Professional and retail traders alike lose a staggering amount of money fighting irrational trends, searching for that perfect moment to catch a juicy reversal, only to find themselves going broke with each failed attempt. The allure of knife-catching—trying to buy at the lowest of lows or sell at the highest of highs—has led many traders down an unprofitable path.

"It can't possibly go any higher/lower, right?" WRONG.

Instead of free-styling this high-risk approach, let's explore systematic methods to maximize risk:reward using early reversal signs.

The Challenge of Extreme Volatility

In today's market, elevated volatility is becoming the norm. Prices often extend beyond their typical ranges, driven by market momentum and significant events. This environment creates both opportunities and risks for traders. The key is to identify over-extended moves and potential reversal points without falling into the trap of contradicting exuberant markets that can continue trending longer than anticipated.

Leveraging LuxAlgo's Reversal Zones

LuxAlgo's Signals & Overlays toolkit offers a valuable feature called Reversal Zones. These zones highlight areas where prices have extended significantly, often signaling areas of potential reversals. However, recognizing these zones is just the first step. To effectively trade reversals, we'll use additional tools to confirm momentum pivots and trend changes.

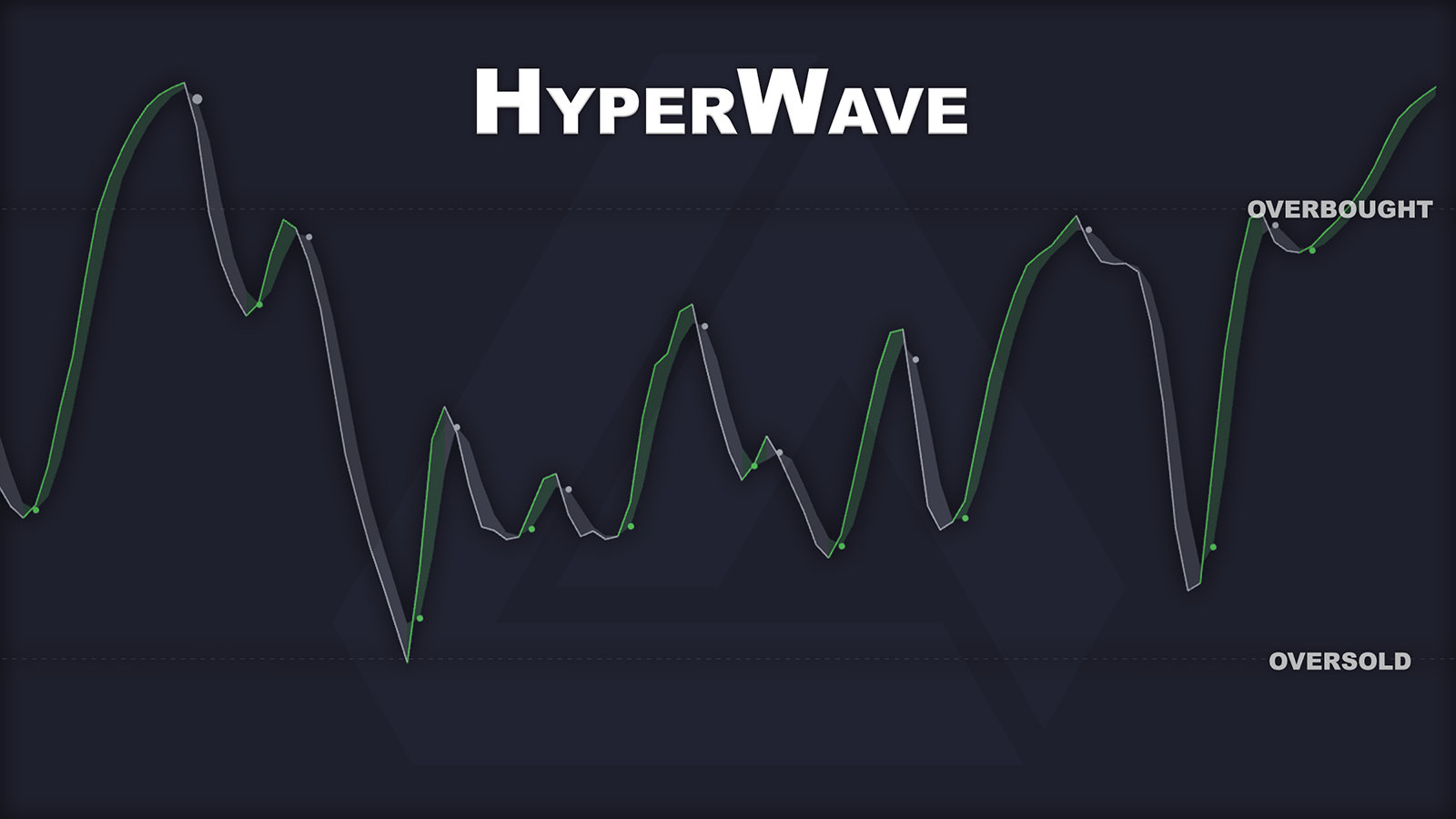

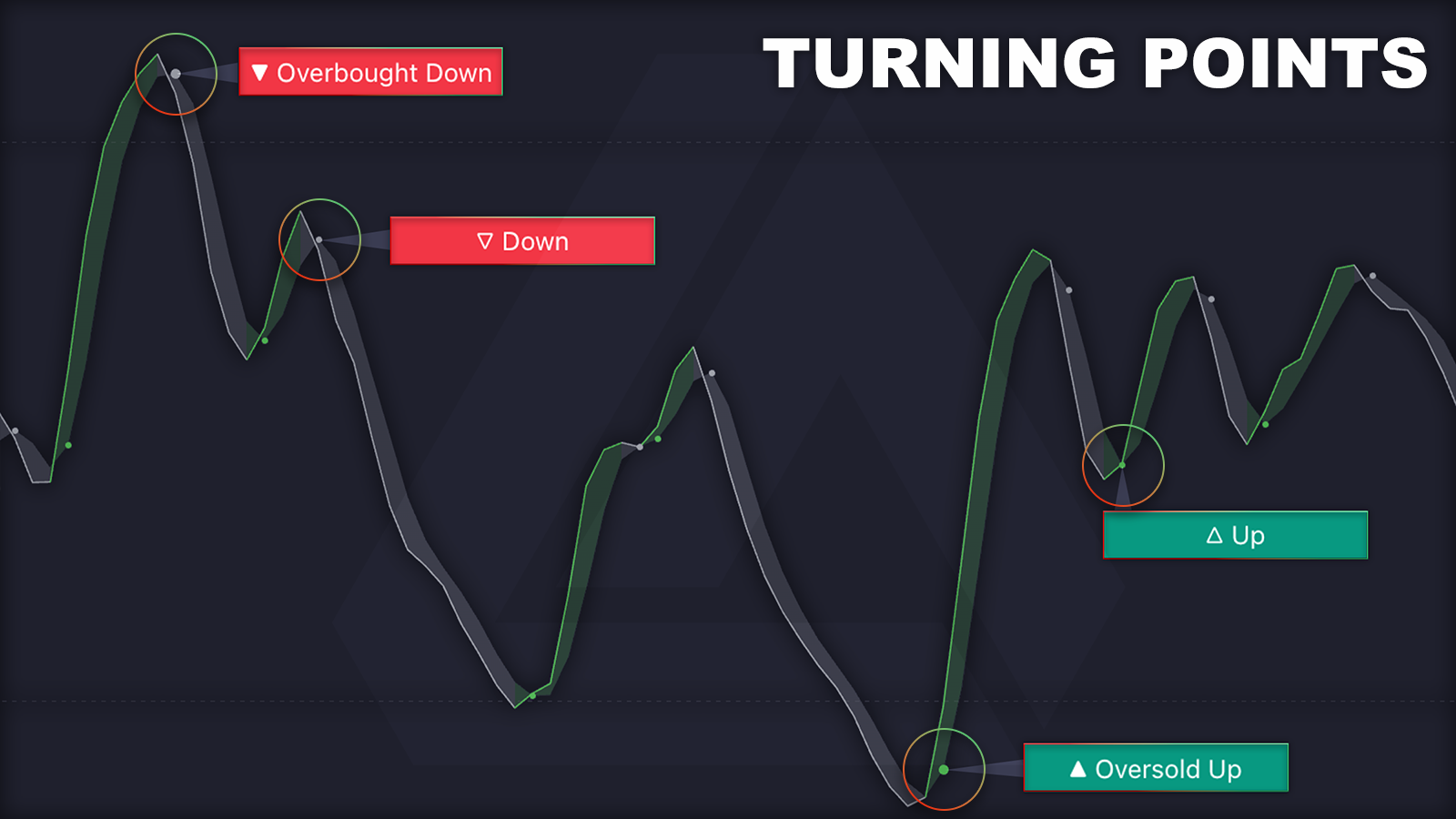

Introducing the HyperWave Indicator

This is where the HyperWave indicator comes into play. As part of LuxAlgo's Oscillator Matrix toolkit, the HyperWave signal line is designed to react to new trend directions and momentum in ways traditional RSI indicators do not. It isolates directional changes by printing Turning Points, with an additional emphasis on overbought and oversold pivots.

