's low economic and population growth spurred Japanese authorities spent over $36 billion in July alone in an effort to reverse the Yen. Weakness in the Yen had hit 34-year lows against the US dollar, highlighting the dramatic need for a change in policy.

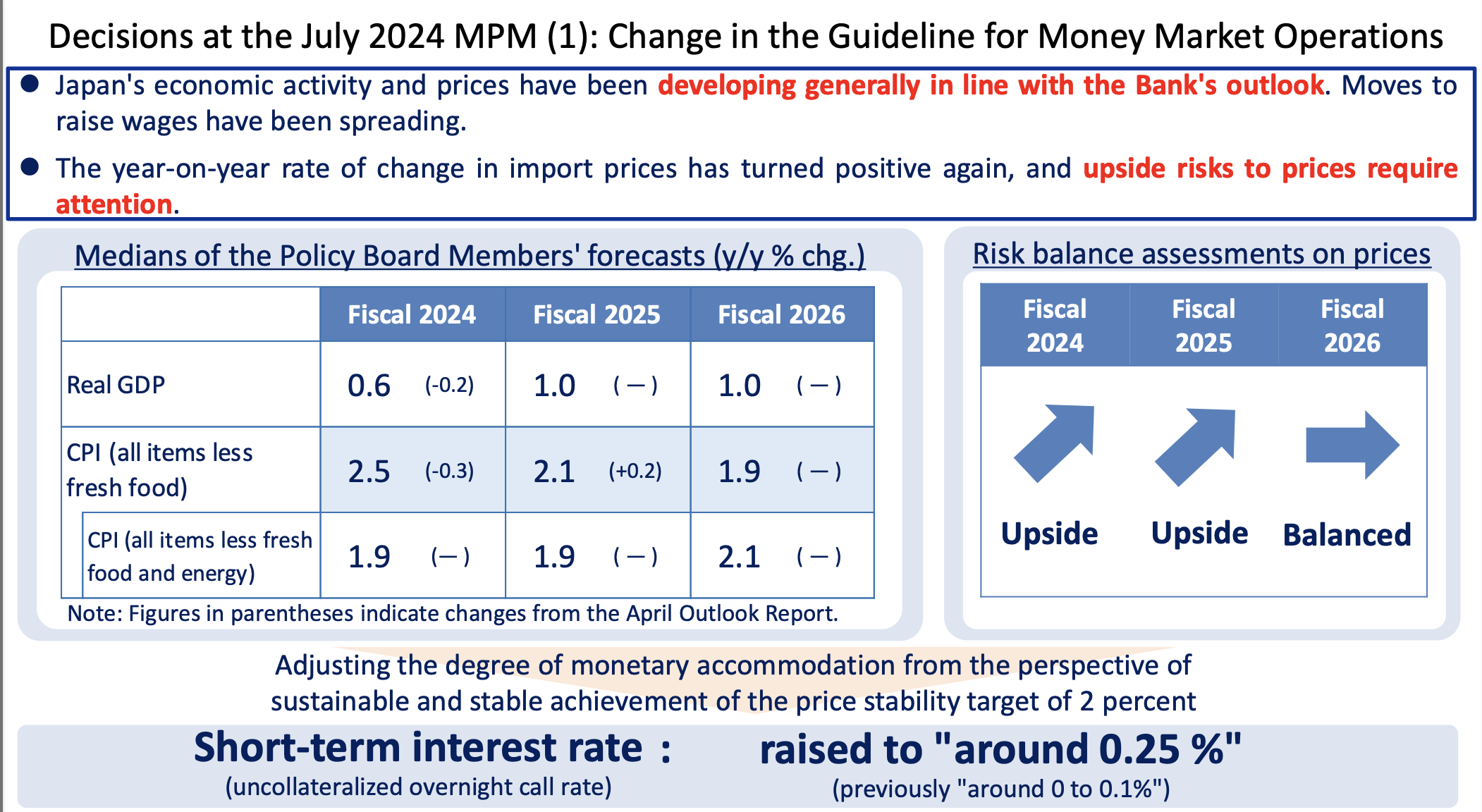

Regime Change At The BOJ

In April this year, the Bank of Japan was led by a new governor, Kazuo Ueda. Ueda holds differing monetary views than the bank's previous leader. So after months of signaling a coming change, the BOJ raised interest rates to 0.25%, the highest rate Japan has seen since 2008. While this 25 basis point change seems small, it triggered a massive move in both forex and equity markets as it changed the cost of capital on potentially Trillions of dollars in equities, bonds, and open currency positions.

