The first thing most traders will have to do is build a portfolio, this process is more complex than just choosing what assets to trade, and in order to build a good portfolio you will need to find your trader profile.

The first thing most traders will have to do is build a portfolio, this process is more complex than just choosing what assets to trade, and in order to build a good portfolio you will need to find your trader profile, which can be determined by asking yourself the following questions:

- What is your initial capital?

- What is your targeted return rate?

- What is your risk aversion?

- What is the investment horizon?

- What is your availability?

All these questions are related to each other, and as such, it can be difficult to find non-conflictive answers to them. The following sections give information about the theme of each question so that you may more easily identify your trader profile.

Initial Capital

The initial capital you are willing to invest is an important matter, again we could ask ourselves various questions to determine it, but let’s go with a simpler approach.

A low capital can have a wide variety of effects. Capital is directly related to buying power, and a low buying power will result in the trader being unable to trade certain assets, but more importantly, it comes with a reduced ability to diversify a portfolio, and as a result, makes traders unable to lower their risk level. Leverage can increase buying power without having to have higher capital but it involves significantly increased risk.

Having a low capital also means potentially reducing the lifetime of your portfolio since you won’t be able to tank more losses, thus conflicting with your investment horizon target.

Certain markets are more accessible than others for traders with low capital, this is the case of the forex and cryptocurrency markets that offer high leverages compared to the stock markets.

Risk Returns

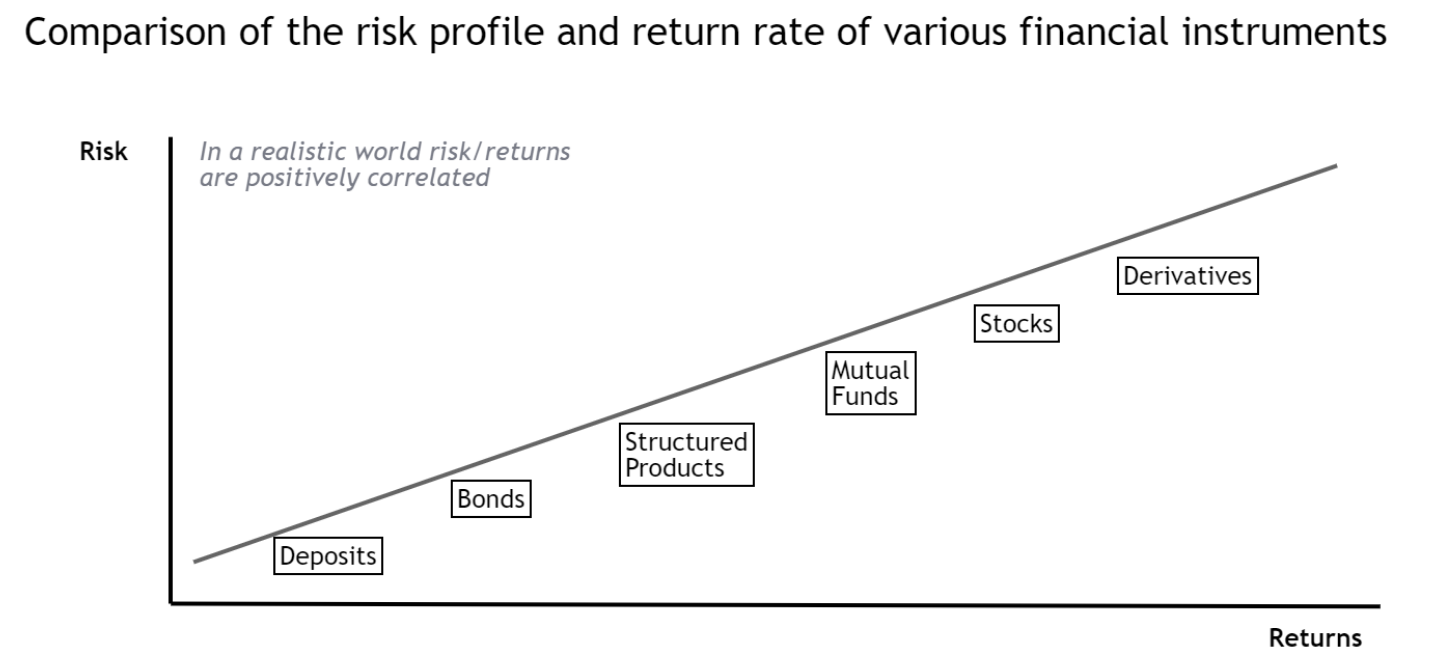

Risk/returns are two correlated concepts, the more returns you expect from an investment, the more risk you are taking, an investment with large potential profits and low risk does not exist. Knowing your risk aversion is crucial if you want to build a good portfolio, and you will need to choose this level in coherence with the other aspects of your trader profile.

Financial instruments all have a different risk/return ratio, and it is important to choose them wisely based on your profile. It is also possible to mix various financial instruments in your portfolio, this is a good way to reduce risk, as such you can have a portfolio consisting of 60% derivatives ( futures , options…) and 40% bonds.

Investment Horizon

Your investment horizon will be a huge factor of your success in trading, certain traders focus on long term trading, holding positions for years, and will use the buy and hold strategy. Others might hold a position from several days to several months, they are often defined as “swing-traders”. Finally, some traders might open and close positions within one trading day, and as such are named “day-traders”, a particularly well-known type of day-traders are scalpers, who usually hold positions for only several minutes.

Most beginners in trading will start day-trading, and a lot will try scalping, however, it must be noted that the shorter your investment horizon is, the more difficult it will be to be consistently profitable. This has various reasons, one of them is that shorter-term investments require more precise timing, also you are expecting smaller profits than ones you would get using longer-term investments, thus encouraging a trader to use higher leverage, thus maximizing risk, also opening a high number of positions will mean you will lose more from frictional costs (commission, spread…), and since your profits will mostly be smaller, frictional costs will have a higher impact on your profit margin.

We strongly advise beginners to stay away from scalping.

Availability

Trading requires time and effort, and it is impossible not to be involved with your positions (even when everything is automated). However, some users will still have more time than others. Traders will have to do certain tasks:

- Monitor existing positions

- Execute orders

- Research for information

Users who can allocate a majority of their time to trading will be able to build & update more advanced portfolios and do shorter-term trades, however, traders with less time will often have to seek longer-term trading styles such as swing trading.

Conclusion

Trader profiles will vary across every trader and understanding the importance of asking yourself the right questions to identify your own trader profile will likely help you overall increase your chances of success in trading.

Thank you for reading!