Learn how to recognize key chart patterns that signal market trends and improve your trading decisions with effective strategies.

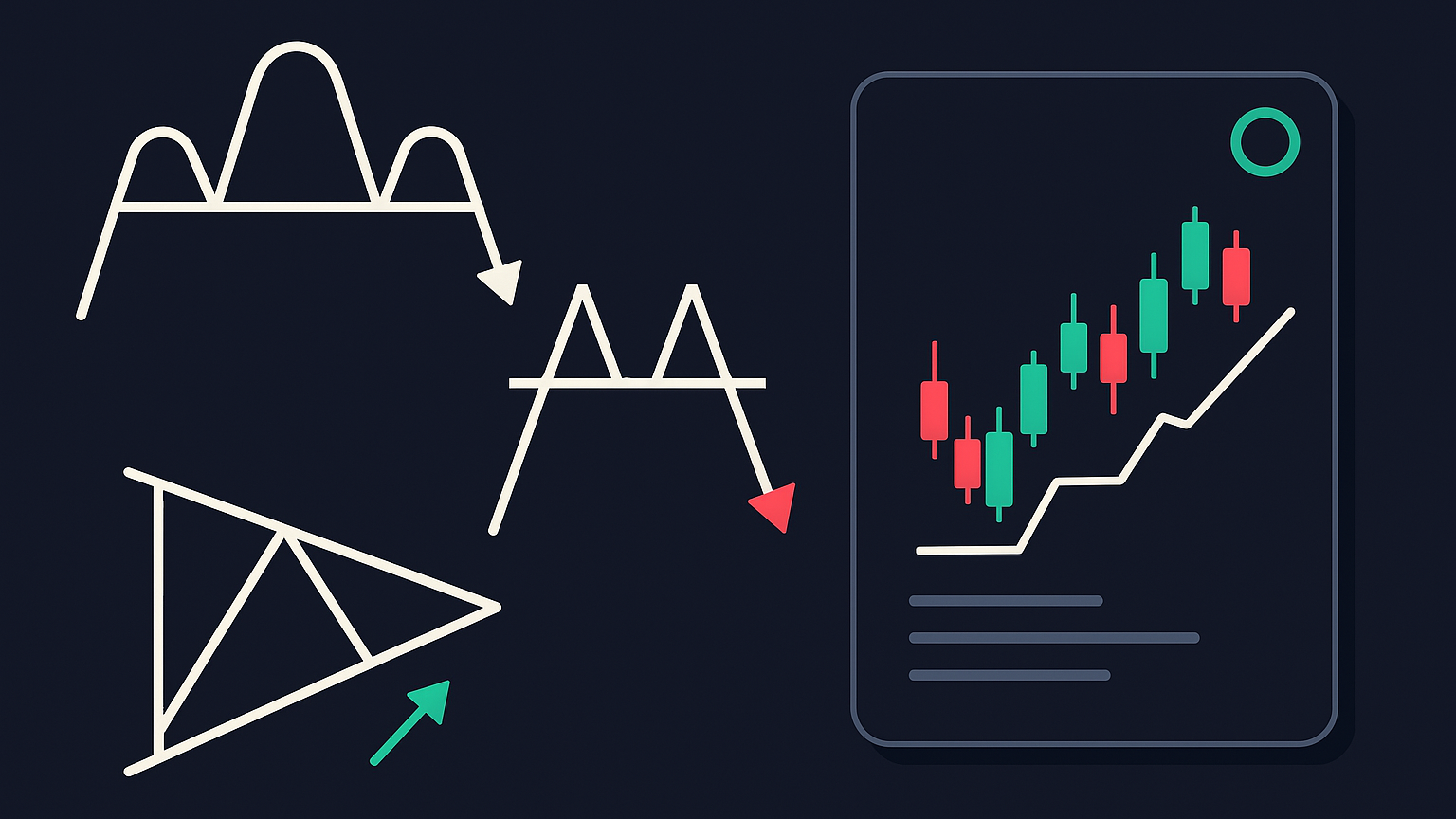

Chart patterns are essential for traders to predict price movements by analyzing market trends. They fall into two categories: reversal patterns, which signal trend changes, and continuation patterns, which indicate trend pauses. Popular patterns include Head and Shoulders, Double Tops/Bottoms, Triangles, and Flags. Key insights:

- Reversal Patterns: Spot trend shifts, e.g., Head and Shoulders, Double Tops/Bottoms.

- Continuation Patterns: Identify trend pauses, e.g., Triangles, Flags, Pennants.

