Trend Lines

Oct 17, 2023

Our new "Trend Lines" indicator detects and highlights relevant trendlines on the user chart while keeping it free of as much clutter as possible.

The indicator is thought for real-time usage and includes several filters as well as the ability to estimate trendline angles.

USAGE

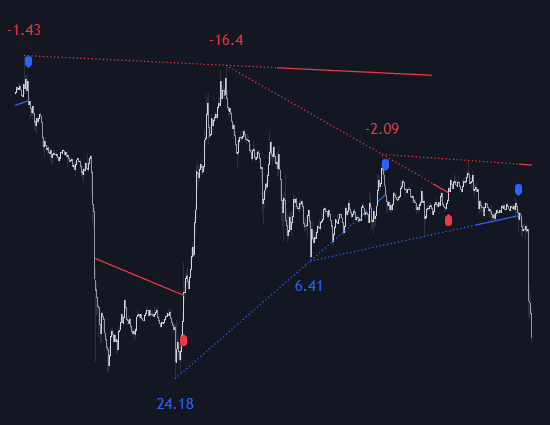

Trendlines can act as support/resistance, with a higher number of tests indicating a more significant support/resistance role.

A broken TrendLine can be indicative of a potential trend reversal. The script highlights breaks with a label.

Users can additionally filter trendlines, only showing trendlines whose angles fall within a user set range:

This allows for the removal of potential clutter from the chart but also helps keep steeper or more horizontal trendlines.

DETAILS

When a swing (pivot point) is found, a Trendline is drawn when certain conditions are fulfilled.

An essential condition is that a Bearish Trendline (red) always occurs on a lower high, while a Bullish Trendline (blue) occurs on a higher low.

Our implementation will first show an initial dotted-styled TrendLine on confirmation, after which a solid-styled secondary TrendLine will develop. The latter will be used for the real-time detection of breaks at that line:

Furthermore, the script allows you to add more conditions:

Length (Swings)

A swing develops when a high/low is the highest/lowest against x highs/lows on the left AND right of that bar. x can be set by "Length" in settings.

The following images clarify this. The script confirms a swing where the yellow flag is shown; the high (here visualized with a purple label) is the highest point against x bars left and right of that point. At that moment, this swing is checked against the previous swing. If all conditions are fulfilled, an initial TrendLine is drawn on confirmation.

After that point, a secondary thicker solid line is seen which keeps progressing bar after bar, until:

• a new TrendLine is formed • the TrendLine is broken

Breaks between Swings

Once there is confirmation that a TrendLine can be drawn, the script allows you to filter for breakthroughs on that line. This can be set with "Check breaks between"

-

Disabled: the initial TrendLine is allowed to be pierced:

-

Check breaks between point A - point B: no breaks are allowed between both Swing points:

-

Point A - Current bar: no breaks are allowed between the first Swing point and the point of confirmation ('current' bar):

TrendLine breaks

As mentioned, the secondary TrendLine (solid line) progresses bar after bar until a new TrendLine is formed or the TrendLine is broken. When a TrendLine is broken, the TrendLine stops progressing, but if there isn't a new TrendLine and price return back, the TrendLine will re-appear, potentially giving several signals when the TrendLine is broken again.

Minimal bars allow you to regulate the amount of signals when the TrendLine is broken.

-

The secondary TrendLine must be uninterrupted for at least x bars before a potential break can be considered.

The following example shows 1 signal against 3 by adjusting this setting from 2 to 5:

Angles

Angles should normally be calculated when the units of the X and Y axis are the same. However, on our charts, the unit of the X-axis is bar_index (bars), and on the Y-axis the unit is price (¥, €, £, $,...).

It is not easy to normalize and create reasonably valid angles. Often certain angle calculations can differ through price changes or volatility.

Our calculate_slope() function tries to make corresponding angles through all bars.

We do this by calculating the difference between the highest/lowest price values in a certain bar range. The bar range is our X-axis, and the price difference is our Y-axis.

Zooming in/out will not change the amount of bars or the price. Since it does change our view on the chart, and thereby how we see the angles, we have included a setting where you can personalize the ratio between X and Y-axis (Angles -> Ratio X-Y axis).

Settings: Angles - Ratio X-Y axis:

SETTINGS

Swings

- Length: Lookback period for the detection of swing points.

Trendline validation

Check breaks between:

- Disabled: the initial TrendLine is allowed to be pierced

- Check breaks between point A - point B: no breaks are allowed between both Swing points

- Point A - Current bar: no breaks are allowed between the first Swing point and the point of confirmation ('current' bar)

Source (breaks): Source which invalidates TrendLine, default: close

TrendLine breaks

Minimal bars: The secondary TrendLine must be uninterrupted for at least x bars before a potential break can be considered.

Angles

Show: Toggle labels.

Ratio X-Y axis: Every user has his preferences regarding zoom, chart layout,... If the shown angles are not according to your expectations, you can adjust this number.

Only TrendLine between: Only allow TrendLines between the minimum and maximum degrees. Set only the minimal and maximum values above 0.

Trading is risky and many will lose money in connection with trading activities. All content on this site is not intended to, and should not be, construed as financial advice. Decisions to buy, sell, hold or trade in securities, commodities and other markets involve risk and are best made based on the advice of qualified financial professionals. Past performance does not guarantee future results.

Hypothetical or Simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, including, but not limited to, lack of liquidity. Simulated trading programs in general are designed with the benefit of hindsight, and are based on historical information. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

As a provider of technical analysis tools for charting platforms, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole based on any content or tool we provide.

Charts used on this site are by TradingView in which the majority of our tools are built on. TradingView® is a registered trademark of TradingView, Inc. www.TradingView.com. TradingView® has no affiliation with the owner, developer, or provider of the Services described herein.

This does not represent our full Disclaimer. Please read our full disclaimer.

© 2025 LuxAlgo Global, LLC.