Utilizing the Screener

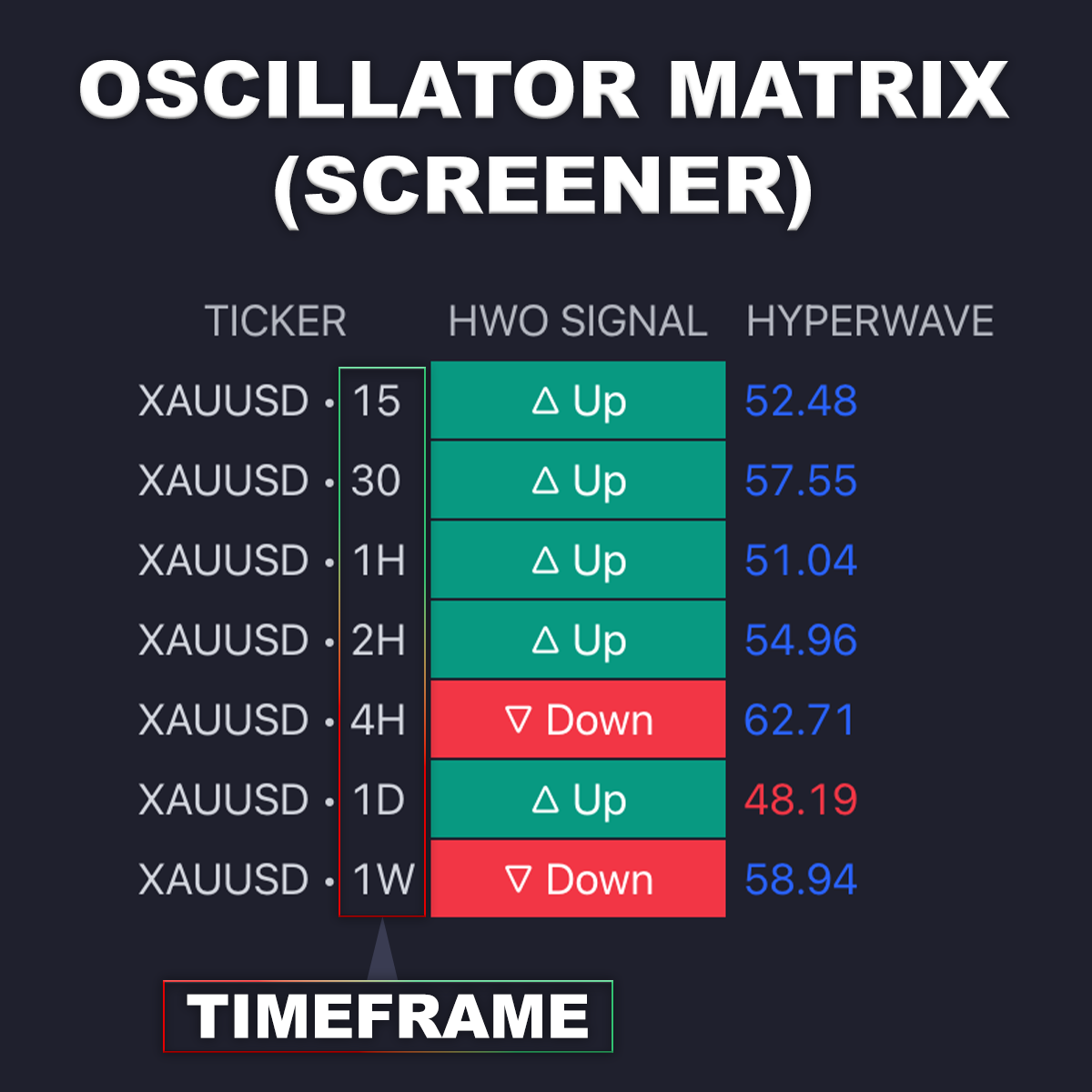

Before we jump into using this in our trading strategy, we're going to save ourselves the time of flipping between multiple timeframes and use the Oscillator Matrix Screener. This tool provides multiple views of price action, allowing you to quickly assess market conditions. It will also enable us to compare the latest Turning Points from each timeframe. Here's how we'll set it up:

