With former President Donald Trump expected to ring the opening bell at the New York Stock Exchange this week, speculation about his potential impact on the stock market is heating up. A recent statement by renowned Wharton professor Jeremy Siegel has reignited the debate, labeling Trump “the most pro-stock-market president” in U.S. history.

But what does history tell us? How did the stock market actually perform during Trump’s first term, and how might it fare if he gets a second?

Trump’s First Term: A Snapshot

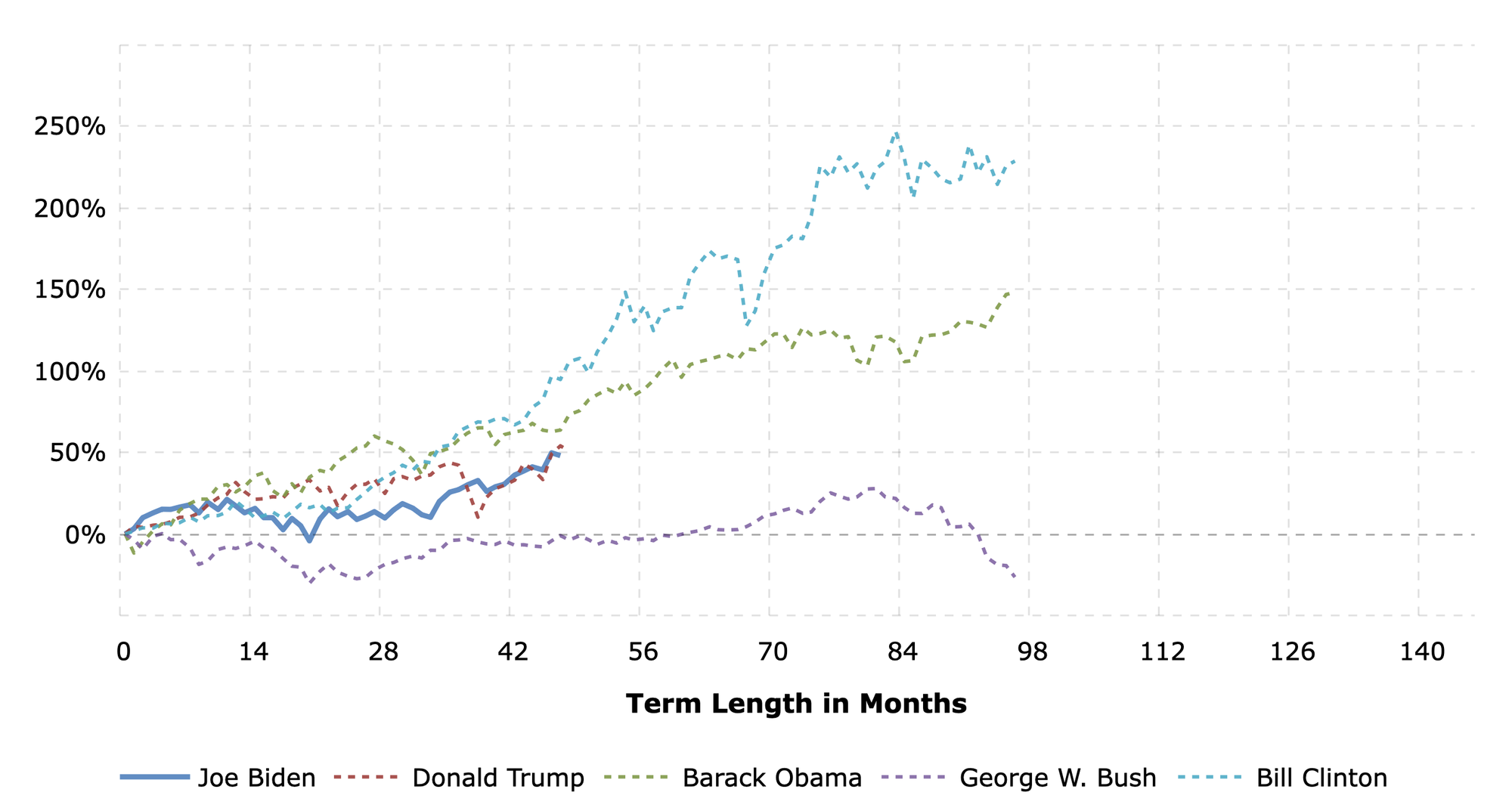

During Trump’s first four years, the S&P 500 surged by 61.29%, marking one of the stronger performances for any presidential term in recent decades. This bullish momentum was bolstered by tax cuts, deregulation, and a pro-business agenda.

In comparison, President Biden’s administration has seen the S&P 500 climb by 57.88% since his inauguration in January 2021. While impressive, this slightly trails Trump’s first-term growth at the same point in time. However, market gains often reflect broader economic conditions rather than purely presidential policies.

Historical Context: How Does Trump Compare?

For context, President Barack Obama’s first term saw the S&P 500 soar by a record-breaking 77.32% as the economy rebounded from the 2007–2009 recession. In contrast, George W. Bush faced a 25.65% decline during his first term due to the dot-com crash and 9/11.

Second Term Speculations: What’s Next for Markets?

Several factors of Trump's second term could influence market performance:

Economic Policies: Trump’s first-term playbook of tax cuts and deregulation could return, potentially spurring corporate profits and stock prices. However, the broader economic climate, including inflation and interest rates, will play a key role.

Global Trade and Geopolitics: Trump’s tough stance on trade, particularly with China, created market volatility during his first term. Investors may brace for similar turbulence if trade wars from planned tariffs resurface.

Sector Impacts: Technology and energy stocks thrived during Trump’s presidency. A renewed focus on traditional energy and deregulation could again boost these sectors.

Should Presidents Get Credit for Market Gains?

Many analysts argue that presidents have limited influence over the stock market’s trajectory. Factors like Federal Reserve policies, global economic conditions, and corporate earnings often carry more weight. For example, the Federal Reserve’s rate hikes during Biden’s term have played a significant role in changing market trajectory. A president's stock performance may just boil down to luck of the draw, depending on alignment with economic and market cycles.

A Cautious Outlook

While Trump’s track record suggests the potential for strong market performance, the future remains uncertain amid shifting economic dynamics. The current AI boom is reshaping industries and propelling significant market gains, particularly in tech. However, this rapid technological advancement could also disrupt labor markets, spark regulatory scrutiny, and challenge traditional economic models. Combined with factors like inflation, geopolitical tensions, and fiscal policy, the economy faces an unprecedented landscape that will ultimately dictate the stock market’s returns for years ahead.