At some point in every trader’s journey, they've tried to create a strategy and backtest it. Whether it's manually tallying each trade or using specialized software to automate the process, the reality is, finding a strategy and backtesting can be incredibly challenging, it usually involves:

- Endlessly sifting through tickers to find the right one, often wasting time on assets that don’t fit your strategy.

- Choosing a timeframe that seems to shift the results with every adjustment, making it hard to land on the "right" one.

- Building a strategy from scratch, often with conflicting data, and adjusting it repeatedly just to see if it works.

- Spending hours, or even days, backtesting, only to end up with inconclusive results or strategies that don’t perform as expected, forcing you to start the process all over again.

It turns into an endless cycle of tweaking settings and hoping for better results. That’s where the LuxAlgo AI Backtesting Assistant comes in. With this tool, you can skip the time-consuming manual work by leveraging AI to automatically analyze countless strategies, optimize settings, and identify the most promising ones. No more spending hours trying to find a strategy that meets your requirements through trial and error. With the AI Backtesting Assistant, you get a smarter, faster way to test, refine, and choose strategies.

How the LuxAlgo AI Backtesting Assistant Works

Overview of the AI’s Capabilities

The AI Backtesting Assistant has been extensively trained on two of our core toolkits: the Price Action Concepts indicator and the Signals & Overlays toolkit. It has a deep understanding of how each of these products functions, and it can provide detailed insights in line with their documentation and with this information along with access to over 1000 strategies the AI delivers backtested strategies that traders can use in current market conditions.

How It Generates Strategies

The AI accesses a database of predefined strategies, each making use of various features from the Price Action Concepts and Signals & Overlays toolkits. These strategies can be applied to any of the available ticker or timeframes, allowing users to easily evaluate the performance of these strategies. Strategy metrics, like performance and trade count, are continuously updated as new price data comes in, ensuring that backtesting results always reflect the latest market conditions.

While these strategies are predefined, the variety is so extensive that users can input specific requirements – such as timeframe, drawdown, indicator features etc – and find strategies tailored to their needs. It’s important to remember that the system doesn’t generate new strategies on the fly. Instead, it intelligently matches your requests with the most relevant strategies from an extensive database, offering a fast and efficient way to find a solution that works.