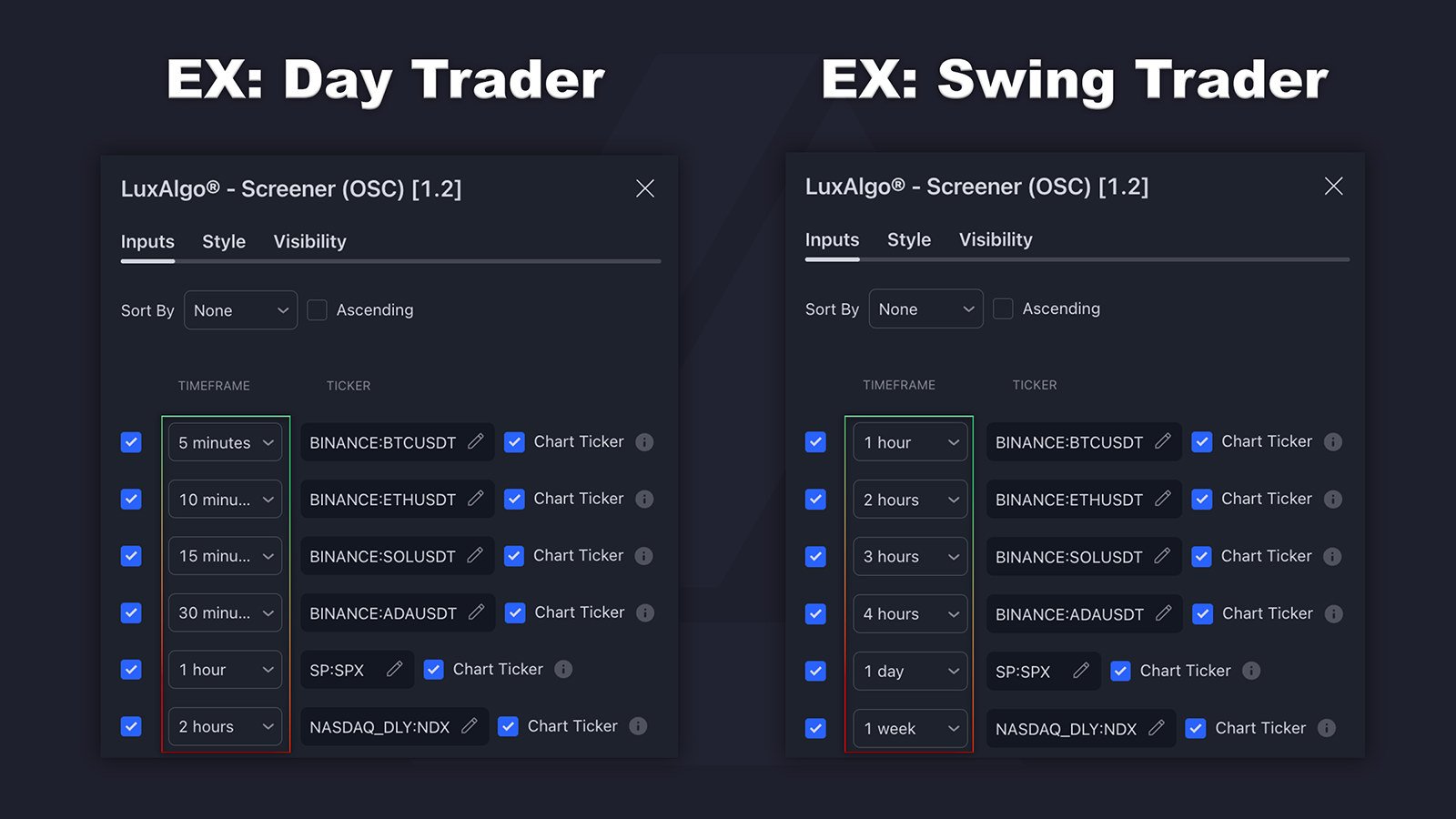

1. Enable Chart Ticker and Set Multiple Timeframes: Start by enabling the Chart Ticker in the screener's settings. Set up multiple timeframes, from short to long intervals, ensuring most intervals are shorter than your main trading timeframe. NOTE: Depending on your trading style, you may want to use a different set of timeframes!

2. Adjust Screener Settings: Disable any unused features to streamline your view and help focus on the latest Turning Point given by the "HWO Signal."

