The Man, The Myth, Michael J. Huddleston

If you have spent any time in the retail trading field within the last seven years, then you’ve heard of ICT (Inner Circle Trader), whose real name is Michael J. Huddleston. He’s a well-known trader who has been around since the 90s and frequently reappears within the space. He’s largely responsible for popularizing many of the terms mentioned in today’s trading space, such as “change of character” or “fair value gaps.” There is frequent debate as to whether these concepts taught by Michael are repackaged traditional price action concepts, but that is not the topic of today’s discussion. Today, we are looking at a concept introduced by ICT himself that is really powerful, yet not many people use or speak about it: the Immediate Rebalance Concept.

What is the Immediate Rebalance Concept.

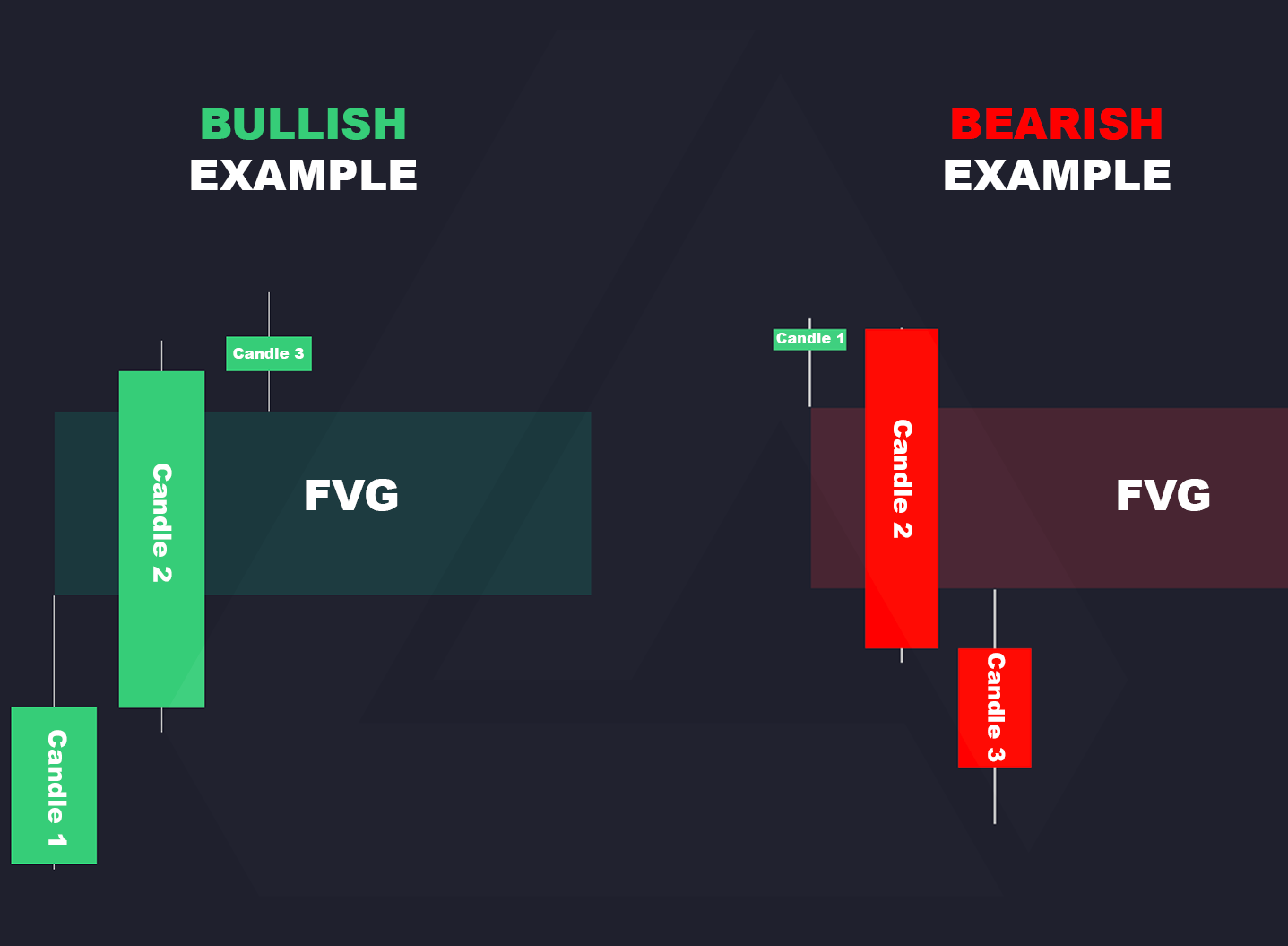

This funnily stems from the same pool of imbalance concepts such as fair value gaps, liquidity grabs, etc., but it is not actually an imbalance. See, I would like to believe we all know what a fair value gap is, but in case we don’t:

