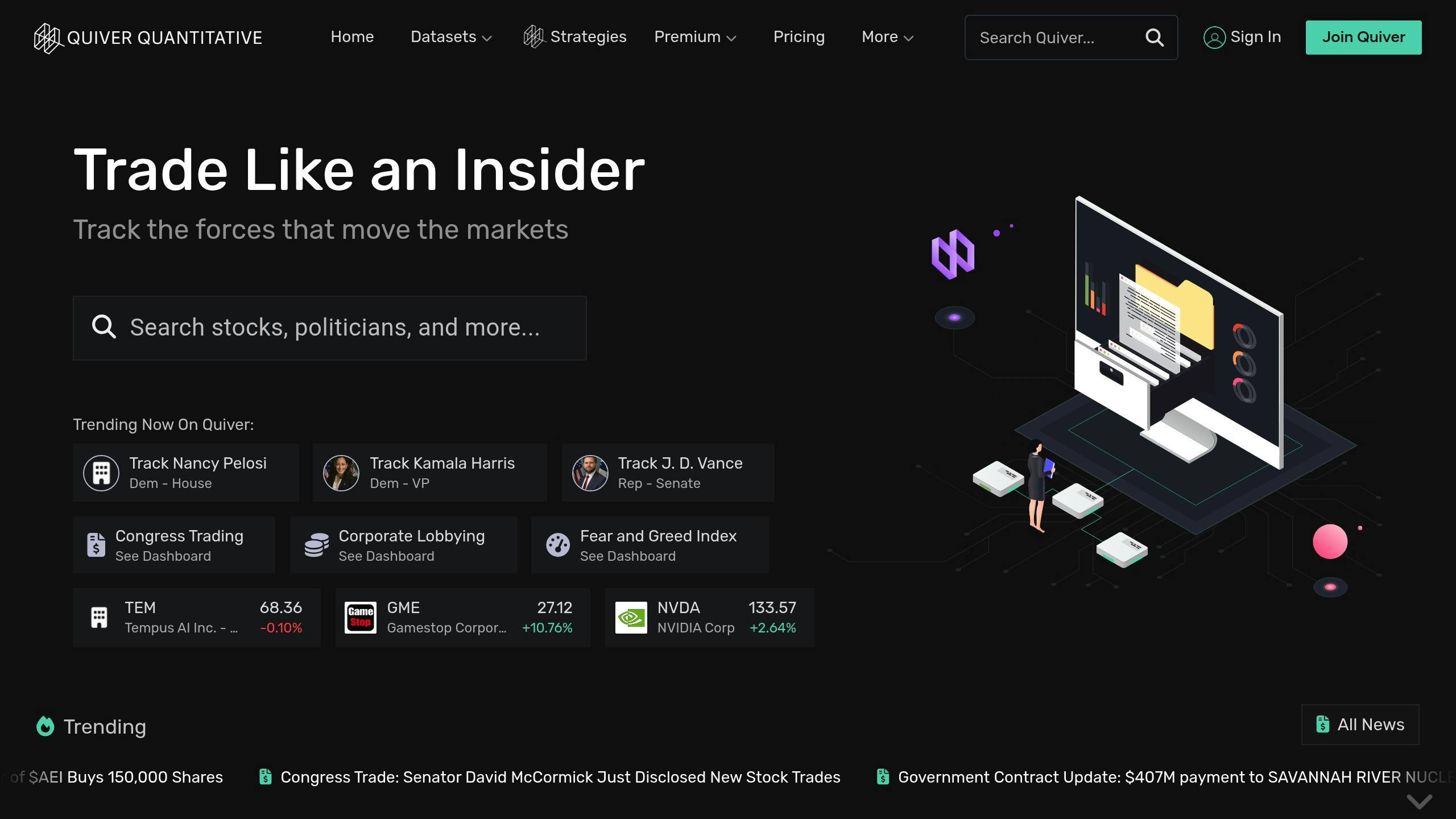

Looking for an edge in trading? QuiverQuant provides retail investors access to institutional-level alternative data, such as congressional trades, government contracts, and social sentiment, starting at just $12.50/month.

QuiverQuant simplifies complex datasets into actionable insights, making it a go-to resource for data-driven investors.

The EASIEST Way to Track Insider Trades

1. QuiverQuant Platform

QuiverQuant offers an intuitive platform that delivers high-quality alternative data through four main datasets:

Core Data Types

- Government Contracts: Tracks federal contract awards.

- Congressional Trading: Monitors changes in politician portfolios.

- Patent Analytics: Tracks patent approvals to spot technological advancements and market opportunities.