- Candlestick Signals: Quick trend insights from Doji, Hammer, and Engulfing patterns.

- Volume Confirmation: Track volume to validate breakouts and avoid false signals.

- Risk Management: Use stop-loss orders and position sizing to manage risks.

For success, combine chart patterns with technical indicators, volume analysis, and the advanced capabilities offered by LuxAlgo – which delivers hundreds of free trading indicators, exclusive features, and an AI Backtesting platform to help refine your trading strategies.

Ultimate Chart Patterns Trading Course

Reversal Patterns

Reversal patterns help identify when a trend is losing momentum and may change direction.

Head and Shoulders Pattern

First introduced by Charles Dow in the early 1900s, the Head and Shoulders pattern is a well-known signal of trend reversal. It features three peaks aligned along a baseline: the middle peak (the "head") is the tallest, while the two outer peaks (the "shoulders") are shorter.

- Left Shoulder: High trading volume indicates the initial uptrend is weakening.

- Head: Buying activity decreases, leading to lower volume.

- Right Shoulder: The lowest volume of the three confirms the potential reversal.

Traders should wait for the price to break below the neckline with strong volume before entering a position. Also, ensure the prior uptrend is at least twice the height of the shoulders.

Double Tops and Bottoms

Double Tops (resembling an "M") and Double Bottoms (shaped like a "W") signal market exhaustion. A reversal is confirmed when the price breaks out—downward for tops, upward for bottoms—accompanied by a spike in volume. Watch for declining volume during the pattern's formation and a surge during the breakout to strengthen the signal.

Next, let’s look at rounding patterns, which reflect a more gradual change in market sentiment.

Rounding Patterns

Rounding patterns develop as market sentiment shifts gradually. For instance, Coca-Cola's chart in mid-2014 showed a rounding bottom after a gap down, followed by consolidation and a rally once the price moved above $41.

Key points for trading these patterns:

- Volume: High during the decline, flat during consolidation, and rising as the reversal begins.

- Price Target: Measure the distance from the neckline to the lowest point of the pattern, then project this distance upward from the breakout.

- Risk Management: Place stop-loss orders near the pattern's midpoint or just below the breakout candle.

Rounding patterns are especially useful for traders who are willing to wait for clear confirmation before making a move. Their defined price targets and reliable nature make them a valuable addition to a trader's approach.

Continuation Patterns

Continuation patterns indicate pauses within strong trends, providing potential entry points for traders.

Triangle Patterns

Triangle patterns emerge when price movements create converging trendlines during consolidation phases. There are three primary types:

| Pattern Type | Characteristics | Trading Signal |

|---|---|---|

| Ascending | Flat resistance, rising support | Signals upward trend |

| Descending | Flat support, falling resistance | Signals downward trend |

| Symmetrical | Converging lines at similar angles | Aligns with the trend |

To trade these patterns, wait for a breakout confirmed by higher trading volume. Determine profit targets by measuring the height of the triangle at its widest point and projecting that distance from the breakout level. Place stop-loss orders just outside the pattern to control risk, as outlined in the Pattern Trading Guide.

Flags and Pennants

Flags and pennants represent brief pauses in trends, often following sharp price movements. Flags form rectangular shapes with parallel trendlines, while pennants resemble small symmetrical triangles. Confirm these formations with breakouts accompanied by increased trading volume.

Rectangle Formations

Rectangle patterns highlight consolidation zones defined by clear support and resistance levels. These require at least two horizontal tops and two bottoms to form.

Steps for trading rectangles:

- Pinpoint horizontal support and resistance levels.

- Confirm consolidation with declining volume.

- Enter trades on clear breakouts supported by higher volume.

- Set profit targets equal to the rectangle's height projected from the breakout point.

For added confidence, integrate RSI readings: values above 50 favor bullish breakouts, while those below 50 support bearish scenarios.

Short-Term Candlestick Signals

These candlestick formations build on established chart patterns to offer quick insights into market sentiment, helping identify potential reversals or continuations in shorter timeframes.

Doji and Hammer Signals

Doji candlesticks—where the open and close prices are nearly identical (body ≤5% of the total range)—reflect market indecision and hint at a possible trend change.

| Pattern Type | Description | Signal Strength |

|---|---|---|

| Standard Doji | Equal shadows above and below | Moderate indecision |

| Dragonfly Doji | Long lower shadow | Possible bullish sign |

| Gravestone Doji | Long upper shadow | Possible bearish sign |

| Long-legged Doji | Extended shadows on both sides | Suggests high volatility |

Hammer patterns, which frequently occur in downtrends, signal a potential reversal when the following candle closes above the hammer's closing price. These patterns often complement other candlestick signals.