A Fair Value Gap (FVG) is a concept in technical analysis that refers to a price range on a chart where minimal trading activity has occurred, often due to a rapid price movement. This creates a “gap” where the market has not traded at fair value, meaning the price skipped over certain levels, causing inefficiencies in the price structure. Traders and analysts believe these gaps can eventually be filled as the market returns to those levels to establish a fair value through more balanced trading activity. Below is an example of how these fair value gaps are identified.

Video Explaining Fair Value Gaps

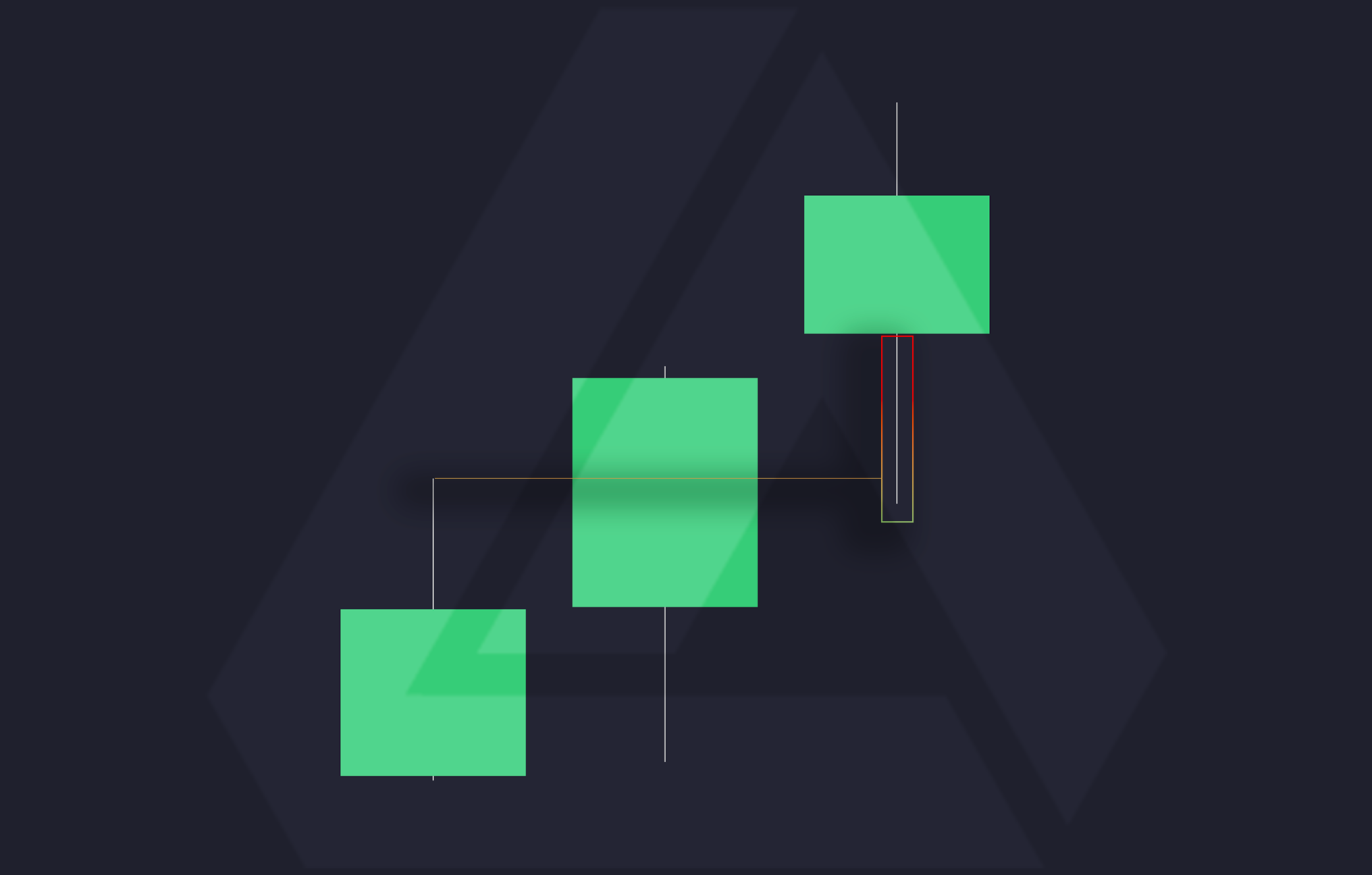

Unlike a fair value gap, which is a three-candle formation that leaves behind an imbalance in price, an immediate rebalance has little to no gaps. With an immediate rebalance, the third candle that would confirm a fair value gap instead immediately fills that price region before closing. An example is shown below.

Why is this a powerful concept

To grasp the power of this concept, you must understand the implications of a fair value gap versus an immediate imbalance. A fair value gap suggests that the price will return to the imbalance to fill the inefficiency within the market. The timing of this retrace is never fully clear, but it typically indicates a potential reversal or retracement within the market. An immediate rebalance implies there are NO imbalances to be filled, allowing the price to continue in the projected direction. These areas can be prime entry points, often followed by a strong market move.

Because of this, it is actually a very effective way to identify optimal entry areas. We can use the immediate rebalance concept alongside other trading methodologies to create powerful systems. The immediate rebalance is best used as an entry model within a larger strategy/system.

ICT Immediate Rebalance Toolkit

Knowing how useful this concept can be, we created a free toolkit based on it, allowing users to formulate incredible trading ideas. As mentioned earlier, the immediate rebalance is best used as an entry model rather than a standalone trading strategy. Because of this, the indicator includes additional features and functions, which we discuss below.

Buyside and Sellside Liquidity

The indicator can identify buyside and sellside liquidity at major swing highs and lows, which are areas in the markets where traders have likely placed stop losses. These levels are usually swept by large institutions for liquidity, leading to a price reversal. We are aware that these significant levels often exist on higher timeframes, so we included a timeframe feature. If trading on the 5-minute chart, you can easily see the daily liquidity levels.

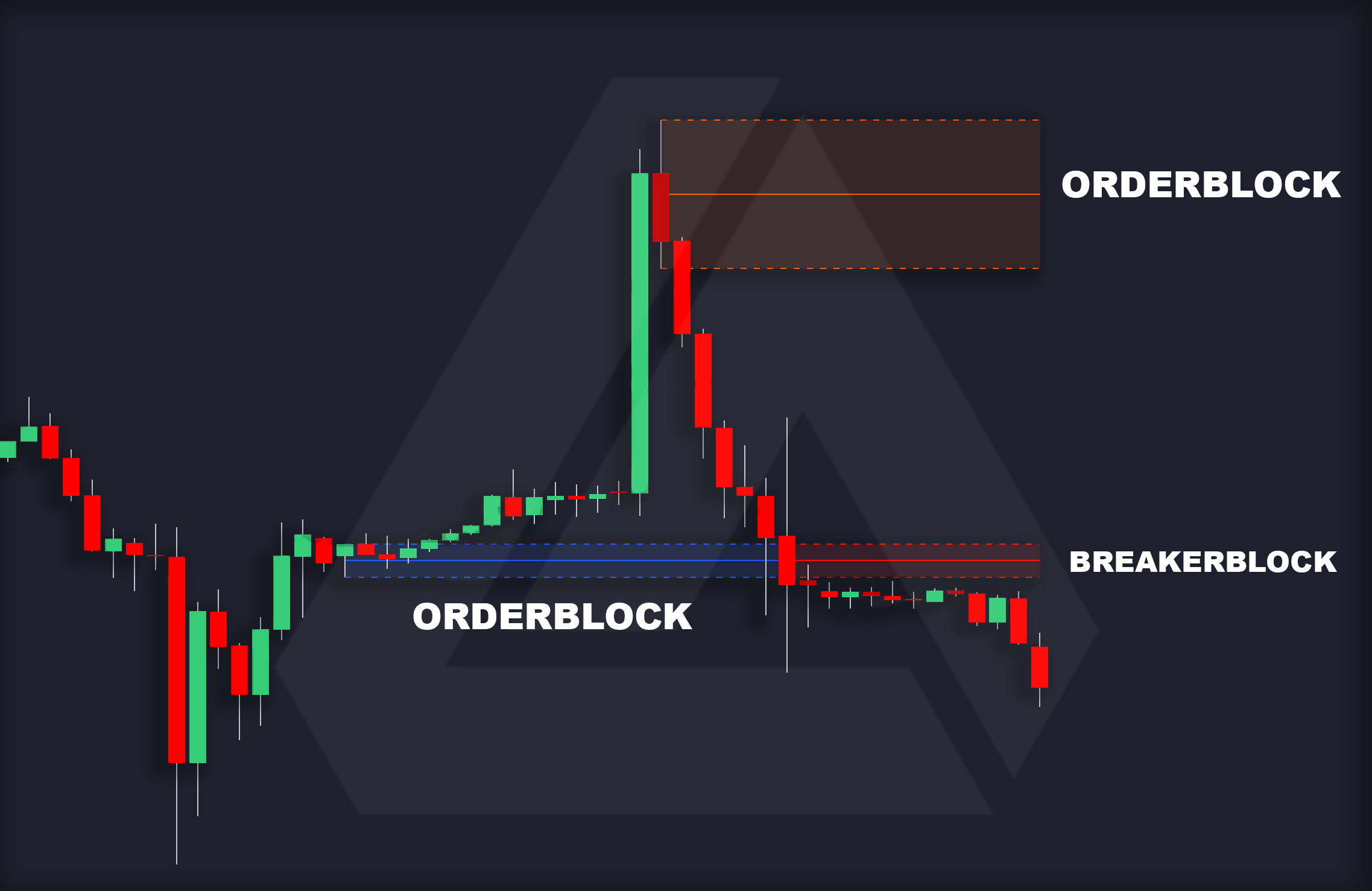

Orderblocks and Breaker Blocks

Orderblocks and breaker blocks identify areas in the market where significant buying and selling have occurred. There is usually a strong reaction if price returns to these levels, and traders often use them as areas to enter trades. When an orderblock is mitigated, a breaker block is formed in that exact area and can be treated as a break and retest. Using buyside and sellside liquidity alongside orderblocks is extremely powerful. Buyside and sellside liquidity can identify stop losses, and knowing where traders have entered using orderblocks will be very important when we discuss some powerful setups later.

Liquidity Voids

Liquidity voids are sudden and strong shifts that usually suggest little to no disagreement between traders on the direction. These are crucial areas of interest to consider in case the asset returns to these levels. If the value is resting above or below a liquidity void, it's essential for traders to be aware of how the market behaved within that range in the past.

Macro Timings

Finally, the indicator can display macro timings, which, according to ICT teachings, refer to specific time periods where an algorithm can significantly influence the direction of price movements in the market. The indicator can identify these timings to be used alongside your analysis to pinpoint the perfect time to take a trade. For instance, when trading a pair such as pound-yen, a trader may want to enable London macro timings since the pound is most active within the London session to see if we’re within or outside a macro before executing.

Video on ICT Immediate Rebalance Concept Toolkit

Video on the ICT Immediate Rebalance Toolkit

Access to the indicator

You can access the indicator for free in the LuxAlgo library. There are numerous use cases for the indicator, so give it a try and let us know what you think. Remember, no indicator should be followed blindly; always use it to support your analysis.

References:

- A study to assess the validity of Michael Joe Huddleston’s technical analysis concept (ICT Power Of 3) in the foreign exchange market- Rounak Agarwal 2023

- ICT Immediate Rebalance Toolkit indicator code - LuxAlgo 2024

- STOP Trading FVG's... Do This Instead (ICT Immediate Rebalance Toolkit) -LuxAlgo 2024

- How to Trade Fair Value Gaps (Best Tutorial) - LuxAlgo 2024

- BEST Order Block Indicator on TradingView 2024 - LuxAlgo 2024