Explore the crucial differences between float and shares, and learn how these concepts impact trading strategies and stock price stability.

Float and shares are two essential concepts to understand when investing in the stock market. Here's a quick breakdown:

- Shares: Represent ownership in a company. Common stock offers voting rights and potential price growth, while preferred stock prioritizes dividends but limits price appreciation.

- Float: Refers to shares available for public trading, excluding insider holdings or restricted shares. Low float stocks (<20 M shares) are volatile, while high float stocks (>100 M shares) are more stable.

Key Takeaways:

- High Float: Easier to trade, stable prices, lower risk of manipulation.

- Low Float: Harder to trade, volatile prices, higher risk of manipulation.

Quick Comparison:

| Feature | High Float | Low Float |

|---|---|---|

| Liquidity | High | Low |

| Price Stability | Stable | Volatile |

| Risk | Lower | Higher |

| Best For | Long-term investors | Day traders |

Understanding the difference between float and outstanding shares, and how float impacts trading strategies, can help you make smarter investment decisions.

What is Shares Outstanding? | Share Outstanding vs. Share Float

Float vs Outstanding Shares

Outstanding shares represent all issued stock, while float refers to shares available for public trading. Understanding this difference is crucial for refining investment strategies.

How to Calculate Float

To calculate float, subtract restricted shares (like insider holdings, ESOPs, foundation shares, or controlling stakes) from the total outstanding shares. Restricted shares include:

- Insider holdings by executives and directors

- Shares held in employee stock ownership plans (ESOPs)

- Company-sponsored foundation holdings

- Controlling stakes held by major investors

For instance, if a company has 450 M outstanding shares, with 300 M available for public trading and 150 M held as restricted shares by executives, the float is 300 M shares.

Float vs Total Shares

The ratio of float to outstanding shares provides insight into ownership structure and trading behavior:

| Aspect | Outstanding Shares | Float |

|---|---|---|

| Definition | All issued shares | Shares available for trading |

| Market Cap Calculation | Used for total market cap | Used for free float market cap |

| Index Consideration | Not typically used for index weightings | Used in indexes like the S&P 500 |

| Ownership Tracking | Shows complete ownership | Highlights tradable portion |

A higher float percentage usually means better liquidity and more stable pricing.

Examples and Implications

Take XYZ Corp. as an example: it has 24 B authorized shares, 7.5 B outstanding shares, and 7 B shares available for public trading. With 93.3% of its outstanding shares tradable, XYZ Corp. is considered high float. On the other hand, family-controlled companies, which make up about 35% of S&P 500 companies, often have lower float percentages due to concentrated ownership.

Float size directly affects trading dynamics:

- High Float: Leads to more stable pricing and narrower bid-ask spreads.

