Explore the impact of share buybacks on stock value, earnings, and investor strategies. Understand the benefits and potential pitfalls.

Share buybacks are when companies repurchase their own stock, reducing the number of shares available. This can increase stock value, boost earnings per share (EPS), and signal confidence in the company's future. In 2023, S&P 500 companies spent $795.2 billion on buybacks, with tech giants like Apple and Alphabet leading the charge. Here's what you need to know:

-

Why Companies Buy Back Shares:

- Boost EPS by reducing share count.

- Indicate undervalued stock.

- Offset dilution from stock options.

- Offer a tax-efficient alternative to dividends.

-

Methods Used:

- Open Market Purchases: Most common (95% of buybacks).

- Tender Offers: Fixed price offers to shareholders.

- Accelerated Share Repurchases: Quick, large-scale buybacks.

-

Impact on Stock Metrics:

- EPS increases (e.g., a 10% buyback can raise EPS from $0.50 to $0.56).

- ROE can rise significantly but may obscure true performance.

- Stock prices often rise 2–3% after announcements, with larger buybacks seeing gains up to 16%.

-

Key Considerations:

- Funded by cash reserves, not debt.

- Balanced with long-term investments.

- Avoid excessive ROE spikes or poor timing.

-

Buybacks vs. Dividends:

- Buybacks provide flexibility and potential capital gains.

- Dividends offer predictable income but are taxed as ordinary income.

While buybacks can enhance shareholder value, poorly executed programs - such as debt-funded repurchases or mistimed buybacks - can harm a company's financial health and growth potential.

The Debate Over Stock Buybacks

Stock Value and Key Metrics

EPS Changes

Share buybacks affect a company's Earnings Per Share (EPS) by reducing the number of outstanding shares while keeping net income unchanged. This adjustment can make the stock seem more appealing to investors.

Here's an example:

| Metric | Before Buyback | After 10% Buyback |

|---|---|---|

| Net Income | $1,500,000 | $1,500,000 |

| Outstanding Shares | 3,000,000 | 2,700,000 |

| EPS | $0.50 | $0.56 |

The extent of the EPS increase depends on factors like the repurchase price, how the buyback is financed, and the cost of capital.

ROE and P/E Effects

Buybacks also influence metrics like Return on Equity (ROE) and the Price-to-Earnings (P/E) ratio. For example:

- At Home Depot, aggressive buybacks during 2017–2018 led to a tripling of ROE, eventually resulting in negative equity by 2019.

- Apple saw its ROE jump from 30–40% (2012–2017) to 150% by May 2022 as its equity value halved .

Here are some key points for investors to consider:

- ROE above 70% during periods of frequent buybacks may indicate the possibility of negative stockholders' equity.

- An inflated ROE can obscure true performance, so metrics like Operating Income ROA (OROA) might offer better insights into management's effectiveness.

- Historically, the long-term average ROE for the S&P 500 is around 14% .