Key Features of the LuxAlgo AI Backtesting Assistant

Wide Range of Strategy Options

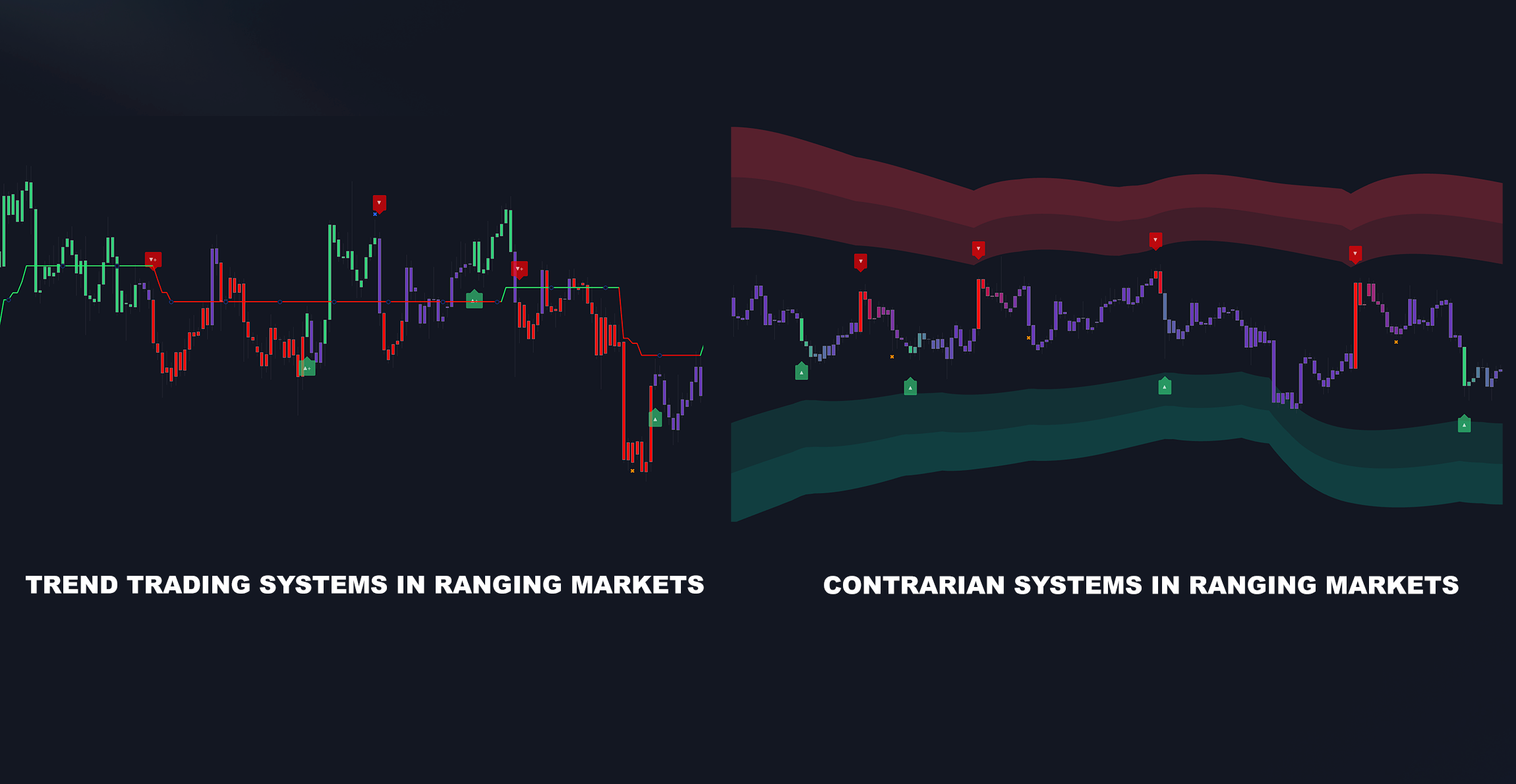

Whether you’re interested in a trend-following system or a contrarian approach, the AI Backtesting Assistant offers access to numerous strategies based on price action or traditional technical indicators. Users who understand the features of LuxAlgo’s toolkits and how those features apply to different market conditions can find strategies tailored to a variety of scenarios.

For example, when market conditions are ranging, trend-following systems often struggle and may lead to increased losses. If you’ve been using a trend-following system and are finding it difficult to minimize losses during these periods, the AI Assistant can be a game changer. It allows you to request strategies designed specifically for ranging markets, leveraging features that excel in such conditions—like reversal zones or the contrarian signals from the Signals & Overlays toolkit.

Instead of using these features blindly, users can now backtest them with a simple prompt to see how well they perform for a specific asset. This makes it much easier to approach the market with data-driven approach improving your confidence.

So this does require moderate understanding of the features from our toolkits and how they work. Fortunately, our documentation on these features is comprehensive, and both the AI documentation and the AI Assistant itself can help deepen your understanding.

Up-to-Date Backtesting Data

The AI Backtesting Assistant ensures up-to-date backtesting data by continuously updating strategy performance as new market data becomes available. This means users always have the most current metrics—such as win rate, drawdown, and profit factor—when evaluating strategies. Unlike many strategies that are based on outdated data and never updated, you can be assured that when a strategy is requested from the AI, the strategy’s performance will reflect recent price action.

Accessible to All Skill Levels

The AI Backtesting Assistant isn’t just a tool for advanced traders—it is also useful as an educational companion for novice users. For example, a beginner might ask, 'What type of strategies works best in a ranging market?' or 'How can I reduce the drawdown of a strategy?' The AI can respond with tailored suggestions, helping new traders learn the basics of strategy selection and risk management. By using it's understanding of market and the toolkits, even beginners can learn which strategies and features might be most applicable in different market scenarios.

Novice users can ask the AI simple questions to understand what features are best suited for specific market phases and how to apply them effectively. This guidance helps build foundational trading knowledge while giving users the confidence to make data-backed decisions. The Assistant is there to bridge the gap between beginner-level understanding and sophisticated market analysis, making the entire process more approachable.

