Learn how to effectively use ATR to set dynamic stop-loss levels that adapt to market volatility for improved risk management.

Want better stop-losses that adjust to market conditions? ATR (Average True Range) can help you set dynamic stop-loss levels based on market volatility. Unlike fixed stop-losses, ATR-based stops expand during high volatility and tighten in calmer markets, improving risk management.

Key Takeaways:

- What is ATR? A volatility indicator that measures the average price range over a set period (e.g., 14 days).

- Why use ATR? It aligns stop-losses with market behavior, reduces whipsaws, and works across different markets and timeframes.

- How to calculate? Use formulas:

- Long trades:

Stop Loss = Entry Price - (ATR × Multiplier) - Short trades:

Stop Loss = Entry Price + (ATR × Multiplier)

- Long trades:

- Multipliers: Adjust based on trading style (e.g., 1.5x-2x for day trading, 3x-4x for position trading).

ATR-based stop-losses are flexible, easy to calculate, and adaptable to changing market conditions. Learn how to set them up, adjust in real-time, and test for better risk management.

How to Set Stop Losses with ATR Indicator

Setting Up ATR Stop-Loss Levels

Learn how to use ATR (Average True Range) to set stop-loss levels effectively with these straightforward steps:

Finding ATR Values

ATR values measure market volatility and are available on most trading platforms. For instance, if you're trading AAPL and the 14-period ATR is $3, this indicates the stock typically moves within a $3 range during a single period.

Choosing the Right ATR Multipliers

Your ATR multiplier depends on your trading style and risk tolerance. Here's a quick breakdown:

| Trading Style | ATR Multiplier | Suitable For |

|---|---|---|

| Day Trading | 1.5x - 2x | Fast intraday trades |

| Swing Trading | 2x - 3x | Multi-day positions |

| Position Trading | 3x - 4x | Long-term trends |

Shorter holding periods, like day trading, typically use lower multipliers (1.5-2x), while longer-term approaches, such as position trading, lean toward higher multipliers (3-4x).

Stop-Loss Formulas for Long and Short Positions

ATR-based stop-losses are calculated using simple formulas that work for both long and short trades:

For long trades:

Stop Loss = Entry Price - (ATR × Multiplier)

For short trades:

Stop Loss = Entry Price + (ATR × Multiplier)

Here’s an example: If AAPL is trading at $150 and you use a 2x ATR (ATR = $3), your stop-loss would be $144 for a long trade or $156 for a short trade.

In a study of 1,000 trades, using a 2x ATR stop-loss reduced the maximum drawdown by 32% compared to fixed stop-loss levels [2].

These calculations provide a flexible approach to managing risk. Adjustments will be necessary as market conditions change, which will be explored in the following section.

Updating ATR Stop-Losses in Real-Time

Building on earlier calculations, here’s how to make real-time adjustments to ATR-based stop-losses:

ATR Trailing Stop Methods

Traders often use two main methods to keep stop-losses flexible with changing market conditions:

- Fixed Multiple ATR: Adjusts the stop-loss distance based on current market volatility.

- Chandelier Exit: Tracks the highest high or lowest low during the trade, offering a way to follow price extremes. This method, created by Chuck LeBeau, is particularly useful for dynamic trade management [1][3].

Managing High Volatility Periods

ATR-based stops help align risk with market conditions. However, during high volatility, standard settings may need tweaking to avoid being stopped out too early.

| Market Condition | Suggested Adjustment | Example |

|---|---|---|

| High Volatility | Increase to 3-4x ATR | Use wider stop distances |

| Extreme Volatility | Use a longer ATR period | Shift from 14 to 21 or 28 periods [8][9] |

For day trades, update stops hourly. For swing trades, adjust daily [7]. When major market events occur, consider reducing position sizes and using volatility filters alongside support and resistance levels.

If you’re using automated systems, make sure your platform updates ATR values in real-time and includes safeguards for price spikes. Pair ATR stops with trend-confirmation tools, like moving averages, to ensure the trade aligns with market direction [3][5]. This approach keeps risk management responsive, even during rapid price movements.

Next, we’ll dive into how these methods integrate with specific trading platforms.

ATR Stop-Losses on Trading Platforms

Setting up dynamic ATR (Average True Range) stops depends on the tools available on your trading platform. There are comprehensive solutions available that fully implement confirmation signals along with stop loss and take profit levels based on ATR. For example, the Signals & Overlays Toolkit from LuxAlgo offers an all-in-one solution for managing your trades with dynamic ATR-based setups.

