Learn how to effectively trade volume spikes to confirm breakouts, spot reversals, and capitalize on high-volume opportunities.

Volume spikes are sharp increases in trading activity that can signal major market shifts. By analyzing these spikes alongside price movements, traders can time entries and exits more effectively. Here's what you need to know:

- Confirm Breakouts: Rising volume during a breakout confirms strong buying or selling momentum.

- Spot Reversals: Spikes near support or resistance levels often indicate trend changes.

- Scalping Opportunities: High-volume periods offer liquidity and tighter spreads for quick trades.

Key Tools: Use indicators like OBV, VWAP, and Volume Oscillators to analyze volume trends. Platforms like LuxAlgo can automate volume analysis and provide real-time alerts for unusual activity.

Risks: Watch for false signals, news-driven spikes, and increased transaction costs during high-volume periods. Manage these with proper risk controls, such as limit orders and position sizing.

Volume spikes are a powerful tool for traders when combined with technical analysis and disciplined risk management.

Strategies for Trading with Volume Spikes

Trading with volume spikes involves using specific methods to spot and act on major market shifts. Here are three strategies that use volume analysis to improve trade timing.

Confirming Breakouts with Volume Spikes

When breakouts happen, volume spikes can act as a key signal to confirm price movements. For example, a price breaking above resistance with rising volume often signals strong buying momentum, making it a good setup for long trades. On the flip side, a price breaking below support with high volume typically points to bearish momentum, which could be an opportunity for short trades. However, if the volume is low during a breakout, it’s best to wait for further confirmation.

To confirm breakouts effectively, traders can use tools like volume oscillators and the On-Balance Volume (OBV) indicator alongside price movement analysis [1].

Spotting Trend Reversals Using Volume Spikes

Volume spikes don’t just confirm trends—they can also highlight potential reversals. These spikes, especially near support or resistance levels, often signal that the current trend is losing steam and market sentiment is shifting [1]. For example, a sudden volume increase—double or triple the average daily volume—usually indicates heightened market interest, making a reversal more likely.

To spot trend reversals with accuracy, focus on:

- Volume behavior near key support or resistance levels

- Using the Volume-Weighted Average Price (VWAP) for confirmation

Scalping During High-Volume Periods

For short-term traders, volume spikes create opportunities for quick trades. Scalping is a technique that takes advantage of the liquidity and momentum caused by these spikes. During high-volume periods, prices often move faster, and spreads become tighter, making it easier to execute rapid trades [1][2].

Successful scalping relies on precise timing, quick decision-making, and strict risk controls. Tools like real-time alerts and scanners available on trading platforms can help identify sudden volume surges, ensuring timely trade execution. Platforms like LuxAlgo offer screeners that filter for specific volume patterns, making them particularly helpful for traders focused on high-frequency strategies.

Tools and Techniques for Volume Spike Analysis

Key Volume Indicators

Understanding market activity often comes down to three main indicators: Volume Oscillator, OBV (On-Balance Volume), and VWAP (Volume Weighted Average Price). Each serves a specific purpose:

- Volume Oscillator measures volume trends, flagging when readings exceed 20% of the average—this suggests heightened market interest.

- OBV tracks cumulative buying and selling pressure, helping to identify potential reversals when its trend diverges from price movement.

- VWAP highlights the average price levels weighted by volume, making it particularly useful for confirming trends when combined with volume spikes.

These indicators are excellent for spotting unusual market activity and identifying ideal trade entry and exit points. For traders seeking more advanced tools, platforms like LuxAlgo can further refine these insights with automation and additional features.

Using LuxAlgo for Volume Spike Analysis

LuxAlgo integrates directly with TradingView, offering specialized features that simplify volume analysis. A key component is the Oscillator Matrix, which brings multiple volume-based signals into a single display. This helps traders recognize volume imbalances quickly, filter out noise, and leverage high-quality signals more effectively.

By customizing your Oscillator Matrix settings, you can automatically detect unusual volume patterns across different timeframes, identify real-time volume anomalies, and even backtest strategies to validate volume-based approaches. With well-defined alerts, traders can hone in on the most impactful volume events.