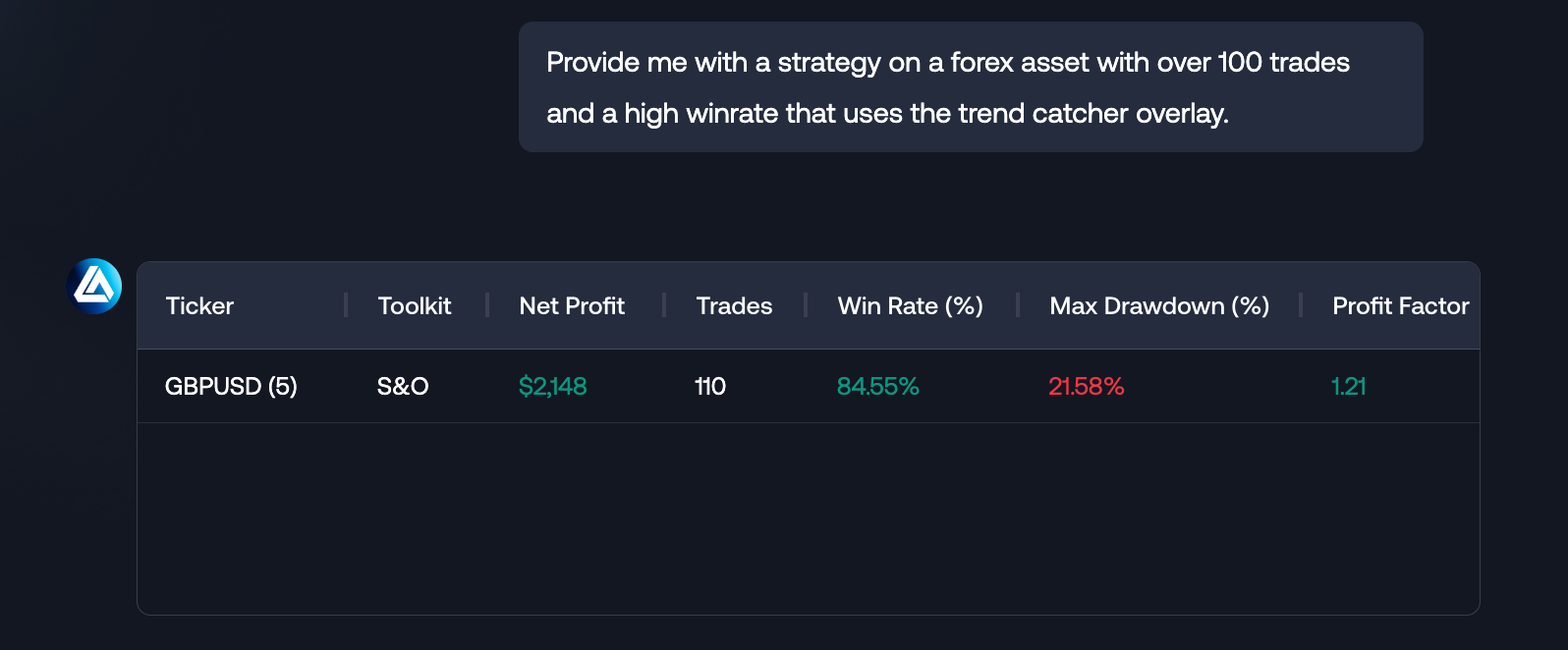

Strategy Info Returned by the Assistant

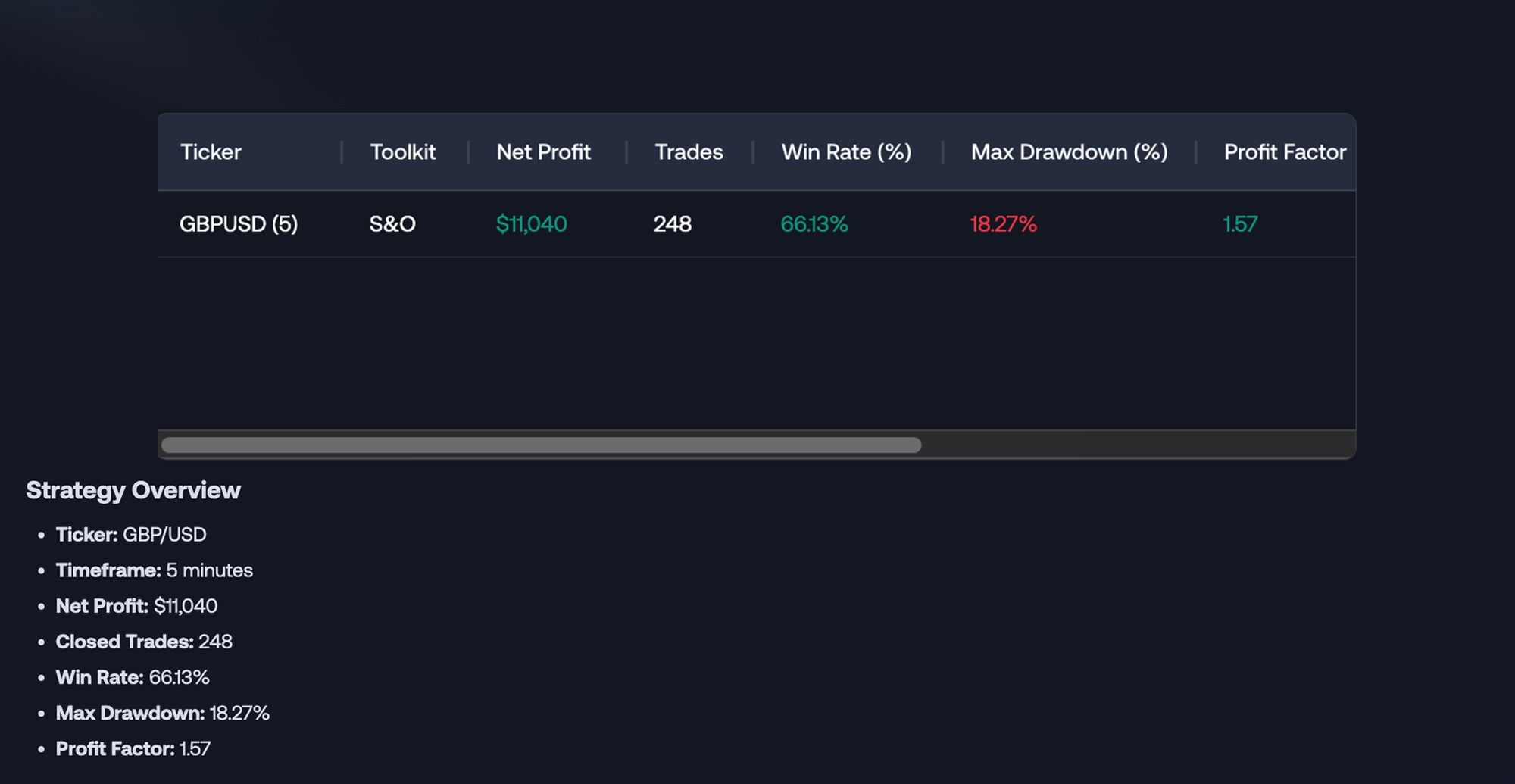

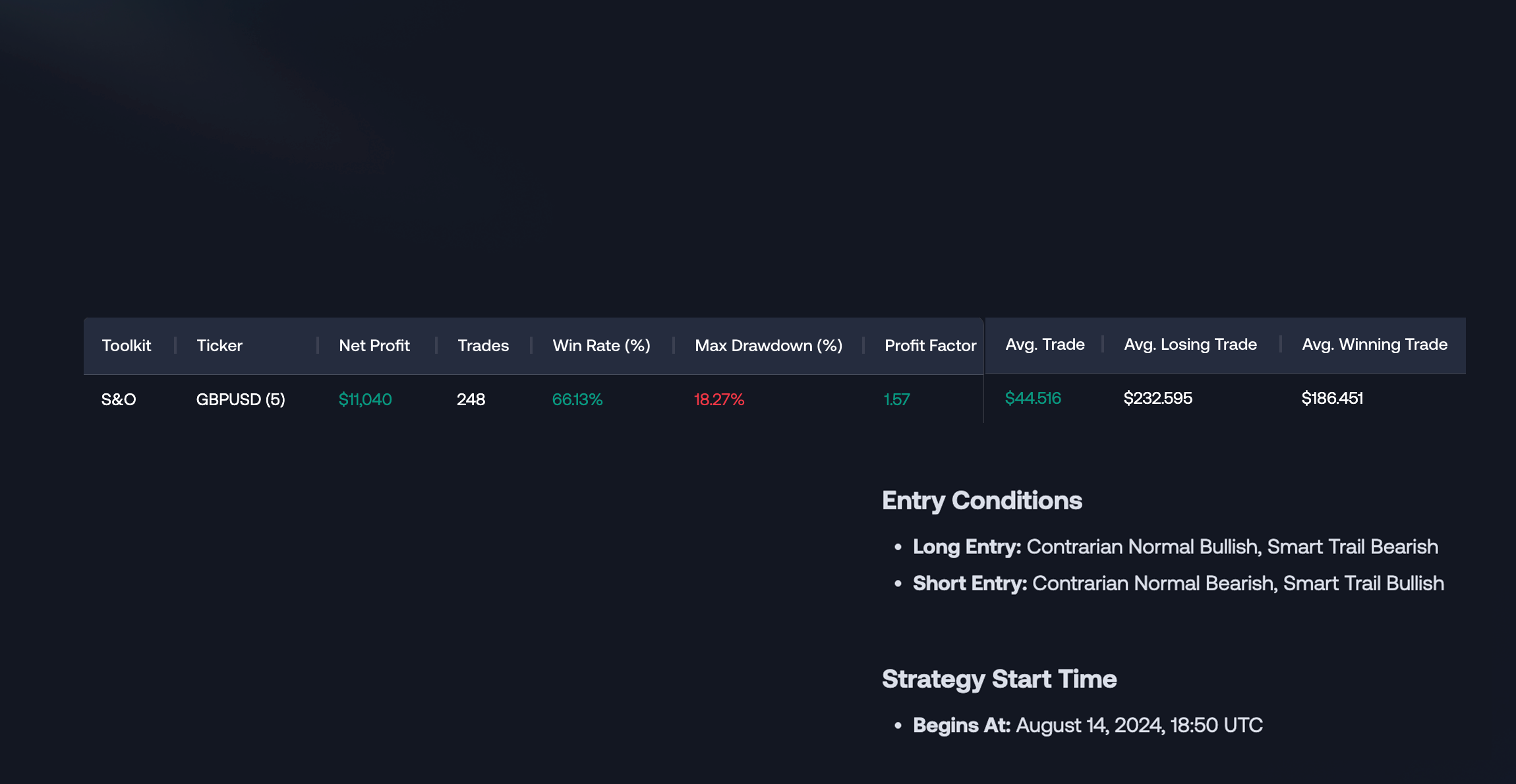

When prompted for a strategy, the AI provides a set of metrics for each strategy, giving users an in-depth look at how the strategy performs and what conditions it relies on. Here’s a breakdown of the key metrics returned by the system:

Toolkit and Ticker Information

Toolkit: The toolkit used to generate the strategy, such as Signals & Overlays (S&O). This helps users understand which indicators and tools are being utilized.

Ticker Symbol: The asset being analyzed (e.g., XAUUSD (Gold)). Knowing the specific ticker helps traders apply the strategy to the right market.