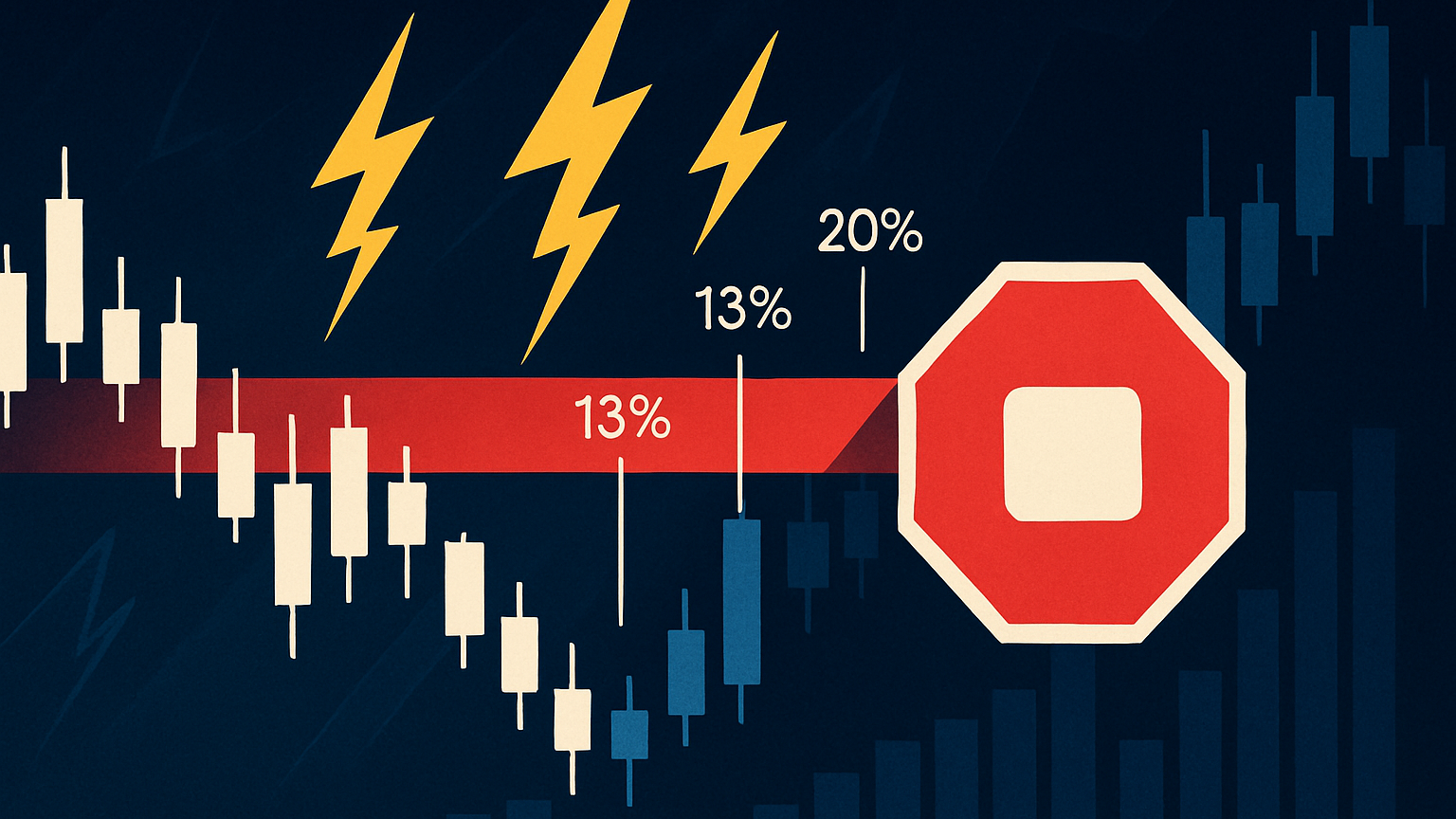

- Low Float: Typically defined as 10–20 M shares or fewer, it often results in higher price volatility.

- Institutional Interest: Large investors favor high float stocks to build positions with minimal market impact.

Float figures can change over time due to buybacks, new share issuances, or insider transactions. Understanding how float is calculated and its role in market dynamics is key to evaluating stock behavior and liquidity.

Float's Effect on Stock Price

The size of a stock's float plays a key role in how its price reacts to trading activity. It helps investors gauge the balance between supply and demand.

Float and Trading Volume

Day traders often keep an eye on stocks with floats under 20 M, as these can experience sharp price swings even with relatively low trading volumes. A key metric here is float rotation, which tracks how often the floating shares are traded in a single day.

The formula for float rotation is:

Float Rotation = Daily Trading Volume / Float Size

When float rotation exceeds 1.0, it means the entire float has been traded at least once during the day. This often leads to heightened price fluctuations. Essentially, the smaller the float, the more likely the stock is to experience instability in its price due to high turnover.

Price Stability and Float Size

Stocks with a high float tend to have more stable prices and narrower trading ranges. On the other hand, low-float stocks are more prone to sharp volatility. Large institutional investors typically prefer high-float stocks because they allow for easier and smoother accumulation of positions.

| Float Size | Price Stability | Trading Characteristics |

|---|---|---|

| High Float (≥20 M) | More stable | Narrow price ranges, higher liquidity |

| Low Float (<20 M) | Less stable | Lower liquidity, prone to larger price swings |

Float Changes and Price Impact

Float size isn't static—it can change due to corporate actions, and these changes often have a direct impact on stock prices.

For example, in May 2024, Apple Inc. announced a $110 B stock buyback. By reducing the float, this move supported the stock price as a smaller supply of shares met consistent demand.

In contrast, secondary offerings can increase the float and put downward pressure on prices. A classic example is Google's 2005 secondary offering. After its IPO at $85 per share raised $2 B, Google issued another offering at $295 per share, raising $4 B.