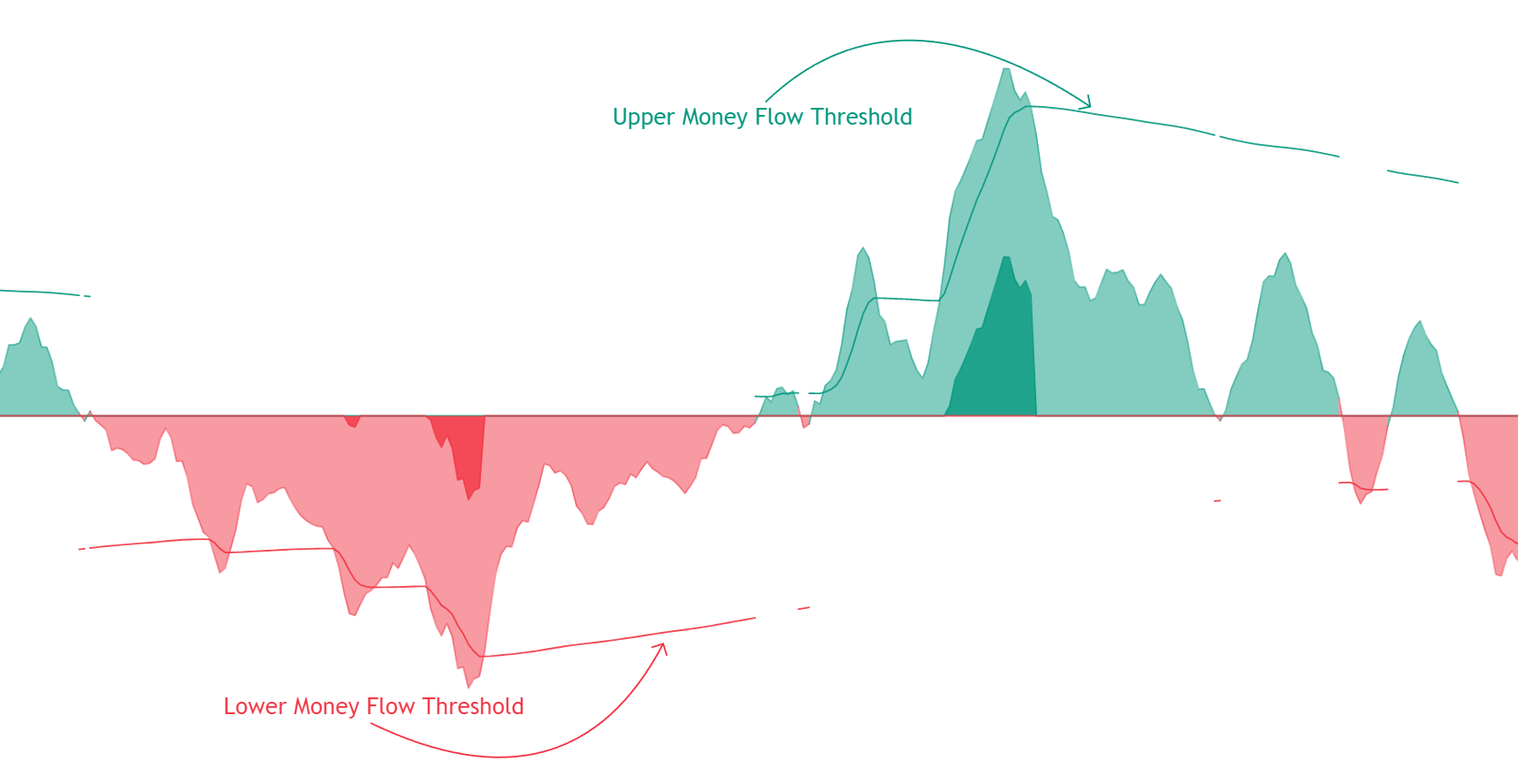

Using the Oscillator Matrix to Identify Excessive One-Sided Volume

The Oscillator Matrix is more than just a tool for measuring volume trends. It can also detect scenarios where either buying or selling volume dominates the market using what’s called the money flow threshold. This threshold helps traders gauge the net volume driving price movement and whether it suggests a bullish or bearish imbalance.

When volume exceeds certain money flow thresholds—whether positively or negatively—it indicates high conviction from one side of the market. This information can be crucial for:

- Identifying potential pivot points when buying or selling pressure reaches extreme levels.

- Confirming whether a breakout is supported by real market conviction rather than low-volume spikes.

- Spotting potential reversals if the threshold swings rapidly from bullish to bearish (or vice versa).

By monitoring these thresholds within the Oscillator Matrix, traders can make more informed decisions about trade entries and exits. For more detailed guidance, check out the Money Flow Thresholds documentation. Additionally, visit LuxAlgo Toolkits to learn how to integrate this feature into your overall trading strategy.

Setting Up Alerts for Volume Spikes

Effective alert configurations can improve trade timing by focusing on the most impactful volume events. Here’s a quick guide:

| Alert Type | Threshold Setting | Purpose |

|---|---|---|

| Absolute Volume | 200% of 20-day average | Spot major volume surges |

| Relative Volume | 150% of the previous hour | Catch intraday spikes |

| Price-Volume Combination | Volume spike + price breakout | Confirm high-probability signals |

Combining these alerts with technical analysis near critical price levels can help traders zero in on the most promising setups. This approach ensures that you’re not just reacting to volume but using it strategically to align with broader market trends [1].

Risks and Challenges of Volume Spike Trading

Dealing with False Signals and Market Noise

While volume spikes often point to market changes, they don't always guarantee profitable trades. These spikes can sometimes mislead traders by signaling incorrect market directions [1].