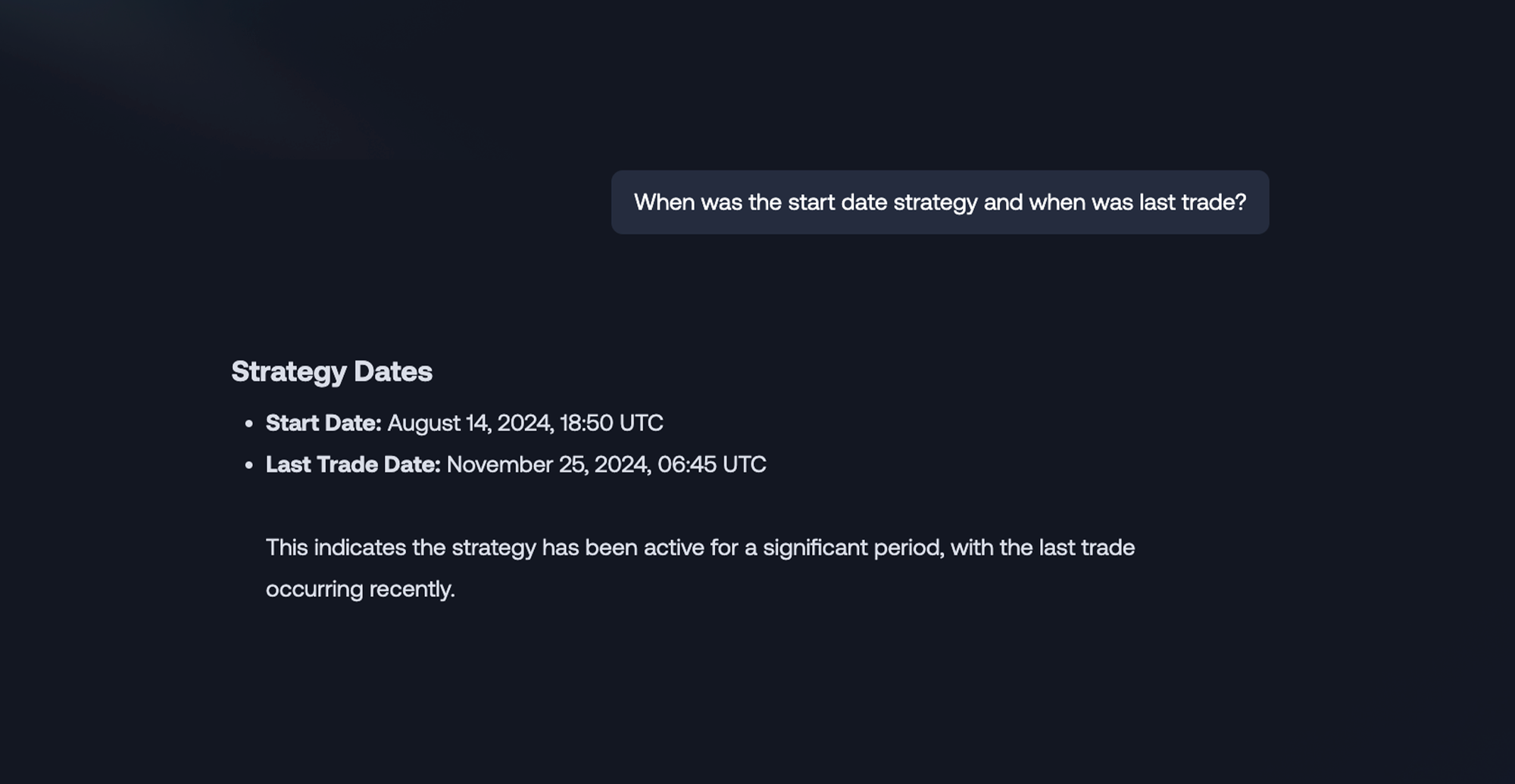

Timeframe and Start Date

Timeframe: The time interval for the strategy (e.g., 5 minutes). This is crucial for traders looking to apply the strategy within a specific timeframe, whether for scalping or swing trading.

Strategy Begins At: The starting point of the backtest (e.g., August 14, 2024, 18:50 UTC). This allows traders to understand the period over which the performance metrics are measured.

Performance Metrics

Total Closed Trades: The number of trades completed during the backtesting period (e.g., 107). This indicates the level of activity the strategy generates.

Winrate: The percentage of trades that were profitable (e.g., 82.24%). A higher winrate indicates a greater likelihood of success in simular historical conditions.

Net Profit: The overall profit or loss generated by the strategy (e.g., $97.018). This helps traders evaluate if the strategy is financially viable over the backtesting period.

Average Trade: The average profit or loss per trade (e.g., $0.907). This provides an idea of the profitability of each trade on average.

Average Winning Trade and Average Losing Trade: The average gains from winning trades (e.g., $5.49) and the average losses from losing trades (e.g., $20.32). Understanding these metrics can help traders assess risk-reward ratios.

Profit Factor: The ratio of total profits to total losses (e.g., 1.251). A profit factor above 1 means that the strategy generated more profit than losses, while a higher value indicates stronger performance.

Max Drawdown Percent: The maximum decline from the peak to the trough during the backtesting period (e.g., 0.86%). This metric measures risk and helps traders understand the potential volatility they might face.

Current Position Status: The status of the strategy’s current position (e.g., Short). This informs traders if there is currently a open position from the strategy.

Entry and Exit Conditions

Exit Conditions: The criteria used to exit trades (e.g., Confirmation Builtin Exits). This shows users the logic behind trade closures, which is important for replicating the strategy accurately.

Entry Conditions:

Long Entry Conditions: For opening a long position, conditions such as Confirmation Strong Bullish and Neo Cloud Bullish.

Short Entry Conditions: For opening a short position, conditions like Confirmation Strong Bearish and Neo Cloud Bearish.

Why These Metrics Matter

These metrics provide traders with a detailed snapshot of the strategy’s behavior, including profitability, risk, and how trades are managed. By understanding metrics like winrate, drawdown, and profit factor, traders can assess whether a strategy aligns with their risk tolerance and trading goals. Additionally, the entry and exit conditions offer transparency, allowing traders to replicate the strategy on their own charts and understand the rationale behind trade decisions.