- Social Sentiment: Analyzes discussions on platforms like Reddit and StockTwits to gauge retail investor sentiment.

Advanced Tools and Features

QuiverQuant transforms complex data into actionable insights with powerful tools:

| Tool | Purpose | Key Feature |

|---|---|---|

| Smart Score | Stock Rating | Integrates congressional trading, lobbying, and media data into a 1-10 rating. |

| Strategy Backtester | Performance Testing | Allows users to test quantitative strategies using alternative data. |

| Patent Dashboard | Innovation Tracking | Filters companies based on technological advancements. |

| Congressional Trading Tracker | Political Investment Monitoring | Displays real-time stock transactions by politicians. |

Pricing Structure

QuiverQuant offers three pricing tiers:

- Free: Basic access to congressional data.

- $12.50/month: Includes screeners and alerts.

- $25/month: Unlocks full backtesting and copytrading features.

Real-World Application

One notable example of QuiverQuant's utility is its patent analysis tool. It identified Nano Dimension (NNDM) as a potential supplier for Apple by tracking titanium molding technology patents—an insight that preceded a 47% price surge [4].

Data Verification

QuiverQuant ensures data accuracy through multiple layers of verification:

- Cross-checking SEC Form 4 filings.

- Automated parsing combined with manual reviews.

- Regular updates from the Senate Office of Public Records.

The platform has processed over $100M in trades using congressional trading data [2], making it a trusted choice for institutional and retail investors alike.

Strengths and Limitations

QuiverQuant excels at turning unconventional datasets into actionable market insights. Its intuitive interface and robust data verification are major strengths. However, some users have noted that the mobile app experience is less optimal and that the predictive models can face challenges during highly volatile market conditions.

Key Advantages

With seamless TradingView integration and automated data normalization, QuiverQuant provides unique insights that were once out of reach for retail investors [1].

Limitations

Some users report that the mobile app experience is not as robust as the desktop version, as reflected in its 3.6/5 rating on the Google Play Store [11]. Additionally, the predictive models may occasionally struggle during unexpected market events [9].

Market Performance Context

In November 2023, QuiverQuant users identified contracting sector trends 11 days before mainstream media coverage, showcasing the platform's ability to provide early market insights [1].

"QuiverQuant's congressional trading insights provide retail traders with institutional-grade surveillance capabilities" - Brandafy.com Review, November 2023 [1]

While its robust data offerings are a major strength, some users have highlighted a need for clearer guidance on how to fully leverage the insights, which can pose a challenge for less experienced traders [12].

Summary and Recommendations

QuiverQuant stands out as a powerful resource for investors who prioritize data-driven decision-making. Its ability to convert complex alternative data into actionable insights makes it an indispensable tool for those focusing on fundamental and event-driven strategies.

For Data-Driven Investors

QuiverQuant is ideal for those looking to harness alternative data for actionable market insights. The free tier provides essential congressional trading data, while the premium plan at $25/month unlocks advanced features like full backtesting and copytrading [3]. Institutional users also benefit from integrations with platforms such as [2].

Trading Style Recommendations

| Trading Style | Platform Choice | Key Benefits |

|---|---|---|

| Long-term Value | QuiverQuant Free Tier | Access to congressional trades and basic sentiment analysis [10] |

| Quantitative | QuiverQuant Premium | Advanced backtesting and strategy analysis [1] |

| Event-driven | QuiverQuant Premium | Real-time insights on legislative impacts [6] |

Investment Horizon Alignment

For medium to long-term strategies (6-12 months), QuiverQuant's insights support strategic market positioning [6][10].

Cost-Benefit Analysis

QuiverQuant delivers strong value through its robust data offerings. Retail investors can rely on the free tier for essential congressional trading data, while the premium plan ($25/month) unlocks advanced features for quantitative traders [3].

Institutional users further benefit from enterprise integrations with platforms like Progress Data Cloud [8] and [2].

Additional Platforms to Consider

For those interested in complementary technical analysis tools, platforms such as LuxAlgo offer advanced indicators and automation features. However, the primary focus of this review remains on QuiverQuant's data-driven approach.

References

- QuiverQuant Homepage

- Brandafy QuiverQuant Review

- QuiverQuant Insider Trading Insights

- AltIndex QuiverQuant Review

- Exabel Integration

- Researcher Life on Quantitative Research

- Progress Data Cloud

- QuiverQuant Progress Data Cloud News

- QuiverQuant on Google Play

- QuiverQuant INTC Revenue News

- Nano Dimension

- BullishBears QuiverQuant Review