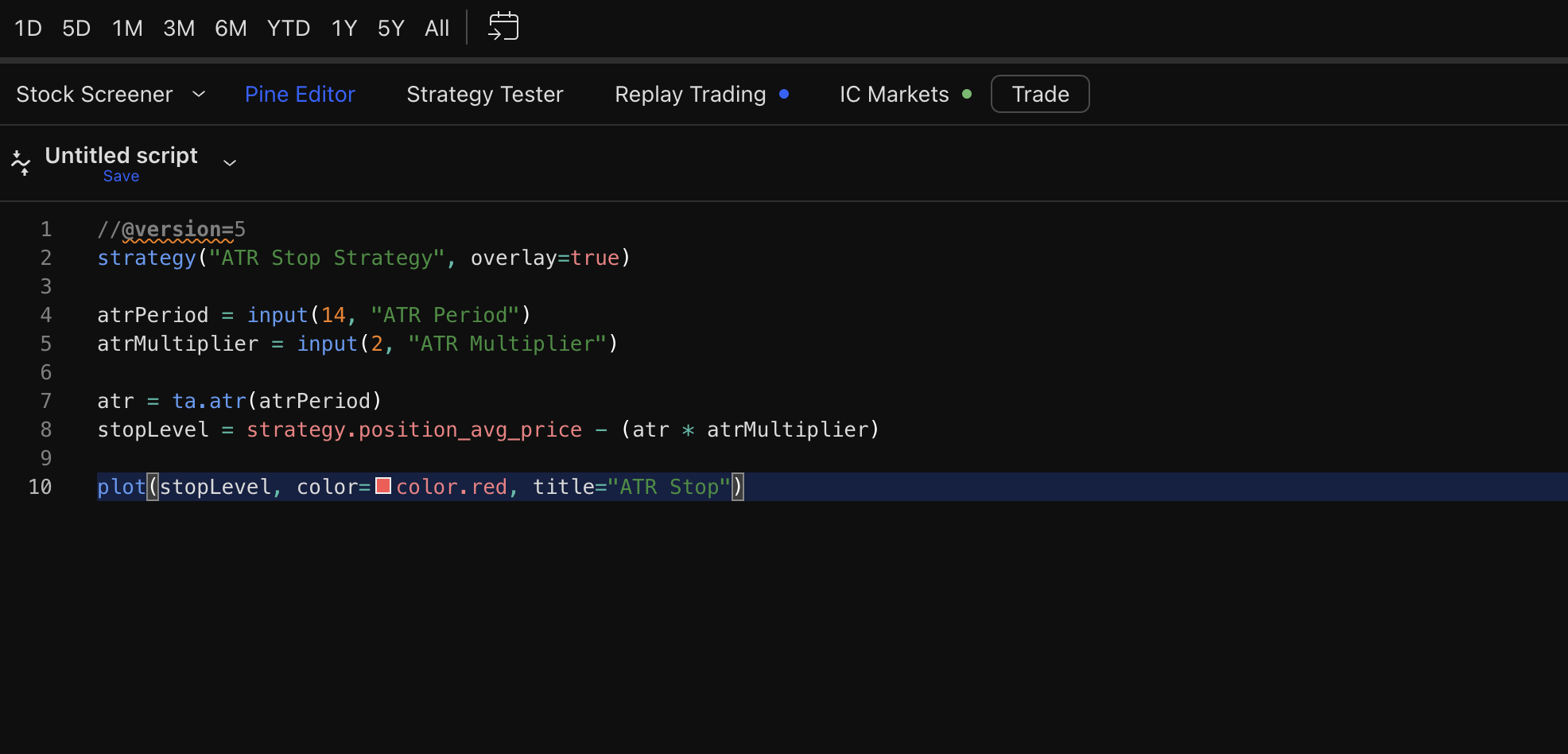

Example: ATR Stop Strategy Using Pine Script

Below is an example of how to create an ATR stop strategy using Pine Script:

//@version=5

strategy("ATR Stop Strategy", overlay=true)

atrPeriod = input(14, "ATR Period")

atrMultiplier = input(2, "ATR Multiplier")

atr = ta.atr(atrPeriod)

stopLevel = strategy.position_avg_price - (atr * atrMultiplier)

plot(stopLevel, color=color.red, title="ATR Stop")