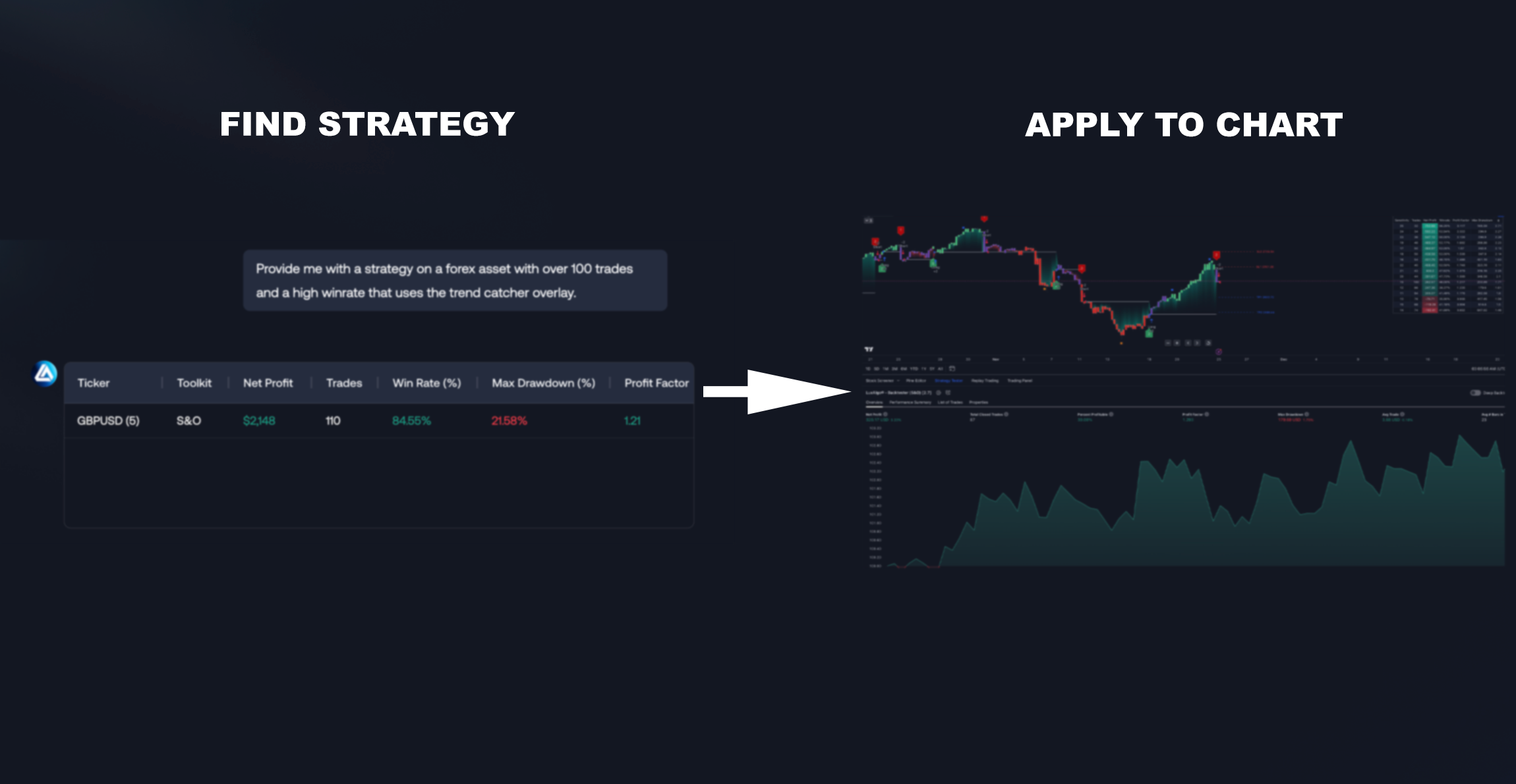

Practical Use Case

So, you’ve prompted the AI and now have a new strategy—great! But what comes next? Well, from here, users can take that information and apply the settings to the indicators on their chart to start using the strategy. It’s also possible to further develop these strategies by seeing their performance directly on the chart.

The AI Assistant works seamlessly with the backtesters from the main toolkits, which allows users to further refine the strategies provided by the AI. Compared to the AI Assistant, the backtesters are more complex and offer greater flexibility in customizing strategies. This means the AI Assistant and backtesters work hand in hand: you can quickly find a strategy with the AI Assistant, then apply it to the backtester to refine or optimize it further. Our videos and documentation provide guidance on using the backtester.

Applying strategy to the backtesters.

When you’ve found a strategy that you’re interested in and want to apply it to your backtester, it’s often a good idea to prompt the Assistant to provide “All information on the strategy, including the start and end dates”. This will give you everything you need to replicate the strategy on your chart.

The strategy’s results may vary slightly when applied to the backtester, depending on factors such as the exchange of the ticker used and the settings enabled in the backtester. However, these differences should never be significant. Any discrepancies between what you see on the backtester and what the AI provides are usually due to specific settings in the properties panel of the backtester, which can lead to minor variations in the results or delays in the results being updated which you can double check by asking the AI when was the last trade alert for the strategies and compare to what is seen on the backtester

Challenges of Manual Backtesting

Time-Consuming Process

Manual backtesting is notorious for being incredibly time-consuming. Traders often have to go through endless iterations—adjusting parameters, testing different tickers, and evaluating various timeframes—all of which can take hours, days, or even weeks. The AI Backtesting Assistant drastically reduces this time commitment by providing optimized strategies within seconds, freeing traders from the tedious, repetitive work of manual testing.

Complexity and Technical Barriers

Backtesting manually often requires a good understanding of scripts, indicators, and technical tools, which can be overwhelming for beginners. The complexity of setting up accurate tests can discourage new traders from exploring this critical part of strategy development. The AI Backtesting Assistant bridges this gap, making backtesting accessible to everyone, regardless of their technical background. With simple prompts, even novice traders can get precise results without having to worry about the underlying technicalities.

Human Error and Inconsistencies

Manual backtesting is inherently prone to human error—whether it’s due to incorrect data entry, inconsistencies in methodology, or simple mistakes that can skew results. These errors can lead to faulty conclusions and ultimately impact trading performance. By automating the process, the AI Backtesting Assistant removes these risks, ensuring consistency and precision in every backtest. Traders can rely on the AI to provide accurate, unbiased data, allowing them to make informed decisions without worrying about errors in their backtesting process.