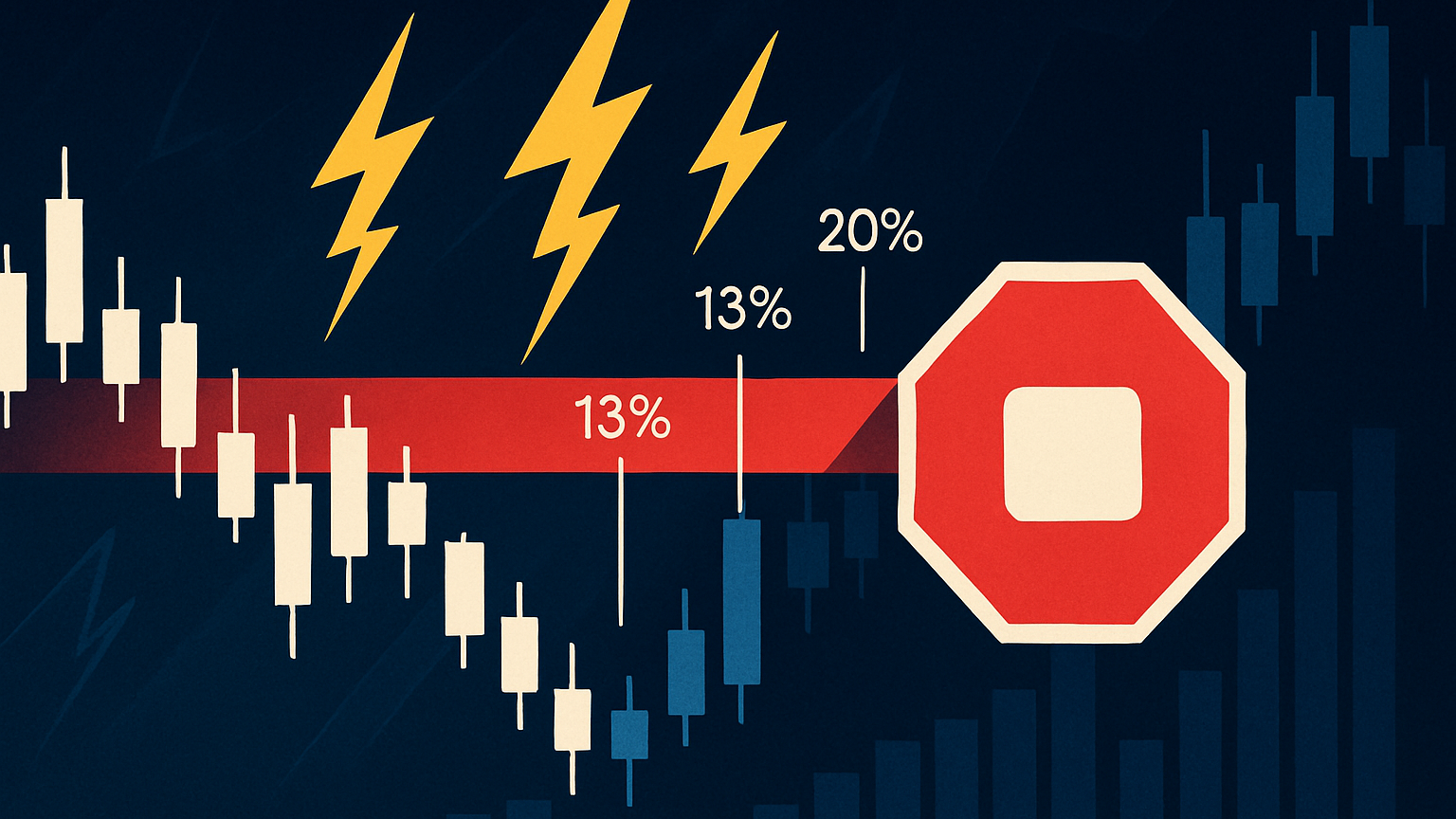

Price Impact Timeline

Stock prices often dip in the six months leading up to a buyback announcement. However, the announcement itself usually triggers a positive market reaction, with average excess returns ranging from 0.5% to 0.75% .

The impact varies depending on the size of the buyback program:

- Smaller programs (repurchasing less than 5% of shares) typically result in price increases of 2–3%.

- Larger programs (repurchasing 15% or more) can lead to price gains of up to 16% .

Since the Global Financial Crisis, market efficiency has improved, leading to quicker price adjustments. The total cumulative average abnormal return from the pre-announcement phase to six months post-announcement remains below 0.5% .

These price trends, combined with changes in EPS and ROE, highlight the importance of detailed company analysis for investors. Understanding these shifts is essential for making informed decisions.

Investor Analysis Guide

Company Health Check

Strong cash reserves are essential for successful stock buyback programs. Take Apple, for example - since 2012, the company has spent over $500 billion on buybacks, showcasing how consistent cash flow can support repurchases while fueling business growth . On the flip side, GE's story highlights the risks of relying on debt. Between 2015 and 2017, GE spent over $24 billion on buybacks, only to later cut dividends and sell key assets .

It's crucial to assess whether buybacks are funded by surplus cash rather than increased debt. Also, consider whether these programs are overshadowing long-term investments. Another important comparison to make is how buybacks stack up against dividends in driving returns.

Buybacks vs Dividends

The decision between buybacks and dividends has a direct impact on returns. Historically, dividends have been a major contributor to U.S. stock returns - accounting for nearly one-third of total returns since 1926 . However, buybacks have gained popularity in recent years, offering distinct advantages for both companies and investors.

Here are key differences to consider:

| Feature | Buybacks | Dividends |

|---|---|---|

| Tax Impact | Capital gains upon sale | Ordinary income |

| Company Flexibility | Adjustable | Expected regularly |

| Income Stream | Variable | Predictable |

| Market Signal | May suggest undervaluation | Reflects stable earnings |

| Performance Impact | Can boost EPS immediately | Supports reinvestment |

After weighing these factors, the next step is identifying potential warning signs in buyback programs.