The effects of float changes depend on the type of action and market conditions:

- Share Buybacks: Reduce the supply of shares, often boosting earnings per share and supporting the stock price.

- Dilutive Offerings: Add more shares to the market, potentially lowering the stock price due to increased supply.

- Non-Dilutive Offerings: These generally have a smaller impact since the total share count remains unchanged.

Keeping an eye on float size and any changes is crucial for understanding both short-term price movements and long-term trends in trading behavior.

Trading with Float Data

Small vs Large Float Trading

The size of a stock's float plays a key role in shaping trading strategies, as it directly impacts liquidity, volatility, and risk. Stocks with floats below 20 M shares often show high volatility, leading to rapid price movements, while stocks with larger floats tend to be more stable, appealing to long-term investors.

| Float Type | Trading Style | Risk Level | Best For |

|---|---|---|---|

| Low Float (<20 M) | Momentum/Day Trading | High | Short-term traders seeking volatility |

| Medium Float (20–100 M) | Swing Trading | Moderate | Traders looking for a balance |

| High Float (>100 M) | Position Trading | Lower | Long-term investors |

Low-float stocks can see sharp price changes, demanding strict risk management and quick decision-making. These trading styles become even more effective when combined with float rotation metrics to pinpoint entry points.

Float-Based Entry Points

Understanding float rotation is essential for timing your trades effectively. Since float size influences volatility, float rotation becomes a key metric for identifying optimal entry points.

- A float rotation above 1.0, especially if it happens multiple times in a session, indicates strong buying pressure. Be cautious with short positions.

- Real-time float rotation data can help you time your entries more precisely.

For long positions, target stocks undergoing their first significant float rotation, particularly if backed by a strong catalyst. Multiple rotations often signal increasing demand, so approach these situations carefully.

Float Analysis Software

Tracking float data is easier with the right platform. LuxAlgo provides hundreds of free indicators in its Library, exclusive toolkits for price action analysis, signal overlays, and oscillator-based money flow indicators, plus real-time float rotation tracking and an AI Backtesting Assistant to refine your strategies. Subscription plans include Essential ($24.99/mo), Premium ($39.99/mo), and Ultimate ($59.99/mo).

Advanced Float Topics

Building on earlier insights, this section dives deeper into trading dynamics related to float.

Short Interest and Float

Short interest plays a key role in share availability and market sentiment. When short positions surpass 20% of the float, it often points to increased bearish sentiment and potential price swings. Interestingly, short interest can exceed 100% due to practices like share re-lending, which creates a more intricate trading environment. Understanding these levels can help fine-tune your entry and exit strategies.

Float Rotation Patterns

Float rotation measures how often available shares are traded within a single session. When trading volume surpasses the float, it often signals the potential for major price shifts.

Float rotation describes the number of times that a stock's floating shares turn over in a single trading day. It is mainly relevant for highly volatile low‐float stocks, which can experience multiple float rotations following a bullish catalyst.

This concept is especially relevant for low-float stocks, where even minor catalysts can trigger significant activity.

Float-Based Price Control

A company like General Electric (GE), with around 260 M shares in its float as of September 2023, highlights how larger floats contribute to more stable pricing.

- Share Availability: A smaller float can limit trading volume, making price movements more pronounced.

- Regulatory Oversight: The SEC monitors float-related disclosures to ensure market fairness and transparency.

- Cost to Borrow: Higher borrowing costs often indicate increased short-selling pressure, which can lead to greater volatility and impact trading strategies directly.

Conclusion

This review highlights the importance of understanding float and shares in crafting trading strategies. Stocks with a larger float tend to show steadier price movements, while those with a smaller float are often more volatile. Additionally, patterns like short interest and float rotation can reveal market sentiment and potential price movements. These concepts, when combined with the detailed analysis provided earlier, offer a solid foundation for making informed trading decisions.

Trading Tips

To effectively use float analysis in your trading, focus on these key areas:

- Float Size: Compare a stock's float to others in the same industry. Smaller floats often lead to more price swings.

- Volume vs. Float: Track daily trading volume against the float to spot possible price shifts.

- Short Interest: Watch short interest as a percentage of the float to understand market sentiment.

Useful Tools

Consider using platforms like Bloomberg Terminal for real-time data, FinViz Elite for screening and visualization, and S&P Capital IQ for detailed float analysis.