Engulfing Candles

Engulfing patterns build on the signals provided by doji and hammer formations. In these two-candle formations, the second candle’s body completely overlaps the first, indicating a strong momentum shift—especially near key support or resistance levels.

"Engulfing Candlestick Patterns are a quintessential asset in a trader's approach, offering insights into market sentiment and potential reversals." – TrendSpider Learning Center

For better accuracy, confirm engulfing patterns by checking for increased trading volume, proximity to key price levels, additional confirmation candles, and momentum indicators such as RSI. These formations work best in liquid markets.

When paired with broader chart patterns, these candlestick signals help facilitate more precise trading decisions.

Pattern Trading Guide

Chart pattern trading involves a structured process for identifying patterns, confirming breakouts, executing trades, and managing risks effectively.

Pattern Detection Steps

Begin by studying price action and the overall market environment. Pay close attention to price movements near key support and resistance levels, as these are the zones where patterns typically emerge.

| Detection Component | Key Considerations | Validation Method |

|---|---|---|

| Price Structure | Support/resistance levels | Cross-check with larger timeframes |

| Volume Profile | Volume trends during formation | Compare against average volume |

| Pattern Completion | Formation requirements | Validate with price action |

| Market Context | Trend direction and strength | Align with technical indicators |

Volume plays a critical role—it typically decreases during the pattern's formation and spikes during breakouts. Once identified, the next step is to confirm the breakout.

"Chart patterns are an integral aspect of technical analysis, but they require practice to use effectively." – IG International

Breakout Analysis

After spotting a pattern, it is crucial to confirm the breakout to avoid false signals. A valid breakout generally includes:

- Price moving beyond the pattern's defined boundary

- Trading volume exceeding the average

- A price retest of the breakout level

- Continuation in the direction of the breakout

The VWAP (Volume Weighted Average Price) is a useful tool for verifying breakouts:

| Price Action | Volume Signal | Trading Response |

|---|---|---|

| Break Above VWAP | Rising Volume | Consider entering long |

| Hold Above VWAP | Sustained Volume | Maintain the position |

| Break Below VWAP | High Volume | Exit or reverse position |

Once confirmed, previous resistance levels often turn to support, while former support areas may become resistance.

Risk Control Methods

Effective risk management is fundamental to successful trading. Position sizing should align with your account size and defined risk tolerance.

| Risk Factor | Management Approach | Implementation |

|---|---|---|

| Position Size | Limit to 1-2% of account size | Risk no more than 1-2% per trade |

| Stop Loss | Place at technical levels | Below support or above resistance |

| Trade Management | Adjust trailing stops | Based on market volatility |

For long trades, place stop-loss orders below support levels; for short trades, position them above resistance. Adjust stops to reflect market volatility and your trading timeframe. These risk strategies integrate seamlessly with the pattern detection and breakout processes outlined above.

Using Price Action Concepts for Pattern Detection

LuxAlgo’s Price Action Concepts toolkit streamlines and enhances pattern detection by automating the identification of key price action formations. This feature enables traders on TradingView to quickly pinpoint common trading patterns, delineate support and resistance levels, and receive real-time alerts that simplify technical analysis. Discover more about this innovative pattern detection capability by visiting LuxAlgo.

Conclusion

Chart patterns provide clear signals that, when combined with disciplined risk management and modern technical indicators, can enhance trading decisions.

Main Points

Chart patterns reflect price movements and aid in predicting trends. Their accuracy relies on understanding both technical factors and market sentiment. Patterns such as Head and Shoulders, Triangle formations, and candlestick signals prove highly effective when confirmed using volume, technical indicators, and broader market context. These fundamentals are essential for leveraging advanced trading capabilities.

Offerings and Subscription Plans

LuxAlgo’s Price Action Concepts offering automates pattern detection and provides real-time alerts. Subscription levels include:

- Essential: $24.99/month

- Premium: $39.99/month (includes advanced signal confirmation and oscillator enhancements)

- Ultimate: $59.99/month (adds AI-powered backtesting for strategy validation)

Each plan is designed to cater to varying levels of trading expertise—from beginners to advanced traders.

Next Steps

Apply these insights by:

- Practice Pattern Recognition: Analyze historical data to identify patterns under different market scenarios.

- Build a Testing Framework: Evaluate the performance of patterns and refine your entry and exit strategies.

- Risk Management: Use stop-loss levels and consistent position sizing to safeguard your capital.