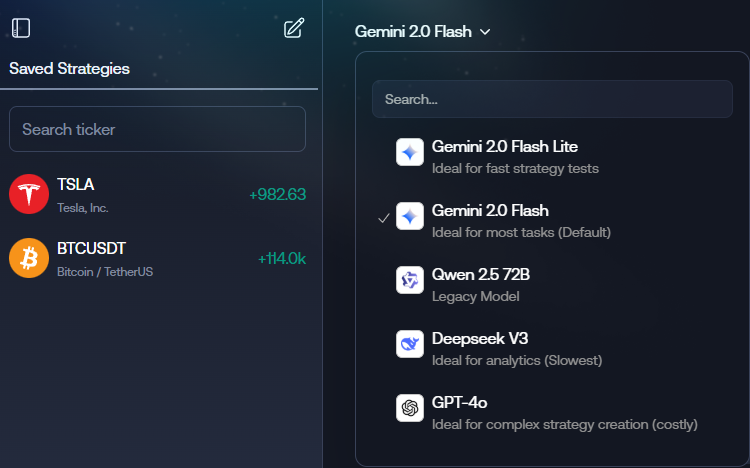

Market Coverage and Availability

As this is the initial launch, the product works on a limited number of tickers and timeframes. Currently, it supports the following tickers and timeframes:

ETFs

- SPY (SPDR S&P 500 ETF Trust) - (5 minutes , 15 minutes , 60 minutes)

- QQQ (Invesco QQQ Trust, Series 1) - (5 minutes , 15 minutes , 60 minutes)

Futures

- ES1! (E-mini S&P 500) - (5 minutes , 15 minutes , 60 minutes)

- NQ1! (E-mini NASDAQ 100) - (5 minutes , 15 minutes , 60 minutes)

- YM1! (E-mini Dow Jones) - (5 minutes , 15 minutes , 60 minutes)

- CL1! (Crude Oil) - (5 minutes , 15 minutes , 60 minutes)

Stocks

- NVDA (NVIDIA Corporation) - (5 minutes , 15 minutes , 60 minutes)

- TSLA (Tesla, Inc.) - (5 minutes , 15 minutes , 60 minutes)

- AAPL (Apple Inc.) - (5 minutes , 15 minutes , 60 minutes)

- MSFT (Microsoft Corporation) - (5 minutes , 15 minutes , 60 minutes)

- META (Meta Platforms, Inc.) - (5 minutes , 15 minutes , 60 minutes)

- AMZN (Amazon.com, Inc.) - (5 minutes , 15 minutes , 60 minutes)

Cryptocurrencies

- BTCUSDT (Bitcoin) - (5 minutes , 15 minutes , 60 minutes)

- ETHUSDT (Ethereum) - (5 minutes , 15 minutes , 60 minutes)

- SOLUSDT (Solana) - (5 minutes , 15 minutes , 60 minutes)

- BNBUSDT (Binance Coin) - (5 minutes , 15 minutes , 60 minutes)

Forex

- EURUSD (Euro/US Dollar) - (5 minutes , 15 minutes , 60 minutes)

- GBPUSD (British Pound/US Dollar) - (5 minutes , 15 minutes , 60 minutes)

- USDJPY (US Dollar/Japanese Yen) - (5 minutes , 15 minutes , 60 minutes)

Commodities

- XAUUSD (Gold) - (5 minutes , 15 minutes , 60 minutes)

Getting Access

You can access the AI Backtesting Assistant by subscribing to LuxAlgo’s Ultimate Plan. This plan not only includes the AI Backtesting Assistant but also provides a full suite of 10 exclusive trading tools, supporting traders at every level. If you're already an Ultimate Plan user, you'll have instant access to the AI Assistant without any extra cost.

Future Updates and Community Feedback

We see the AI Backtesting Assistant as just the beginning of a broader journey towards simplifying trading analysis with AI. Future updates will focus on expanding the number of supported assets, introducing new features based on community requests, Allow features such as saving strategies and refining the AI’s capabilities to ensure it continues to meet the evolving needs of traders with the possibility of also introducing the Oscillator Matrix toolkit as apart of the system.

Community feedback is at the heart of our development process. We actively encourage users to share their experiences and suggestions, as these insights help us identify areas for improvement and new opportunities for growth. By listening to our community of over 150,000 traders, we aim to make the AI Backtesting Assistant even more powerful and adaptable.

We’re committed to continuous improvement, and with each new update, we strive to make backtesting and trading strategy development more efficient and accessible for everyone.

LuxAlgo AI backtesting System Introduction Video

For more information on the product your get view our full documentation below: