Learn the essentials of IPOs, from the reasons companies go public to investment strategies and risk management for potential investors.

An IPO (Initial Public Offering) is when a private company sells its shares to the public for the first time. This guide explains why companies go public, how the IPO process works, and how to evaluate IPO investments. Here’s what you’ll learn:

- Why Companies Go Public: To raise capital, gain visibility, improve share liquidity, or allow early investors to exit.

- IPO Process: Steps include financial preparation, pricing, and working with underwriters, legal teams, and accountants.

- Investment Analysis: Focus on financial health, market position, and IPO documents like the prospectus.

- Risks: Be aware of price swings, lock‐up periods, and challenges faced by new public companies.

- Trading Strategies: Options include flipping for quick gains, breakout trading, or long‐term buy‐and‐hold.

Quick Overview of IPO Analysis Strategies

| Focus Area | Key Points |

|---|---|

| Financial Ratios | Analyze P/E, Debt-to-Equity, ROE, and P/B to assess stability and growth. |

| Market Position | Evaluate industry growth, competition, and market share. |

| IPO Documents | Review risk factors, use of proceeds, and financial statements in the S-1. |

| Risks | Watch for volatility, insider lock-up effects, and profitability challenges. |

Learn how to research, assess risks, and choose the right trading strategy for IPO investments. Utilize technical analysis indicators and risk management techniques for improved decision-making.

Related Video

IPO Process Steps

The IPO process typically takes six months to over a year, giving investors time to assess potential opportunities. Below is a breakdown of the main stages involved.

Pre-Listing Requirements

Before going public, companies must prepare extensively—often starting one to two years in advance. This involves setting up systems for financial reporting, corporate governance, and compliance to meet the scrutiny of public markets.

Main IPO Participants

Several key players drive the IPO process. Investment banks handle underwriting and pricing, while institutional investors typically purchase about 80% of offered shares. Other participants include:

| Participant Type | Primary Responsibilities |

|---|---|

| Investment Banks | Underwrite shares, set price, and manage distribution |

| Company Management | Lead investor presentations and strategic direction |

| Legal Teams | Draft registration statements and ensure compliance |

| Accountants | Audit financials and prepare prospectus |

| Exchange Partners | Verify listing requirements and coordinate IPO day |

Share Price Setting

Underwriters calculate the share price by dividing the company’s estimated valuation by the number of shares. Factors include:

| Pricing Factor | Impact on Valuation |

|---|---|

| Market Conditions | Economic trends and investor sentiment |

| Comparable Companies | Valuations of similar public companies |

| Growth Prospects | Future earnings potential and market opportunities |

| Investor Demand | Feedback from institutional roadshows |

Most IPOs follow a firm commitment model, guaranteeing capital for the company. Underwriting fees typically range from 4.1% to 7% of gross proceeds.

IPO Investment Analysis

Time to dive into numbers, market dynamics, and official filings to evaluate investment potential.

Financial Health Checks

Analyze key ratios to gauge stability and growth:

| Financial Ratio | What It Tells You |

|---|---|

| P/E | Valuation vs. earnings |

| Debt/Equity | Leverage and risk |

| ROE | Efficiency and profitability |

| P/B | Market vs. book value |

Market Position Review

Evaluate industry growth, competition, and market share to see how the IPO stacks up against peers.

IPO Document Review

The S-1 filing provides crucial details. Focus on these sections:

| Section | Key Insights |

|---|---|

| Risk Factors | Industry-specific challenges |

| Use of Proceeds | Fund allocation plans |

| Financial Statements | Performance metrics and trends |

| Management Discussion | Strategic insights |

| Competitive Analysis | Market positioning |

IPO Risk Factors

Dive into common risks to better shape your approach.