Unwinding The Short Yen

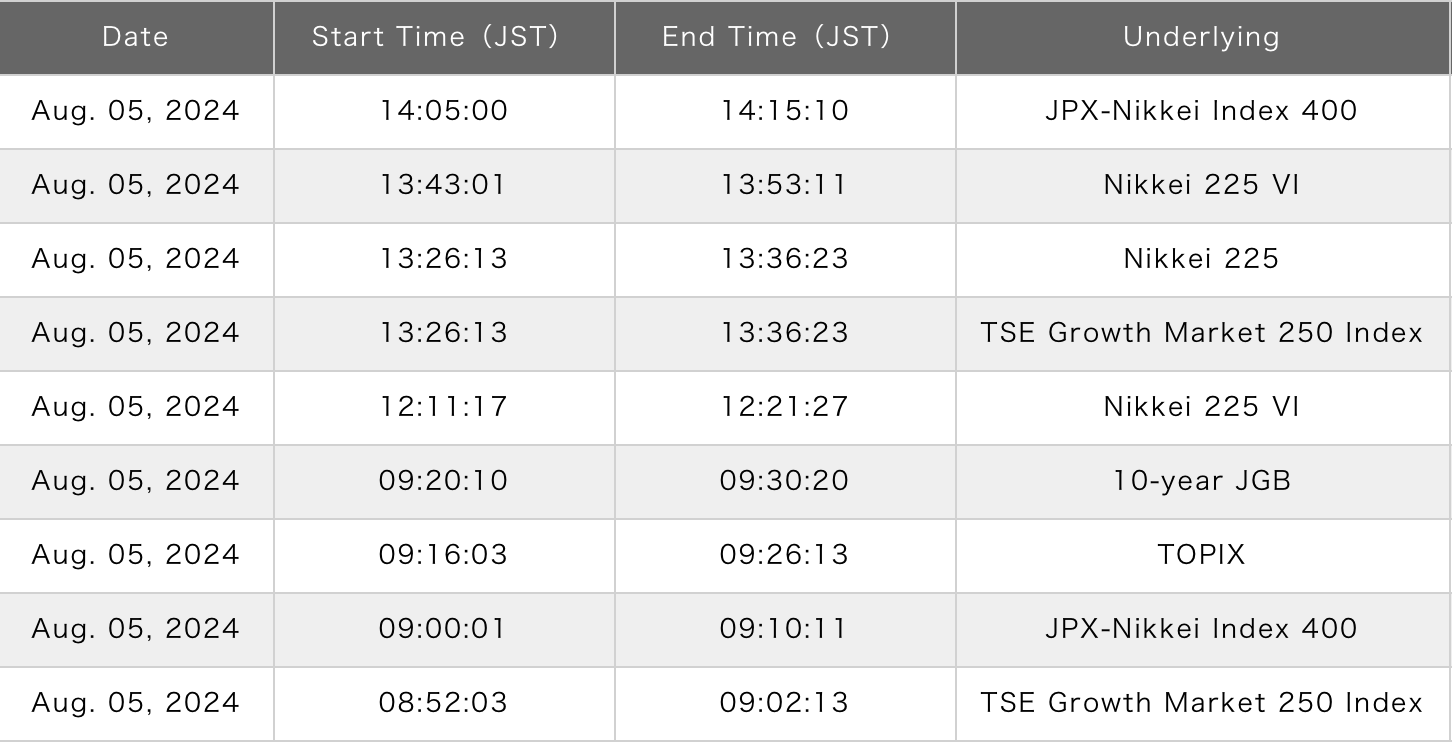

Once the interest rate hike went into effect August 1st, 2024, enormous shifts in Japan's currency took place. At one point, the Yen had strengthened against the US dollar as much as +7.5% in only three days! As traders and financial institutions looked to unwind their short Yen positions before they rapidly dropped in value, the influx pushed not only the currency, but all of Japan's equity portfolios into a volatile frenzy, marking the largest price swing these markets have seen since early 2020. Broad regional stock indices, like the Nikkei Index, halted trading numerous times in this period.

Effects Felt Around The Globe

The instability of not only the Yen, but the changing cost basis of open carry trades rocked US markets. The VIX (an index that tracks volatility and through that said to measure 'market fear') rose over +300% in only two trading sessions over this time. As the carry trades unwound, VIX hit its third-highest level since the index was created in 1993!

Stocks slid as fear escalated in markets. In the worst day since the start of the AI market rally, the US S&P 500 index closed down over -3% on August 5th. Some JP Morgan analysts said the positions in the Yen carry trade could be valued at $4 Trillion, a number that seems feasible given the breadth and size of the sell off. While markets may have stabilized since Japan's rate hike, it is important to understand the incredible shifts in stocks, forex, and even Bitcoin that can come from a single decision at a central bank.