Warning Signs

Certain red flags can signal trouble with a company's buyback strategy:

- Timing Problems: GE's $12.3 billion buyback in 2007 - right before the market crash - followed by selling $600 million of stock in 2009 during a bull market, is a prime example of how poor timing can destroy value .

- Excessive ROE: If Return on Equity spikes above 70% after repeated buybacks, it might indicate issues with the company's equity base.

- Missed Investments: AT&T's situation is telling. Over a decade, the company spent nearly $50 billion on buybacks, possibly at the expense of critical network upgrades .

Keep an eye out for these specific issues:

- Debt-funded buybacks that could hinder long-term growth

- Reduced spending on R&D while buybacks increase

- Executive pay tied heavily to EPS targets

- Shareholder returns consistently exceeding 100% of earnings

"A company that buys back its stock is signaling to the market that it lacks profitable opportunities for investment." – David Trainer, Contributor, Great Speculations .

Rules and Debates

Current Rules

Share buyback regulations vary widely across major markets. In the U.S., the Securities and Exchange Commission's Regulation 10b-18 offers a safe harbor framework, shielding companies from market manipulation accusations when conducting buybacks . Additionally, the Inflation Reduction Act of 2022 introduced a 1% excise tax on buybacks exceeding $1 million .

In contrast, the European Union's Market Abuse Regulation prioritizes transparency and shareholder protection. EU companies are required to disclose:

- Full program details

- Maximum spending limits

- Number of shares involved

- Program duration

- Trading restrictions, including price and volume limits

Main Arguments

In 2022, U.S. corporations spent over $1 trillion on buybacks , sparking debates about their economic effects and corporate priorities.

| Perspective | Supporting Arguments | Opposing Arguments |

|---|---|---|

| Financial | Boosts EPS and ROA metrics | May signal a lack of growth plans |

| Economic | Efficiently returns excess capital | Reduces funds for business growth |

| Social | Benefits long-term shareholders | Could widen wealth inequality |

| Strategic | Demonstrates company confidence | May focus too much on short-term gains |

"The diversion of cash flow to stock buybacks has inevitably resulted in lower rates of business investment." - James Montier, GMO asset allocation manager

Future Rule Changes

Regulatory changes hint at tighter oversight and greater transparency in buyback practices. The IRS's final rules on the 1% buyback tax, issued in June 2024, clarified exemptions for REITs and regulated investment companies .

Emerging trends in buyback regulations include:

- Greater transparency in how buybacks are executed

- Stricter rules for Accelerated Share Repurchases (ASRs)

- More detailed disclosures on executive compensation linked to buybacks

- Potential new rules aimed at limiting tax benefits

The Joint Committee on Taxation projects the excise tax will generate $74 billion between FY2022 and FY2031 . At present, 68% of ASRs are conducted without price caps, raising concerns and calls for additional safeguards. These developments reflect the evolving regulatory environment, reshaping buyback strategies and setting the stage for further market analysis.

Conclusion

Effects Overview

Share buybacks play a major role in the U.S. market, with corporations spending a staggering $3.8 trillion on their own stocks . For example, Apple's program, launched in 2012, has repurchased over $500 billion in shares and significantly increased its market cap. On the other hand, IBM's $140 billion buyback effort between 2000 and 2020 happened alongside falling revenues and flat stock prices . Typically, the market reacts with a 2–3% positive abnormal return after buyback announcements , and larger buybacks - around 15% of shares - can lead to average price increases of 16% .

These mixed results show how critical it is to evaluate buyback strategies with clear and specific criteria.

Trading Guidelines

To make informed decisions about buyback opportunities, it's essential to rely on clear metrics. Here are some key areas to assess:

| Assessment Area | Positive Indicators | Warning Signs |

|---|---|---|

| Financial Health | Strong balance sheet, excess cash | High debt levels for funding |

| Valuation | Price-to-Economic Book Value (PEBV) under 1 | Overvalued shares |

| Business Outlook | Strong operational performance | Declining revenues |

| Market Timing | Purchases during market downturns | Buying at market peaks |

"In most cases, buybacks create value because they help improve tax efficiency and prevent managers from investing in the wrong assets or pursuing unwise acquisitions." – McKinsey

Looking ahead to 2024, U.S. companies are expected to repurchase $885 billion in stock , showing that buybacks remain a key part of investment strategies. Investors should prioritize companies with sustainable cash flow, a clear strategic purpose behind their buybacks, a balanced approach between rewarding shareholders and reinvesting in the business, and strong operational performance to support their repurchase programs.

However, poorly executed, debt-driven buybacks can erode value instead of creating it.