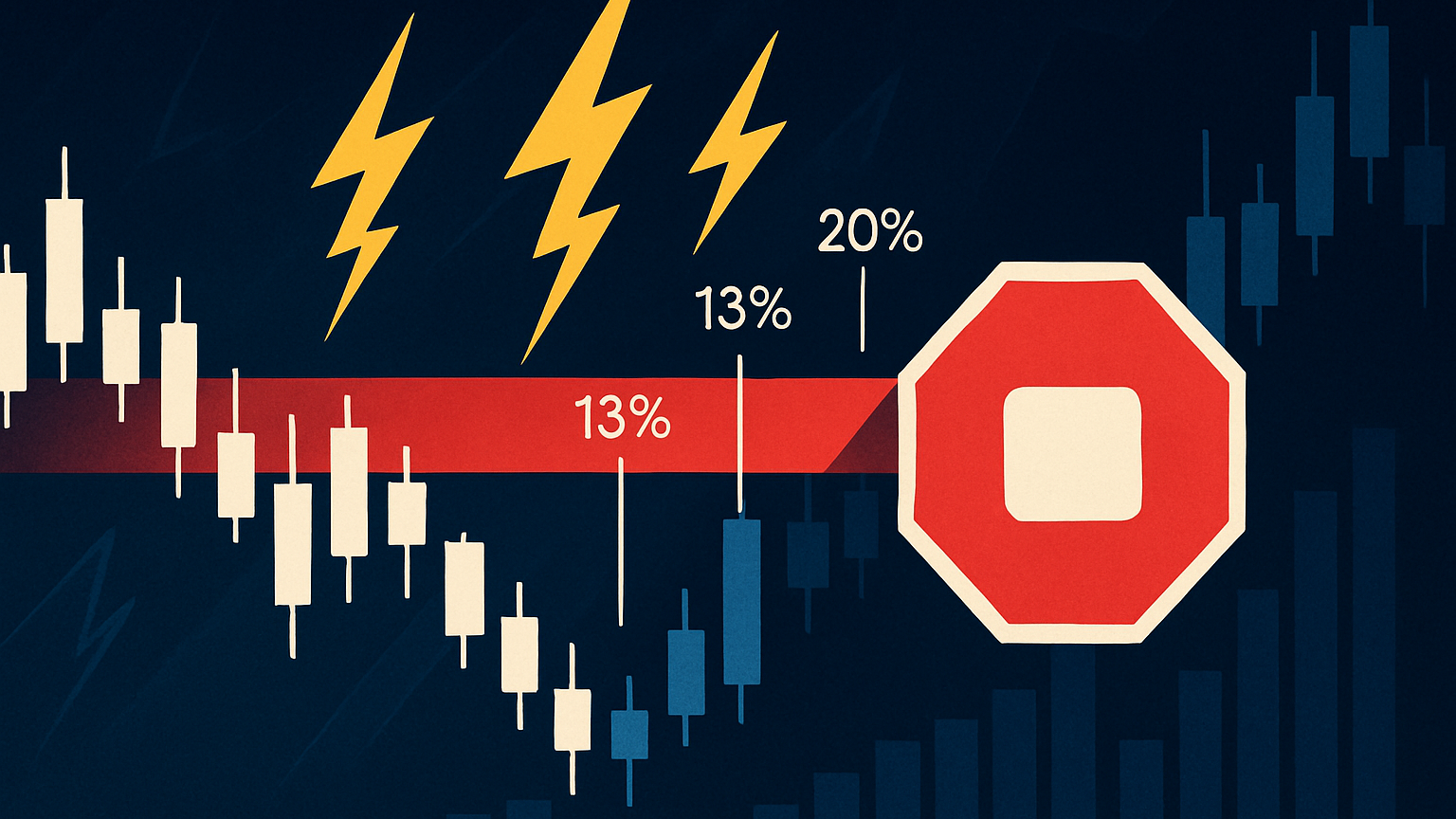

Price Swings

High early volatility presents both opportunities and challenges.

| Risk Factor | Impact |

|---|---|

| Initial Overvaluation | Sudden price drops |

| Market Sentiment | Drives stability |

| Industry Conditions | Investor confidence |

Share Lock-Up Effects

Lock-up periods (90–180 days) can create downward pressure once insiders can sell shares.

New Company Challenges

In 2023, only 42% of IPOs were profitable, with a median U.S. net margin of –5% vs. 8% globally. Assess revenue growth, cash flow, governance, and growth strategy carefully.

| Assessment Area | Key Considerations |

|---|---|

| Financial Foundation | Revenue trends and cash management |

| Governance | Transparency and board effectiveness |

| Market Position | Competitive strengths |

| Growth Strategy | Roadmap to profitability |

Example: Groupon launched at $524 (split-adjusted) in 2011 but fell to ~$13 by January 2024, underscoring fundamentals over hype.

IPO Trading Methods

Once you understand the risks, you can focus on strategies to capitalize on IPOs.

Trading Timeframes

| Strategy | Timeframe | Key Points |

|---|---|---|

| First-Day Pop (Flipping) | Minutes to hours | Requires precise timing and fast execution. |

| Breakout Trading | Days to weeks | Waits for prices to break above resistance. |

| Pullback Strategy | 1–4 weeks | Enters after price dips post-surge. |

| Buy-and-Hold | 6+ months | Focuses on long-term growth via fundamentals. |

Portfolio Risk Control

Use position sizing and stop-loss orders, diversify across sectors, and rebalance regularly to manage aggregate volatility.

Summary and Action Steps

Research Guidelines

- Deep-Dive S-1: Focus on financials, risk factors, and use of proceeds.

- Compare Peers: Benchmark ratios against industry standards.

- Assess Strategy: Review growth plans, governance, and market positioning.

Risk Assessment

Anticipate volatility around lock-up expirations and maintain a diversified allocation.

Getting Started

- Paper-trade with technical indicators to validate entries and exits.

- Define clear position sizes (2–5% of portfolio) and stop-loss levels.

- Keep detailed notes on each IPO’s metrics and your rationale.