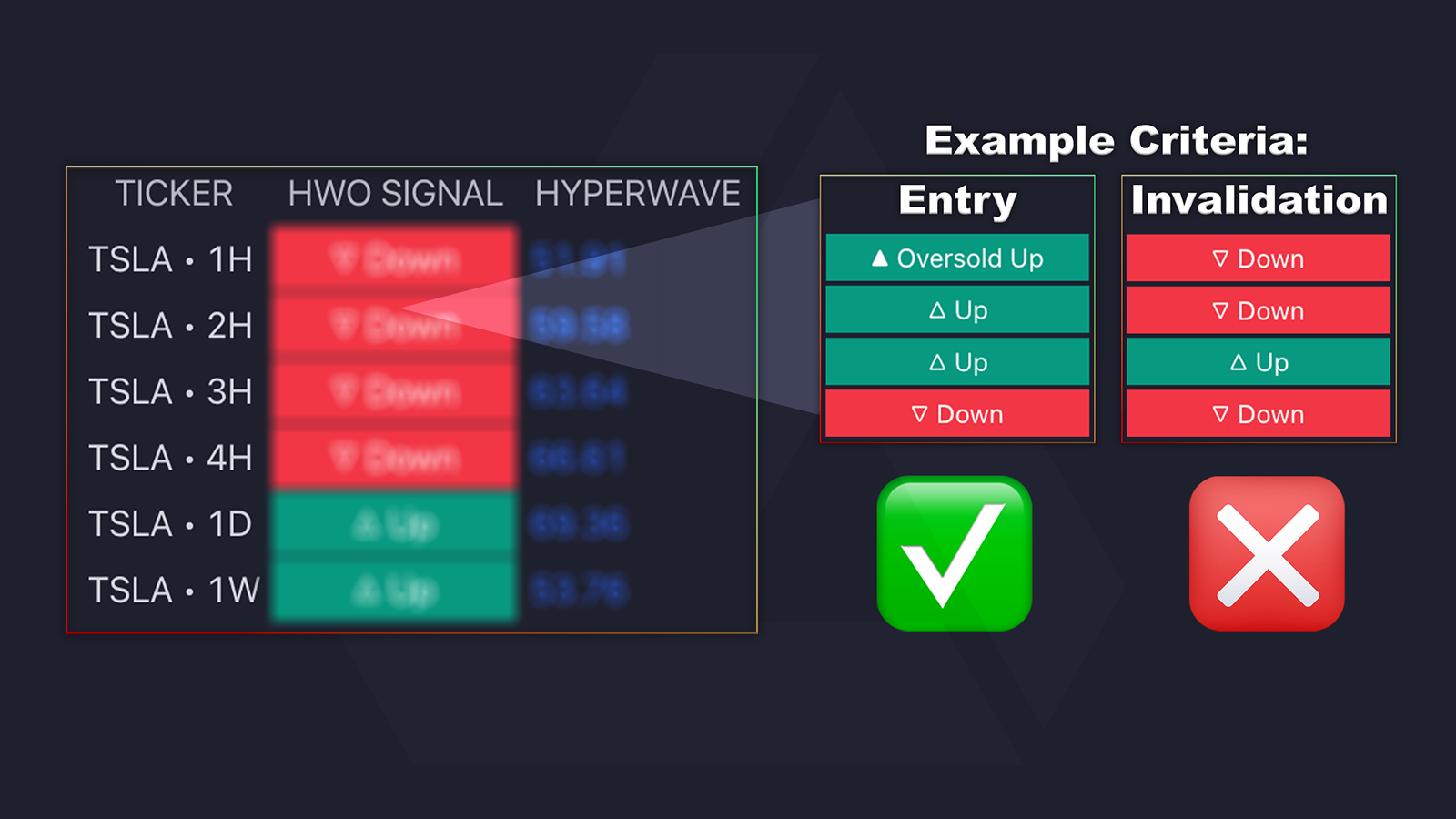

3. Determine Entry Requirements: Watch for HWO (HyperWave Oscillator) Turning Points to begin printing reversals, starting with the lower timeframes. Decide ahead of time what signals make for a reversal trade depending on your trading and position style.

4. Confirm Trend Shifts: Once your target timeframe confirms a trend shift, confirming a reversal, use shorter timeframe Turning Points (HWO Signal) as a stop or exit signal. This layered approach helps you maximize risk:reward, without getting caught in trend continuation.

Systematizing Your Trading Approach

By systematizing how one approaches reversals, you can avoid the pitfalls most traders face when taking contrarian positions. The combination of Reversal Zones and multi-timeframe HyperWave pivots provides a robust starting framework for strategizing and trading reversals effectively. It's important to document and understand your strategy, not just so it can be replicated, but so it can also be improved.

Trading reversals doesn't have to be a gamble. With the right tools and a systematic approach, you can enhance your trading strategies for an improved success rate.

For even more strategies using LuxAlgo's advanced trading tools, join us in the User Strategies section in our free Discord.