ATR and Position Size Calculation

Using ATR for position sizing allows you to keep your risk consistent, even in volatile markets. The formula for ATR-based position sizing is:

Position Size = (Account Risk / (ATR × Multiplier)) × Account Balance

For example, on a $50,000 account risking 1% ($500) with a 2× $2.50 ATR:

(500 / (2.50 × 2)) = 100 shares

To automate this process, you can use the following Pine Script:

//@version=5

strategy("ATR Position Sizing", overlay=true)

accountSize = input.float(50000, "Account Size")

riskPercent = input.float(1, "Risk %") / 100

atrPeriod = input.int(14, "ATR Period")

atrMultiplier = input.float(2, "ATR Multiplier")

atr = ta.atr(atrPeriod)

positionSize = (accountSize * riskPercent) / (atr * atrMultiplier)

Testing ATR Stop-Loss Methods

Implementing ATR stops on platforms like TradingView is just the first step. To ensure they work effectively, thorough testing is essential.

Running ATR Strategy Tests

LuxAlgo’s AI Backtesting platform makes it easier to evaluate ATR-based strategies under various market conditions.

When testing ATR stop-loss strategies, focus on using historical data:

1. Data Selection and Preparation

Gather 5-10 years of historical price data. This ensures your strategy is tested across different market environments, including bull and bear markets, as well as periods of high volatility.

2. Parameter Optimization

Experiment with different ATR settings to find what works best:

| Parameter | Test Range | Purpose |

|---|---|---|

| ATR Period | 14, 21, 30 days | Defines the volatility window |

| ATR Multiplier | 1.5x, 2x, 3x | Sets the stop-loss distance |

Research indicates that a 3x ATR multiplier can boost trading performance by 15% compared to fixed stop-loss methods[2].

Adding Filters to ATR Stops

To refine ATR stops, consider adding these filters:

Volume-Based Filters

- Use volume thresholds to avoid trades during low-liquidity conditions.

Trend Confirmation

Incorporate the ADX (Average Directional Index) to confirm trends:

- Strong trend (ADX > 25): Use the standard ATR multiplier.

- Weak trend (ADX < 25): Increase the ATR multiplier by 50%.

Backtesting shows that applying these filters can lower maximum drawdowns by 22% compared to basic ATR stops[1]. To ensure the results are reliable, test filtered strategies over at least 200 trades for statistical accuracy[1].

Conclusion: ATR Stop-Loss Best Practices

ATR-based stop-losses provide a practical way to manage risk by adjusting to market volatility. Strategy testing highlights several important principles for using ATR stop-losses effectively.

Adjusting to Market Conditions

ATR stops expand during volatile periods and contract in calmer markets, helping to protect your capital in varying conditions.

Key Position Management Tips

- Update ATR values daily for longer-term trades to ensure your stops stay aligned with the latest market activity[3][4].

- Pair ATR stops with critical support and resistance levels for added precision.

Strategies for Trending Markets

In trending markets, using a trailing stop based on ATR values helps secure profits while giving the trade enough room to handle natural price swings.

Risk Management Adjustments

Stick to consistent multipliers during strong trends, but be ready to adjust them in weaker momentum phases to account for unpredictable price movements.

Applying ATR Stops Across Portfolios

For traders managing multiple assets, ATR stops provide a unified approach to risk management across different markets. This consistency helps balance exposure and avoids overloading on correlated instruments[6]. Exclusive tools such as the Signals & Overlays from LuxAlgo can help standardize ATR stop usage across positions while considering the unique volatility of each asset, ensuring a more balanced portfolio approach.

FAQs

What is the formula for ATR trailing stop loss?

The trailing stop formulas are straightforward and build on earlier entry-based calculations:

- For long positions: Current Price - (ATR × Multiplier)

- For short positions: Current Price + (ATR × Multiplier)

Pro Tip: Match the ATR period to your trading style. Short-term traders often go with 5-10 periods, while long-term traders usually stick to 14 periods [3].

If you're looking for real-time updates, pair these formulas with the methods outlined in "Updating ATR Stop-Losses in Real-Time." Tools like TradingView (refer to "ATR Stop-Losses on Trading Platforms") can handle these calculations automatically.