Here are some common signal types and how to handle them:

| Signal Type | Risk Factor | Mitigation Strategy |

|---|---|---|

| Pre-Market Spikes | Low liquidity makes them unreliable | Wait for confirmation during regular hours |

| News-Driven Volume | Can trigger short-lived, unstable movements | Combine with fundamental analysis |

| End-of-Day Spikes | Often reflect position adjustments, not trends | Focus on volume patterns during mid-session |

To avoid false positives, pair volume analysis with fundamental data. Tools like LuxAlgo can help filter out irrelevant noise and highlight actionable patterns, making it easier to spot genuine opportunities [1].

However, identifying reliable signals is just one part of the equation. Managing costs during high-volume trading is just as important for staying profitable.

Managing Increased Transaction Costs

Trading during high-volume periods can come with hidden costs that eat into your profits. Spreads tend to widen, and slippage becomes more frequent, particularly in volatile markets [1][2].

Here’s how these costs break down and how to manage them:

| Cost Factor | Impact | Management Strategy |

|---|---|---|

| Wider Spreads | Increases entry and exit costs | Opt for limit orders over market orders |

| Slippage | Execution at unexpected prices | Adjust position sizes to account for slippage |

| Commission Fees | Higher fees due to frequent trades | Scale positions carefully to reduce turnover |

To maintain profitability, adjust your position sizes based on market conditions. Gradual scaling during volatile periods can help you stay disciplined and avoid rash decisions. Stick to a well-thought-out trading plan to navigate these challenges effectively [1].

Conclusion: Using Volume Spikes for Trade Timing

Key Takeaways for Volume Spike Trading

A well-structured approach to analyzing volume spikes can help traders identify market opportunities and manage risks effectively. Volume spikes confirm price movements and reveal trading opportunities through these primary strategies:

| Trading Strategy | Advantages | How to Apply |

|---|---|---|

| Breakout Confirmation | Confirms price movements | Watch for volume surges during breakouts |

| Trend Reversal Signals | Detects potential reversals | Monitor spikes during price consolidations |

| High-Volume Scalping | Increases liquidity | Trade during periods of higher activity |

LuxAlgo's tools simplify this process by filtering out irrelevant data and highlighting actionable signals [1].

To integrate volume spike analysis into your trading, here are some practical steps:

Steps to Use Volume Spike Analysis

-

Set Up Tools and Baselines

- Configure volume indicators like OBV and Volume Oscillators.

- Identify normal trading volume levels to spot real spikes.

- Use technical analysis tools to validate signals.

-

Manage Risks Effectively

Risk Factor How to Manage It False Signals Pair volume analysis with technical tools Market Volatility Use proper position sizing and stop-losses

Patience and discipline are crucial for success in volume spike trading. By combining these strategies with advanced tools, traders can improve their timing for entries and exits while keeping risks under control [1][2].

FAQs

How to trade volume spikes?

To trade volume spikes effectively, combine volume analysis with technical indicators. Here's how:

| Component | Strategy |

|---|---|

| Technical Confirmation | Look for signals at key support or resistance levels to validate trades. |

| Volume Tools | Use tools like OBV (On-Balance Volume) and VWAP (Volume Weighted Average Price) for additional confirmation. |

When volume spikes occur at critical technical levels and are backed by these tools, they can point to actionable trading opportunities [1].

Does volume affect price action?

Yes, volume plays a key role in understanding market strength and price momentum. Two key scenarios to watch for:

- Strong Uptrend: When prices rise alongside increasing volume, it confirms the strength of the trend.

- Potential Reversal: If new price highs are accompanied by decreasing volume, it may indicate the trend is losing momentum.

How to trade high volume?

Trading during high-volume periods requires a focus on volume-by-price analysis and strict risk management. Volume-by-price indicators can help traders:

- Pinpoint important support and resistance zones based on historical trading activity.

- Detect potential reversal points where trading volume shifts significantly.

- Optimize entry and exit points by analyzing volume distribution patterns [3].

Tools like LuxAlgo's volume analysis features can help cut through market noise, highlighting meaningful patterns to improve trade timing [1]. By combining volume-by-price insights with other technical indicators, traders can sharpen their approach to handling high-volume situations.

References

- coruzant.com

- dotnettutorials.net

- blog.hubspot.com

- docs.luxalgo.com — Reversal Signals

- luxalgo.com — Volumetric Toolkit

- LuxAlgo App — Volumetric Toolkit

- luxalgo.com — Toolkits

- docs.luxalgo.com — Money Flow Thresholds

- luxalgo.com — Market Structure Volume Distribution

- luxalgo.com — Support & Resistance Dynamic

- docs.luxalgo.com — Oscillator Matrix Reversal Signals

- tradingview.com

- investopedia.com — VWAP

- en.wikipedia.org — On-Balance Volume

- luxalgo.com/blog — Reversal Spotting

- luxalgo.com